SINGAPORE: After the Ministry of Defence announced on Oct 30 that S$200 in LifeSG credits would be progressively disbursed to all national servicemen this month, a TikTok user helpfully created a video that showed the step-by-step process.

TikTok user Haiqal HSG (@hservicesg) posted a video teaching everyone how to claim their credits on Nov 1. Since then, it has been viewed almost 120,000 times.

@hservicessg ALL NSMEN TAKE NOTE!! #foryou #foryoupage #fyp #viralvideo #fypsingapore #fypsingapore🇸🇬 #kachin #hack #tiktokviral

While the credits can be used at any online or physical merchants accepting payments via PayNow UEN QR or NETS QR, acceding to Haiqal HSG’s video, they can also be withdrawn as cash.

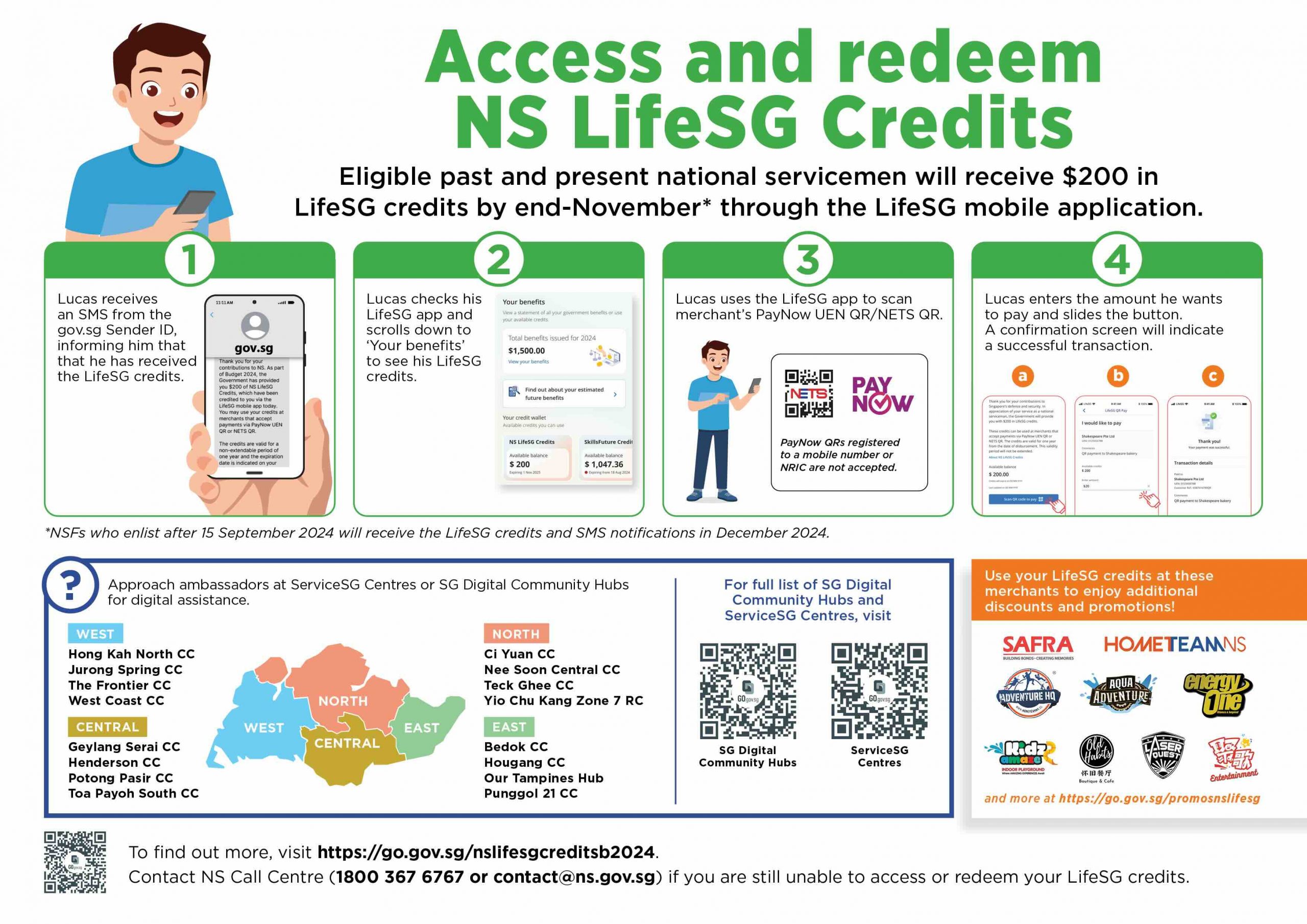

Step-by-step guide

First, he said claimers should open their Life SG app and scroll until they see a portion that says NS LifeSG credits.

He then went to a bright green ATM (near Sheng Shiong, in Ms Haiqal’s case) and clicked on the Paynow option.

When withdrawing, he reminded viewers of the S$0.20 convenience fee and added that people could only withdraw up to S$190.

Since providing a QR code is necessary for the withdrawal, Mr Haiqal also went through this process and reminded people again there would be a S$0.20 convenience fee.

He ended his video by saying, “Enjoy the money!”

Commenters on his video thanked him, saying it was helpful information.

“You can transfer the $200 to YouTrip app first and then transfer it to your bank account,” another added.

One suggested that a person can “pay the money to Shopee wallet and transfer the full $200 to your own bank account,” meaning no surcharge fees.

Mr Haiqal merely responded that his guide was a faster process.

When one asked where the balance of S$9.80 would be, Mr Haiqal assured him it would be back in the LifeSG app and told another that it could be used in shops that use Paynow.

“The LifeSG credits are valid for one year from the disbursement date. National servicemen may access the credits and check their validity period through the LifeSG mobile app,” MINDEF said.

The credits, which MINDEF said are in recognition of the contribution of past and present national servicemen “to Singapore’s defence and security,” were first announced when the Budget was rolled out at the beginning of the year.

Around 1.2 million of them will be receiving this amount.

Each national serviceman will receive an SMS and a notification letter from official channels informing them that their credits have been disbursed.

The ministry also published the following infographic to make this easy:

/TISG

Read related: Budget 2024: ‘We will always have your backs’ — Tax rebates, workfare payouts, LifeCredits for NSMen and more