SINGAPORE: Cryptocurrency fund Three Arrows Capital Pte Ltd (3AC) collapsed last year, with debts totalling $3.3 billion (S$4.43 billion), shocking the crypto market and demolishing the savings of millions of amateur investors.

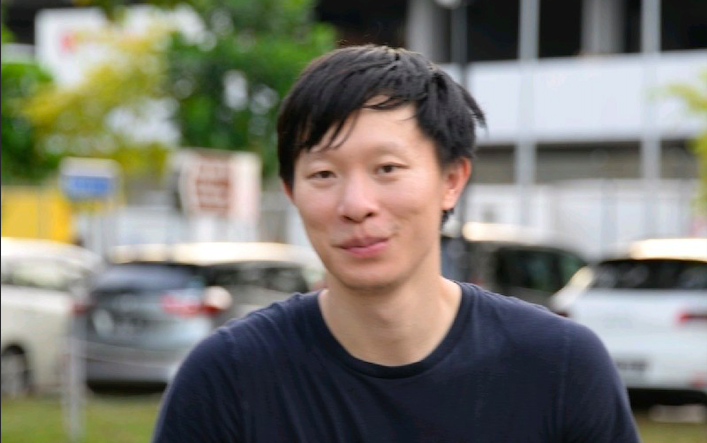

However, according to a recent report from the New York Times, its founder Zhu Su, a Singaporean, and Kyle Davies, an American, lived it up in Bali, Indonesia, after the collapse of the company.

After leaving Singapore, where 3AC was based, the two headed to Bali. Indonesia does not have an extradition treaty with the United States, noted the Times.

This happened as the liquidation process for 3AC, which had managed around $10 billion in assets even until March 2022, began.

After 3AC’s collapse, Zhu spent a lot of time playing video games, “maybe like 12hrs a day,” but eventually “started going into the ocean, surfing, taking hard walks, getting back into gym routine, reading books, learning new languages.”

He has since returned to Singapore.

On the other hand, Davies’ days were spent “painting in cafes and reading Hemingway on the beach” in Bali.

The Times added that he meditated, took shrooms, and attended a Formula 1 event in Bahrain.

In their latest tweets, the 3AC founders sounded somewhat defensive.

“The way Kyle and I choose to show remorse is to help build a global business @OPNX_Official that makes the business models of 2018-2022 obsolete. If we succeed, many creditors will be whole. If we fail, we will keep trying again. Kyle+I were nearly suicidal last year this same time; now we are thrilled to be able to build for the crypto community once again,” wrote Zhu.

For Davies, he wrote, “A lot of people asked me why I didn’t write a remorseful book. Someone help me with the math, but it would be hard to make 8figs to pay back a single reasonably sized creditor. I’d have to write Harry Potter to make 10figs.”

Zhu and Davies founded 3AC in 2012 at the kitchen table of their apartment. The two men were then working as traders at Credit Suisse.

At one point, their crypto assets were allegedly worth several billion dollars.

The Monetary Authority of Singapore reprimanded 3AC on June 30, 2022, because it had provided false information and breached industry licensing rules for fund management.

Five high-end properties are collectively owned by Mr Zhu and others connected to 3AC. In addition to the three GCBs are a townhouse and a shophouse. They also own a yacht and a fleet of high-end cars.

At one point last year, Zhu and Davies were said to have gone missing. /TISG

Future of crypto in Singapore uncertain after collapse of 3AC