The Government of the United Kingdom (UK) has announced plans to increase the Stamp Duty Land Tax on foreign buyers.

The policy of increasing Stamp Duty Land Tax aims to increase the current additional tax from 1% to 3%. In announcing the new tax, British Prime Minister Theresa May said 13% of London based homes were bought by foreign buyers; a percentage that is taking much needed housing stock from current residents.

The Stamp Duty Land Tax hopes to address the issue of foreign buyers looking to speculate on the UK housing market, significantly raising housing prices in that country by over 2%. The British Government claimed that this in turn prevents UK residents from being able to afford a property.

In explaining why her government will levy a new Stamp Duty Land Tax on individuals and companies not paying tax in UK, May told the BBC’s Andrew Marr Show that it “cannot be right that those who don’t live in the UK can buy properties as easily as British residents”.

May said: “At the Conservative conference last year, I said I would dedicate my premiership to restoring the British dream, that life should be better for each new generation, and that means fixing our broken housing market. Britain will always be open to people who want to live, work and build a life here.”

She added: “However, it cannot be right that it is as easy for individuals who don’t live in the UK, as well as foreign-based companies, to buy homes as hardworking British residents. For too many people the dream of home ownership has become all too distant and the indignity of rough sleeping remains all too real. This government is committed to helping hardworking British residents get the right home for them and helping to end the scourge of rough sleeping for good. The money we raise from this extra stamp duty is going to be spent on dealing with the issue of rough sleeping. We’ve sadly seen rough sleeping going up recently, which is why it is is important we are taking a number of actions. We’ve already put money in to projects to ensure that we are helping those who are sleeping rough, this will enable more money to be put in.”

UK student accommodation buildings acquired by SPH for $321 million

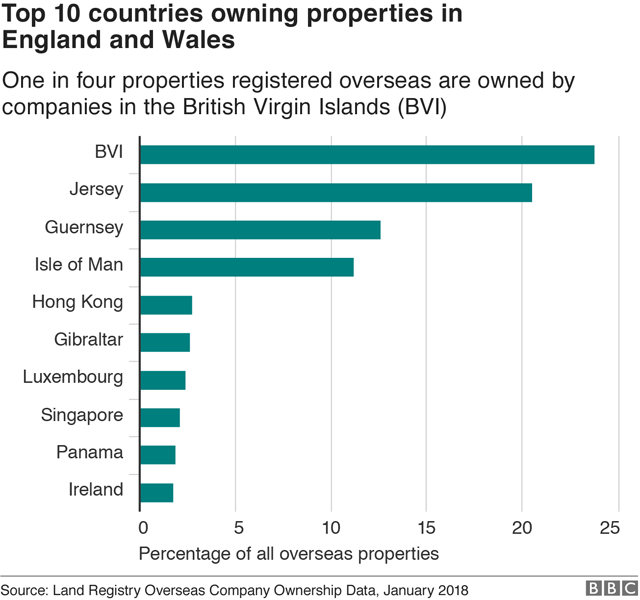

UK’s property market is a hot favourite with Singapore’s affluent individual and corporate investors. About 97,000 properties in England and Wales are owned by overseas firms, and Singapore is among the top 10 countries owning properties. The BBC made this analysis after the United Kingdom’s Land Registry made its data on Commercial and Corporate Ownership and Overseas Companies Ownership available at no cost.

This release of data in November last year follows the UK government’s commitment to fix a housing market they described as “broken”, a commitment which includes their aim to improve the availability of data to make it easier to identify those with interest in land. The Land Registry echoed this and explained that the change is “to promote economic development, financial stability, tax collection, law enforcement and national security.”

The analysis showed that out of 42,680 of the properties owned by foreign companies in England and Wales, some 44 per cent of the total, were in London, and that they had a value of £33.9 billion.

The UK property market has historically been a very open and accessible market for international investors, where it is also not unusual for investors to use intermediate centres to pool capital with other investors in collective structures (such as funds and real-estate investment trusts), to diversify their asset allocation across a wider range of projects and opportunities.

An annual survey of the Association of Foreign Investors in Real Estate also ranked London at the top (tied with Los Angeles) for stability and opportunity for capital appreciation. The Association’s members who are estimated to have more than $2 trillion in real estate assets under management also said that they were less worried about the impact of Britain’s exit from the European Union than they were a year ago.

In July last year, a study for the London Mayor showed that foreign investors are buying up thousands of homes suitable for first-time buyers in London and that they were using them as buy-to-let investments.

Foreign buyers led by Singapore and Hong Kong snapped up 3,600 of London’s 28,000 newly built homes between 2014 and 2016, the research said. About half of these homes were priced between £200,000 and £500,000.

More than 70 per cent of the homes bought by foreigners were as rental investments and in 15 per cent of cases, the properties were bought by companies. The London Mayor said that the Government would give local people “first dibs” on new homes, but stressed that “international investment plays a vital role in providing developers with the certainty and finance they need to increase the supply of homes and infrastructure for Londoners”.

The new Stamp Duty Land Tax comes at a time when London is being seen as a safe haven by very wealthy foreigners to “park their money” as a source of a stable investment.

Proptech to impact and disrupt traditional business operating models in real estate

The research also found that almost all of London’s largest residential development needed overseas investment to get under way, either through purchasers buying off-plan or through equity finance or investment in UK house-building companies. Singaporean buyers especially favoured properties in Westminster. It is estimated that four out of 10 new-build properties there were sold abroad over a two-year period.

The British pound’s depreciation against the world’s major currencies has also helped increase the attractiveness of UK real estate to overseas investors. London’s robust market fundamentals which translates into attractive yields over other global cities also boosts investor confidence in the London real estate market. With an average of 10 to 15 years, the city’s lease lengths are also significantly longer than many markets. UK’s robust legal system, along with its market transparency and liquidity all play a part in the appeal.

Are planning to acquire properties in UK before the new Stamp Duty Land Tax is enforced?

Speak to iCompareLoan mortgage brokers who can set you up on a path that can get you a commercial loan in a quick and seamless manner.

[findhomeloan key=”2″]

Alternatively you can read more about the Best Commercial Loans in Singapore before deciding. Our brokers have close links with the best lenders in town and can help you compare Singapore commercial loans and settle for a package that best suits your commercial purchase needs.

Whether you are looking for a new commercial loan or refinance, our brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the loan. And the good thing is that all their services are free of charge. So it’s all worth it to secure a loan through them.

For advice on a new commercial loan or Personal Finance advice.

To speak to our distinguished Panel of Property agents.

For refinancing advice on your properties.