The Real Estate Developers’ Association of Singapore (Redas) on Friday challenged the Government’s latest round of property cooling measures saying there was “no rationale” for the new property curbs. imposed on Friday (July 6). REDAS. the leading developers’ group here, said the additional buyers’ stamp duty (ABSD) and lowering of the loan-to-value (LTV) limits were “tough” new regulations – “especially since the “property market is in the early stages of recovery and that the recovery is in line with economic fundamentals.”

<TO FIND THE BEST HOME LOANS IN SINGAPORE CLICK HERE>

The developer’s group noted in their statement that market started to pick up only last year and the volume of transactions is within expectations and said that the market should be allowed time to find its own course.

JLL, a leading real estate services firm, agreed with REDAS and said: “All said, we feel the additional measures have been introduced too hastily coming just after 9.1% growth in PPI over four quarters. The market should have been given a chance to find its own level in response to the expected surge in launches in coming months.”

The new property curbs were rolled out a day after the Singapore’s central bank noted “euphoria” in the market. The new property curbs affected the Straits Times Index which dropped 2 per cent on Friday as property developers and banks led declines.

The rising prices in Singapore were not driven because of strong demand-and-supply, but because of strong property market sentiments. The Government announced the new property curbs fearing the record land bids and redevelopment deals threatened to undo previous restrictions which prevented a property market bubble from forming here.

It justified the new property curbs as being necessary to check sharp increase in prices, which could run ahead of economic fundamentals and raise the risk of a destabilising correction later, especially with rising interest rates and the strong pipeline of housing supply.

Barely one hour after the Government announced the new property cooling measures which kicked-in from Friday (6 July), home buyers thronged several developers’ hastily launched property sales. Property market observers suggest that over 1,000 units must have been snapped with buyers putting up an option fee before the deadline kicked-in.

Videos uploaded on social media showed prospective buyers’ frenzy at launches like Park Colonial show suites and Riverfront Residences. Thousands continued to swarm the show-suites well past midnight to put down an option fee for units of their choice before the deadline.

The Straits Times (ST) said that “the flurry of last-minute sales reflects strong liquidity and pent-up demand.” Some market observers said that ST made that suggestion in self interest, and pointed to Woodleigh Residences.

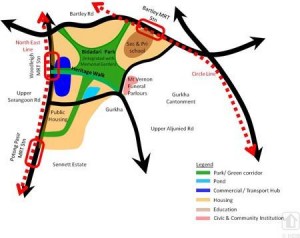

Woodleigh Residences and Woodleigh Mall will be landmark projects for the upcoming new Bidadari estate. The mixed commercial and residential development will be developed by ST’s parent company Singapore Press Holdings and Kajima Development. The joint-developers won the top bid of $1.132 billion for the 25,440 sq m site, which can yield about 825 private homes.

Woodleigh Residences and Woodleigh Mall will be landmark projects for the upcoming new Bidadari estate. The mixed commercial and residential development will be developed by ST’s parent company Singapore Press Holdings and Kajima Development. The joint-developers won the top bid of $1.132 billion for the 25,440 sq m site, which can yield about 825 private homes.

The development will comprise about 161,460 sq ft of commercial space for uses such as shops and restaurants, integrated with a 65,000 sq ft community club, a 20,000 sq ft Neighbourhood Police Centre, a commercial bridge towards Bidadari Park, and an underpass to connect to the bus interchange.

SPH, the largest media organisation in Singapore, recently said that it was going to count on property investments for revenue growth. It suffered a 25 per cent decline in net profit for the second quarter of this fiscal year, as compared to the same period last year. SPH’s report on revenue decline came amidst the group’s massive job cut exercise for media personnel.

Besides leading developers, banks are also expected to be impacted by the Government’s new property curbs. But as property market is but one source of banks’ revenue, it will not derail them

DBS said that “loan growth sentiment will be dampened from here as this is currently driven largely by property development companies. Mortgage growth might still stay relatively stable over the next few quarters from existing drawdowns. The property cooling measures would likely take a hit on UOB which is most exposed to property-related lending.”

Irvin Seah, DBS Group Holdings Ltd economist, acknowledged that “this is a pre-emptive move by the government to cool down the market before it gets too hot.”

Paul Ho, chief mortgage consultant at the icompareloan.com, said that the unpredictable nature of if a bank loan would be approved after the announcement of the new property curbs is one major reason why buyers must use the services of mortgage consultants.

Ho said: “Mortgage consultants will be able to assess the buyers Mortgage Service Ratio (MSR) and Total Debt Servicing Ratio (TDSR) to gauge the buyers’ financial risk profile and advise on a suitable loan package. This will save them the hassle of running around, going to a bank that does not offer a loan for their housing type or ther personal profile, – not knowing what documents are needed, having to make 5-10 loan application and even the possibility of impacting the process of your home purchase.”

For foreign purchases of residential property, the additional buyer’s stamp duty has been raised to 20 percent from 15 percent, while for Singaporeans the extra charges apply only from their second home purchase, the Monetary Authority of Singapore, Ministry of National Development and Ministry of Finance said in a joint statement on Thursday.

<TO FIND THE BEST HOME LOANS IN SINGAPORE CLICK HERE>

If you are concerned about how the new property cooling measures will affect you, our Panel of Property agents and the mortgage consultants at icompareloan.com can advise you. The services of our mortgage loan experts are free. Our analysis will give industrial property loan seekers better ease of mind on interest rate volatility and repayments.

Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at paul@icompareloan.com for a free assessment.