Singapore — A sharp rise in phishing scam cases, with customers losing a total of S$140,000 in a mere 10 days, has prompted OCBC Bank to warn its clients to be extra careful.

“For the month of December so far, OCBC Bank has detected and initiated the takedown of 45 phishing websites, about eight times more than the average takedown requests every month,” the bank said on Thursday.

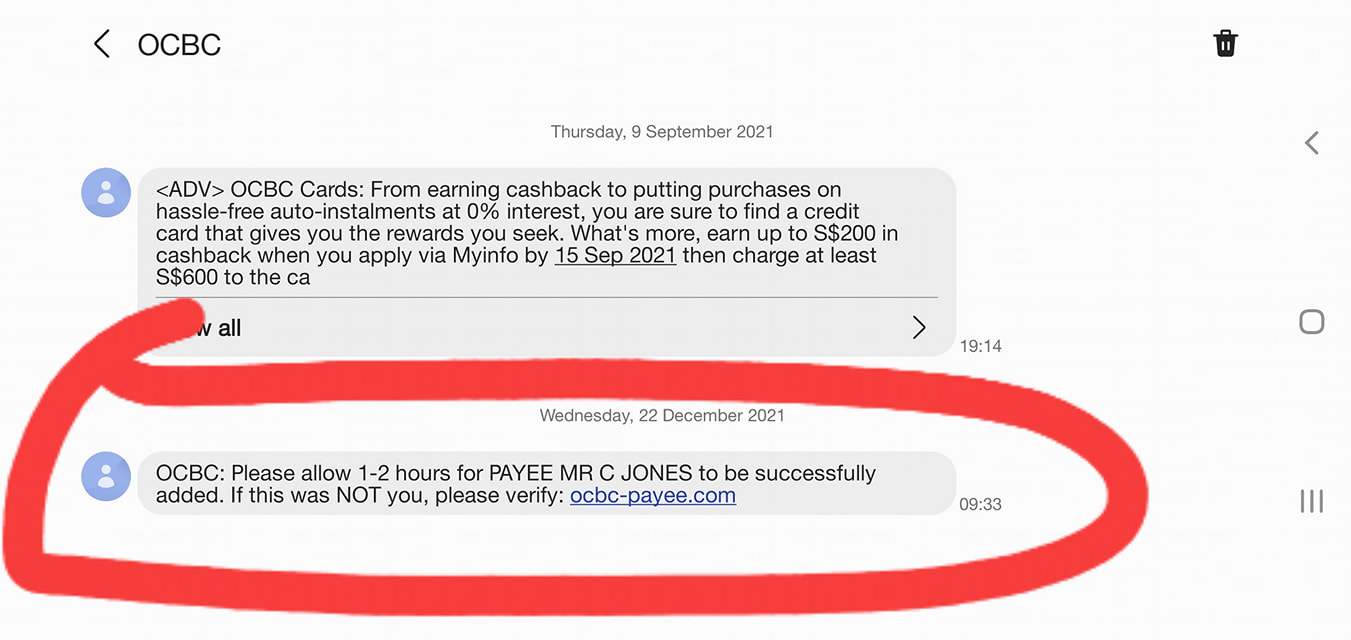

It related that mobile phone users had received unsolicited SMSes purporting to be from OCBC, claiming there were issues with their bank accounts or credit cards.

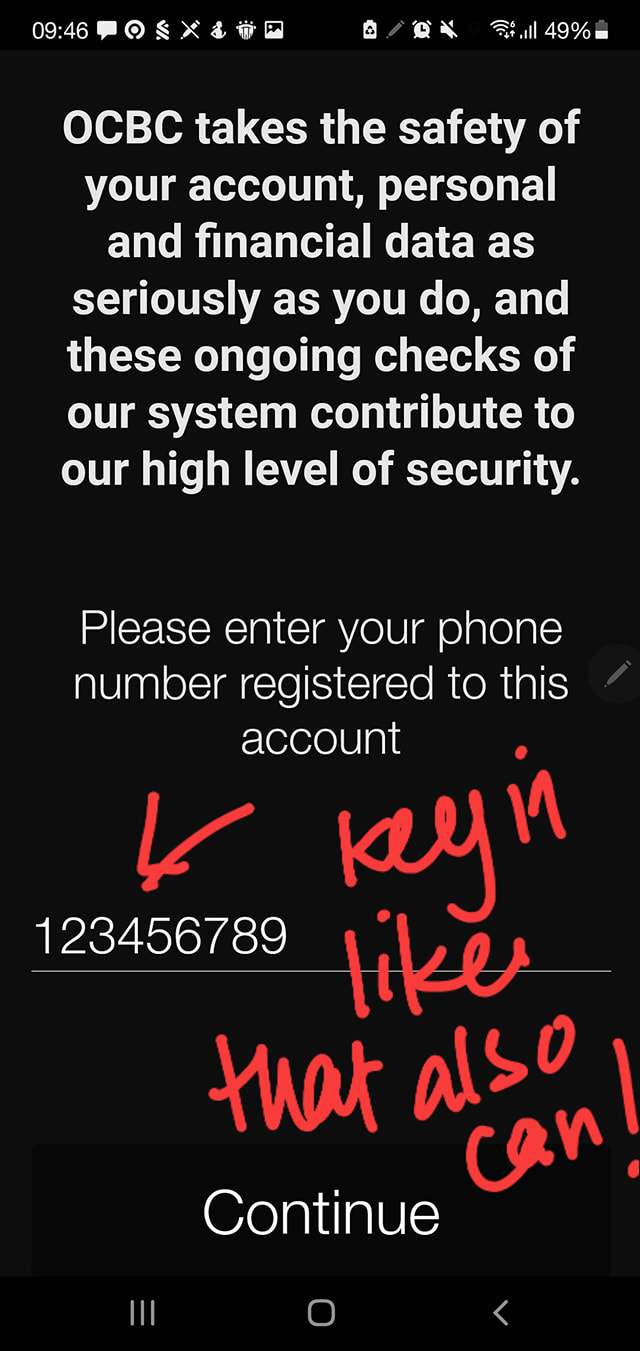

“The SMSes contain a link to a fraudulent website disguised as a legitimate bank website requesting banking information and passwords,” OCBC said in a report in The Straits Times.

The bank confirmed it would never send its clients an SMS to inform them of account closure or temporary lockout from their accounts.

Between Dec 8 and 17, 26 customers lost a total of S$140,000 to the scam.

A quick scan of Facebook shows multiple users warning others of the ongoing phishing scam.

One user, Gina Koh, said that the scammers were “getting better” because the SMS looks like the system-generated message from the genuine OCBC for one-time passwords.

She attached a sample phishing SMS and noted that the difference was in the website. The genuine message from OCBC comes from “ocbc.com”, while the scammers use “ocbc-payee.com” as the website.

Ms Koh added that the phishing page would appear as if it’s really from OCBC with a login and IP address section.

Separately, in a press release, the Singapore Police Force said that it has seen an increasing trend in phishing scams in which scammers impersonate banks.

It advises everyone to follow preventive measures such as:

- Not clicking dubious URL links provided in unsolicited text messages and online advertisements

- Verifying the authenticity of the information with the official website or sources

- Never disclose personal or Internet banking details and OTPs to anyone

- Reporting any fraudulent transactions to your bank immediately

OCBC said that those using iPhones could download the ScamShield app, which blocks unsolicited messages and calls.

When in doubt, customers can call OCBC at 1800-363-3333, or +65-6363-3333, if they happen to be overseas.

Meanwhile, those with any information relating to such crimes should call the Police Hotline at 1800-255-0000, or submit information online at www.police.gov.sg/iwitness /TISG

Read related: Scammers with faulty police disguise level up in latest attempt after taking public “constructive” criticisms