SINGAPORE: A recent study is showing that over half of Singaporeans don’t think of themselves as financially wealthy, and only 38 per cent are satisfied with their personal wealth.

“Accelerating the Wealth Journey – From Stability to Abundance,” a study conducted by wealth management firm St James Place (SJP) Asia.

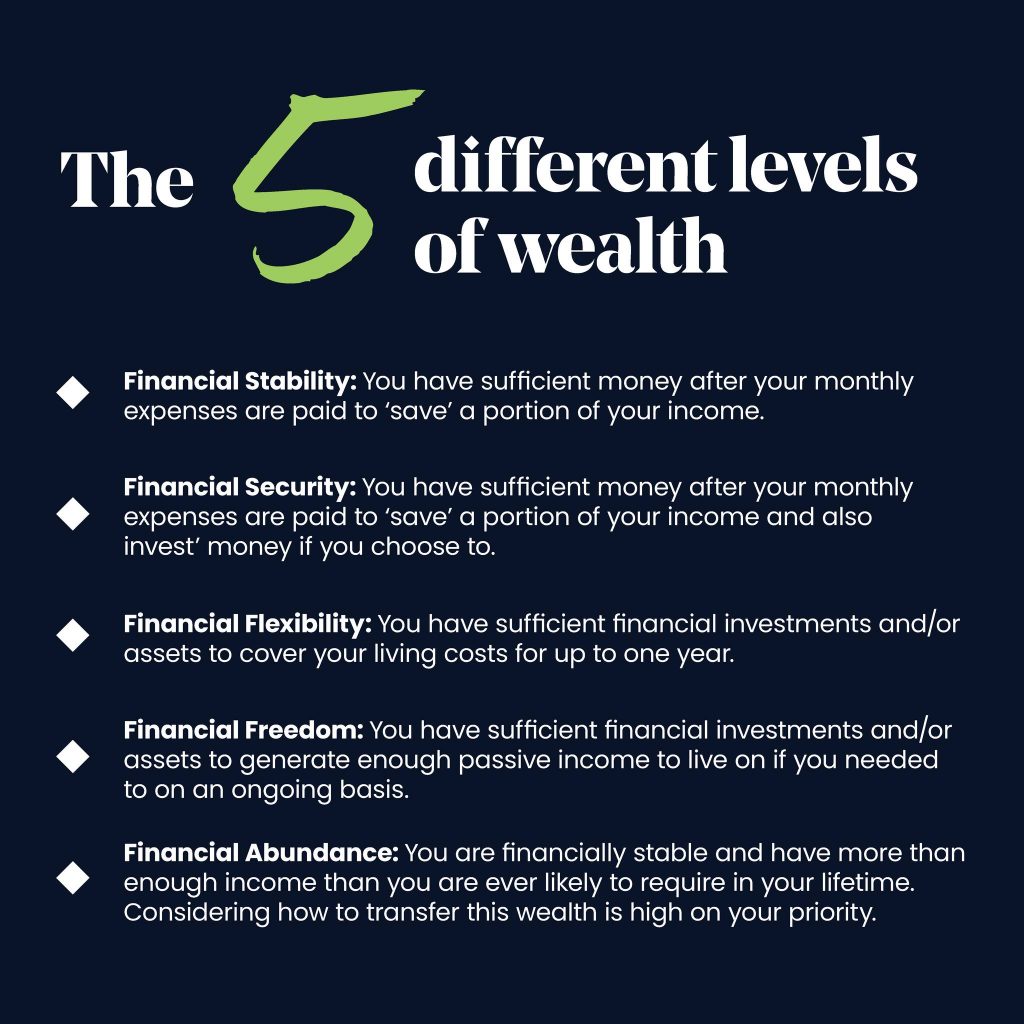

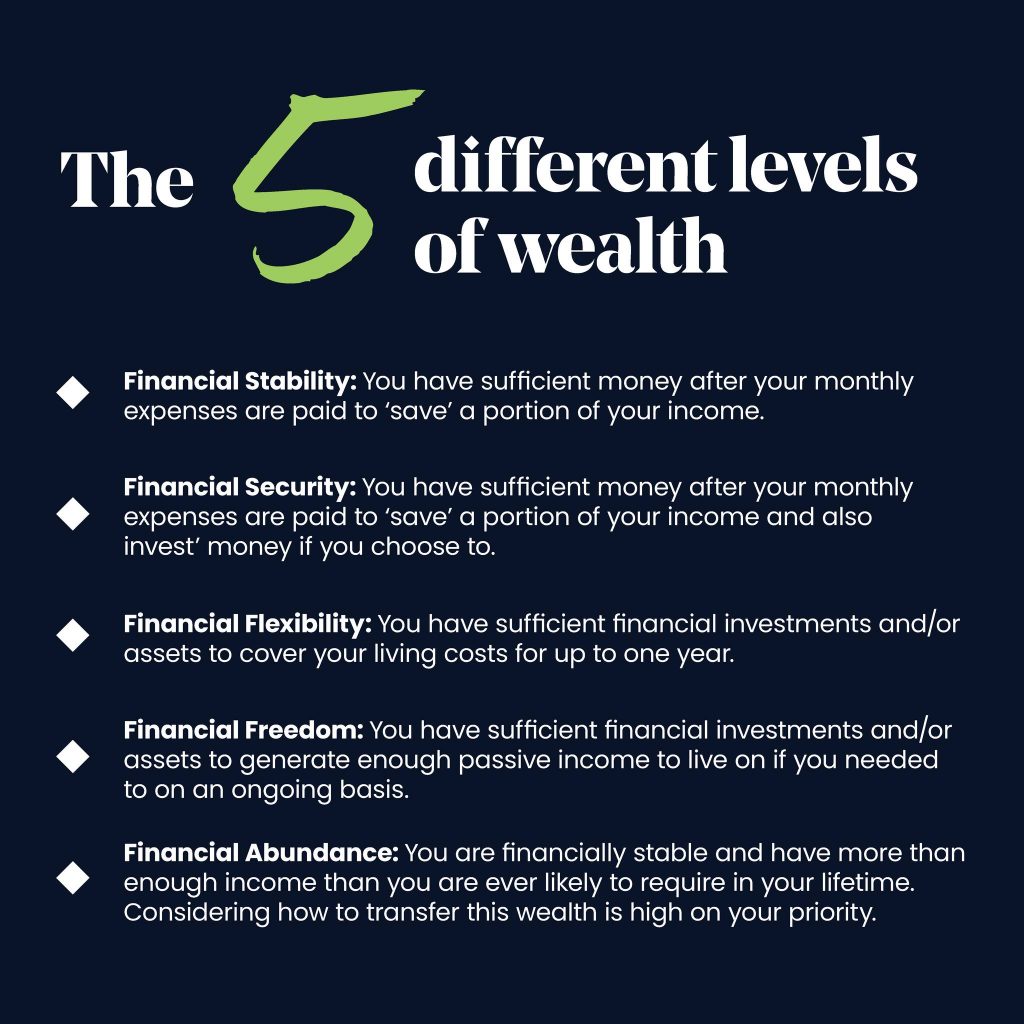

The study examined five different levels of wealth, which are stability, security, flexibility, freedom, and abundance, as well as how respondents view wealth creation, and intergenerational wealth transfer.

The study, whose results were launched this week, surveyed 1,000 well-heeled Singaporeans.

It showed that Singaporeans think that it takes 32.3 years to move from financial stability to abundance. In contrast, respondents from Hong Kong believe that it takes 40.4 years to move from one wealth level to another.

In Singapore, only 38 per cent of the respondents said they are happy with how wealthy they are, while 42 per cent said they want to be more wealthy.

Interestingly, 19 per cent of the respondents say they think they are too rich.

As people move from the first stage, financial stability, to the third stage, financial flexibility, the majority believe that their wealth is too small.

It’s when they get to the fourth stage, financial freedom, they begin to think that their wealth is sufficient and by the final stage, financial abundance, most think they already have too much wealth.

The SJP Asia study also shows that over half of the respondents (53 per cent) are willing to sacrifice spending on luxuries for the purpose of generating more wealth over the long term, while 51 per cent say they’d sacrifice work-life balance and 42 per cent say they’d forego family time to amass more wealth.

The possibility of losing wealth is a major cause for concern for many (92 per cent) of Singaporeans.

And when asked for their motivations for building wealth, the top answers were financial security and protection (76 per cent), having a good personal lifestyle (61 per cent) providing a good life for their family (57 per cent) and intergenerational wealth creation (46 per cent).

SJP Asia partnership director Oliver Wickham says, “Amid ongoing challenges of inflation, we recognise the rising concerns when it comes to protecting one’s hard-earned savings. Despite these economic headwinds, there are still opportunities for investors to successfully navigate through inflationary times as well as protect and grow their wealth.”

/TISG