SINGAPORE: The Monetary Authority of Singapore’s (MAS’) Enforcement Department is tackling increasingly large-scale and challenging cases, says its executive director, Ms Peggy Pao-Keerthi Pei Yu.

The MAS Enforcement Report released on Tuesday (Sept 19) shows it is dealing with more breaches of laws and regulations in its mission to maintain the integrity and reputation of Singapore as a trusted financial centre.

The 2022-2023 report released on Tuesday (Sept 19) shows the MAS Enforcement Directorate obtained 39 criminal convictions compared with seven in 2020-2021 and nine in 2019-2020.

MAS also imposed S$12.96 million in civil penalties and S$7.88 million in financial penalties and compositions in 2022-2023, compared with S$150,000 in civil penalties and S$2.59 million in financial penalties and compositions in 2020-2021 and S$11.7 million in civil penalties and S$3.4 million in financial penalties and compositions in 2019-2020.

MAS issued 18 prohibition orders in 2022-2023, 20 in 2020-2021 and 25 in 2019-2020.

The Enforcement Directorate opened 136 cases in 2022-2023, including 32 for insider trading, 22 for false trading, 20 for unlicensed activities, and seven for money laundering.

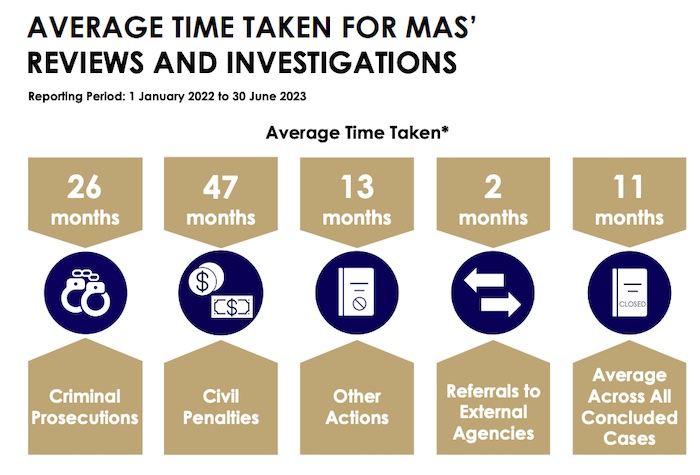

The report showed the average time taken for MAS’ reviews and investigations.

Criminal prosecutions took 26 months, civil penalties 47 months, and other actions 13 months on average.

Among notable cases:

- MAS imposed a civil penalty of S$12.6 million on Noble Group in August 2022 for publishing misleading information in financial statements from 2016 to 2018 in breach of the Securities and Futures Act

- Five former remisiers (Mr Alan Lee, Mr Chew Wei Zhan, Mr Lee Wei Kai, Mr Lim Ming Yi and Mr Lim Ming Chit) were convicted for false trading and received sentences ranging from 12 to 24 weeks of imprisonment and fines ranging from $190,000 to $260,000.

- Nine-year prohibitory orders were issued against Three Arrows Capital Pte Ltd (TAC) directors Mr Zhu Su and Mr Kylie Livingston Davies, banning them from performing any regulated activity and taking part in management for failing to discharge their duties as directors.

- MAS imposed a composition penalty of S$365,000 on UOB Kay Hian Private Ltd (UOBKH) for failure to comply with Business Conduct Requirements and Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) requirements.

- Ten-year prohibition orders were issued against former wealth planning manager Mr Loh Thim Mu Marcus, who was banned from providing financial advisory services, performing any regulated activity, and taking part in management after he was convicted of cheating and forgery offences.

- Composition penalties totalling S$3.8 million were imposed on Citibank N.A., Singapore branch (Citibank) (S$400,000), DBS Bank Ltd (DBS) (S$2,600,000), OCBC Singapore (OCBC) (S$600,000) and Swiss Life (Singapore) Pte Ltd (Swiss Life) (S$200,000) for breaches of Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) requirements.

The breaches were found when MAS’ examined the financial institutions following news of irregularities related to Wirecard AG’s financial statements and the alleged involvement of Singapore-based individuals and entities in the matter.

The financial institutions were found to have inadequate Anti-Money Laundering and Countering the Financing of Terrorism controls when they dealt with persons who had transactions with or had other links to Wirecard AG and its related parties.

- Prohibitory orders were also issued against officers of BSI Bank and Goldman Sachs in connection with the 1 Malaysia Berhad (1MDB) scandal.

Mr Raj Sriram, the former Deputy CEO and head of private banking of BSI Singapore was handed a 10-year prohibition order. He was also issued a conditional warning by the Commercial Affairs Department in lieu of prosecution for his neglect, which resulted in BSI Bank’s failure to file suspicious transactions reports in respect of 1MDB-related transactions. Under the conditional warning, Mr Sriram paid a sum of S$150,000 and committed to refrain from criminal conduct for 24 months.

Mr Ng Chong Hwa, also known as Roger Ng, a former managing director of Goldman Sachs (Singapore) Pte Ltd, was issued a lifetime prohibition order by MAS. He was convicted in America and sentenced to 10 years in jail for conspiracy to launder money embezzled from 1MDB.

MAS Enforcement Department executive director Peggy Pao-Keerthi Pei Yu said in the report: “Since its formation in 2016, the Monetary Authority of Singapore Enforcement Department has tackled increasingly large-scale and challenging cases. Such cases involve multi-faceted and cross-border misconduct, requiring intensive collaboration with both local and overseas enforcement partners; voluminous digital services as well as novel financial services and products.”

Amid the growing complexity of the financial world, the regulators stress the need for constant vigilance.

The report said: “MAS will continue to pay attention to asset and wealth managers as their proper conduct remains vital in ensuring Singapore’s position as a leading asset and wealth management hub.”

The MAS Enforcement Department was established in 2016 to centralise MAS’ enforcement functions across banking, insurance, capital markets and other sectors regulated by MAS.