SINGAPORE: Singapore has solidified its status as a premier hub for life sciences in the Asia-Pacific region, dominating investment activity during the first nine months of 2024 (9M2024).

According to a recent report from JLL, the city-state has witnessed a surge in life sciences initiatives bolstered by government support to foster growth in this vital sector.

One of the standout transactions during this period was the US$206 million acquisition of Elementum, a life sciences complex located in One-North, by the Brunei Investment Agency, the sovereign wealth fund of Brunei.

This investment reflects the increasing interest from regional investors in Singapore’s burgeoning life sciences landscape.

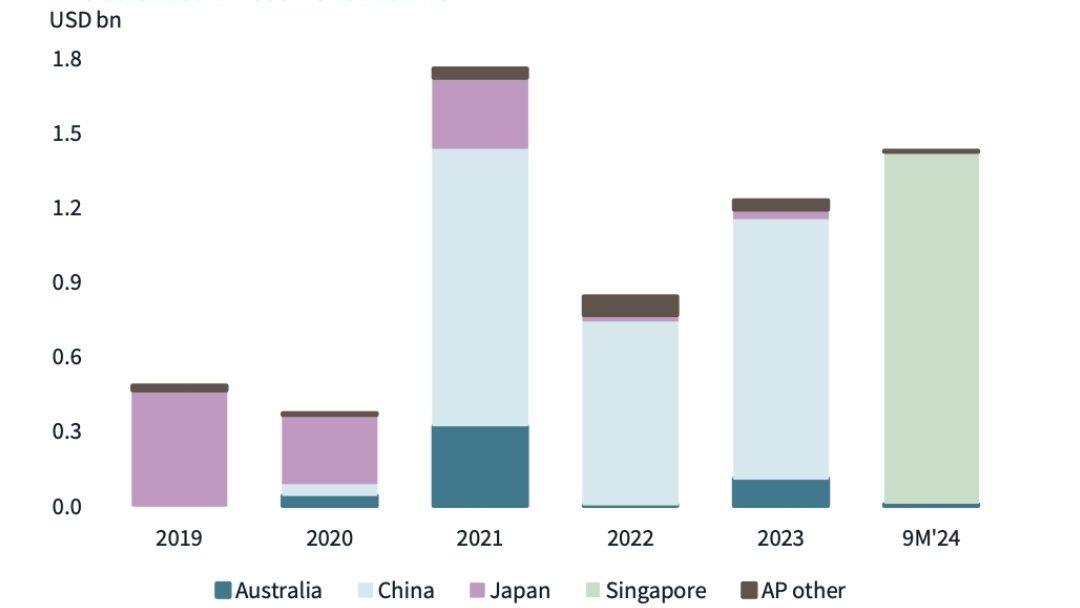

In addition to this major deal, a significant joint venture between Warburg Pincus and Lendlease focused on Asia-Pacific life sciences has successfully acquired a portfolio of seven assets comprising business parks and specialized facilities in Singapore for US$1.2 billion.

This portfolio, currently leased to companies in the life sciences, technology, advanced manufacturing, and logistics sectors, underscores the growing demand for dedicated spaces catering to these industries.

JLL’s report highlights Singapore’s strengths, noting its global leadership in innovation and the concentration of talent as key factors attracting multinational life sciences firms seeking to establish research and development and corporate headquarters in the city.

However, the report also points out a critical challenge: the undersupply of high-quality life sciences and R&D spaces in the region.

To navigate this competitive landscape, JLL suggests that investors could capitalize on opportunities by converting existing industrial properties into specialized laboratory spaces or by engaging in sale and leaseback transactions.

Such strategies could help address the demand for dedicated facilities and position investors favourably in Singapore’s dynamic life sciences market.