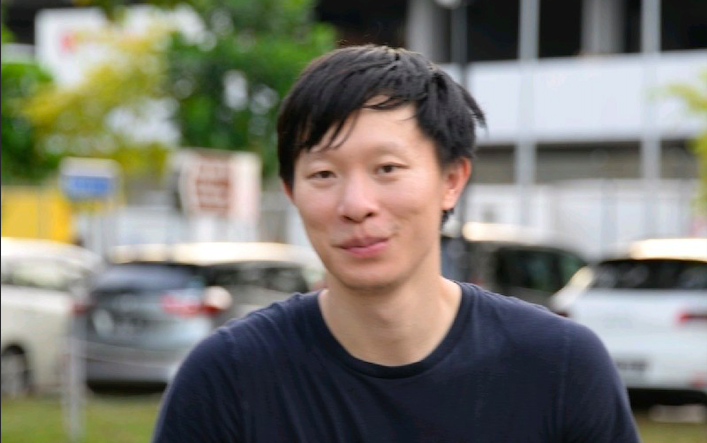

After cryptocurrency hedge fund Three Arrows Capital entered liquidation in late June, its co-founder, Mr Zhu Su, is now selling his Bukit Timah S$48.8 million Good Class Bungalow, which was purchased only last December.

This is one of three bungalows that Mr Zhu, 35, bought from 2019 to 2021, for a total amount of $83.55 million.

A report from EdgeProp says that liquidators are now trying to seize the properties owned by the founders.

Mr Zhu, along with Mr Kyle Davies, founded Three Arrows Capital (3AC) in 2012, at the kitchen table of their apartment.

The two men were then working as traders at Credit Suisse.

At one point, their crypto assets were allegedly worth several billion dollars.

However, a court in the British Virgin Islands put the company under liquidation last Monday (June 27), due to 3AC’s failure to pay its creditors.

Its liquidation is being handled by Teneo, an advisory and consulting firm.

Furthermore, 3AC was reprimanded last Thursday (June 30) by the Monetary Authority of Singapore because it had provided false information and breached industry licensing rules for fund management.

But even as Mr Zhu is endeavoring to sell his Bukit Timah GCB, which is located at a 31,863 sq ft, 999-year leasehold site at Yarwood Avenue in Kilburn Estate, he still has two others.

One property, bought in September 2020, is near Botanic Gardens at Dalvey Road. He had bought it for $28.5 million and is currently under construction. Its title is under the name of his wife, Tao Yaqiong.

And in 2019, he bought a strata bungalow on Balmoral Road for $6.25 million, one of eight such residences at Goodwood Grand, a 73-unit development.

EdgeProp added that there are five high-end properties collectively owned by Mr Zhu and others connected to 3AC. In addition to the three GCBs are a townhouse and a shophouse.

They also own a yacht and a fleet of high-end cars.

A petition was filed in the US Bankruptcy Court for the Southern District of New York by representatives of the company, which is reportedly seeking protection from creditors under a US law that allowed foreign debtors to shield its assets in the US.

/TISG