SINGAPORE: The Central Provident Fund (CPF), on which the city-state’s retirement income system is based, is regarded as one of the best in the world.

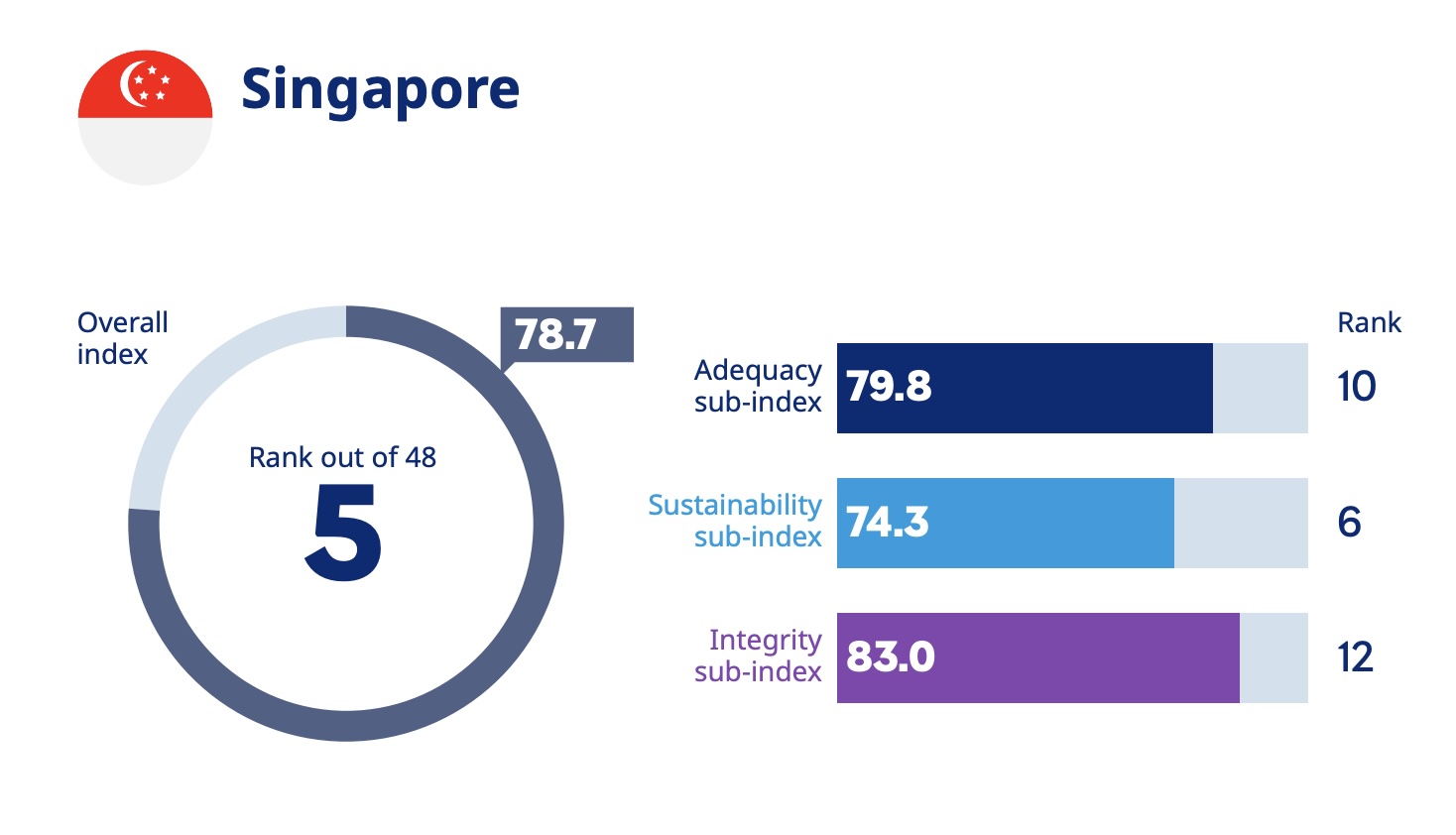

In this year’s Mercer CFA Institute’s Global Pension Index, Singapore ranks fifth, two spots higher than in 2023.

Nevertheless, it is still not in the “A” category, defined as “a first-class and robust retirement income system that delivers good benefits, is sustainable and has a high level of integrity”.

Only the top four countries — the Netherlands, Iceland, Denmark, and Israel, respectively — are in the top category, having received a total score of 80 and above on the Index.

Read also: Malaysia ranks 8th in best places to retire list; the only Asian country in Top 10

Singapore, along with Australia, Finland, and Norway, received a “B+”. It’s given to retirement systems having “a sound structure, with many good features but (with) some areas for improvement that differentiate it from an A-grade system.”

The city-state’s overall score this year is 78.7, an improvement from 2023’s score of 76.3. Singapore received 79.8 for adequacy, 74.3 for sustainability, and 83 for integrity.

In comparison, the Netherlands, which took first place, received 86.3 for adequacy, 81.7 for sustainability, and 86.8 for integrity, and its overall score is 84.8

Nevertheless, Singapore scored the highest among countries and territories in Asia. No other Asian country is in the A and B categories. Hong Kong received a C+ for an overall score of 63.9. The pensions of China (56.5), Malaysia (56.3), Japan (54.9), Vietnam (54.5), Taiwan (53.7), South Korea (52.2), Indonesia (50.2), and Thailand (50.0), are all in the C category.

Mercer defines this as “A system that has some good features but also has major risks and/or shortcomings that should be addressed; without these improvements, its efficacy and/or long-term sustainability can be questioned”.

Read related: CPF Life vs Retirement Sum Scheme — Which Should You Go For?

The report includes a number of recommendations for improvements to Singapore’s pension system, including opening the CPF to non-residents. It points out that they make up a key percentage of the city-state’s workforce.

It also recommended raising the age at which CPF members can access their savings that are set aside for retirement/

Mercer’s other two recommendations are decreasing the barriers to establishing tax-approved group corporate retirement plans and introducing a requirement to show income projections on members’ annual statements. /TISG

Read also: Singapore should be aiming for an “A” rating on the global pension index