Amidst the longest bull market in history, investors are constantly chattering about whether the market has reached its peak. While many smart people have had many smart things to say on both sides of this argument, there is a particular individual of interest who has been consistently quiet on this topic. Widely considered to be the best investor of all time, Warren Buffett is famous for not trying to predict how the market is going to behave. Given this stance, he naturally has not made much comments on whether there is a market bubble. But here, the old adage “actions speak louder than words” might reveal more about his stance on the topic than one may think.

Cash as “Dry Powder”

In order to deduce Buffett’s opinion on the current market valuations, we took a look at the cash portion of his company Berkshire Hathaway. In the investing world, cash is often referred to as “dry powder.” The term originates from the old days when soldiers had to keep dry gun powders in preparation for battles. In terms of investing, dry powder represents the resource investors can readily deploy should they find attractive investment opportunities. For example, if you have already used all of your money to purchase stocks, it will be difficult for you to take advantage of new investment opportunities without reluctantly selling your existing investments. In contrast, having some cash available on hand keeps that option open, especially when you have trouble finding a lot of attractive investments.

Warren Buffett’s Growing Cash Reserve… for 4 Years

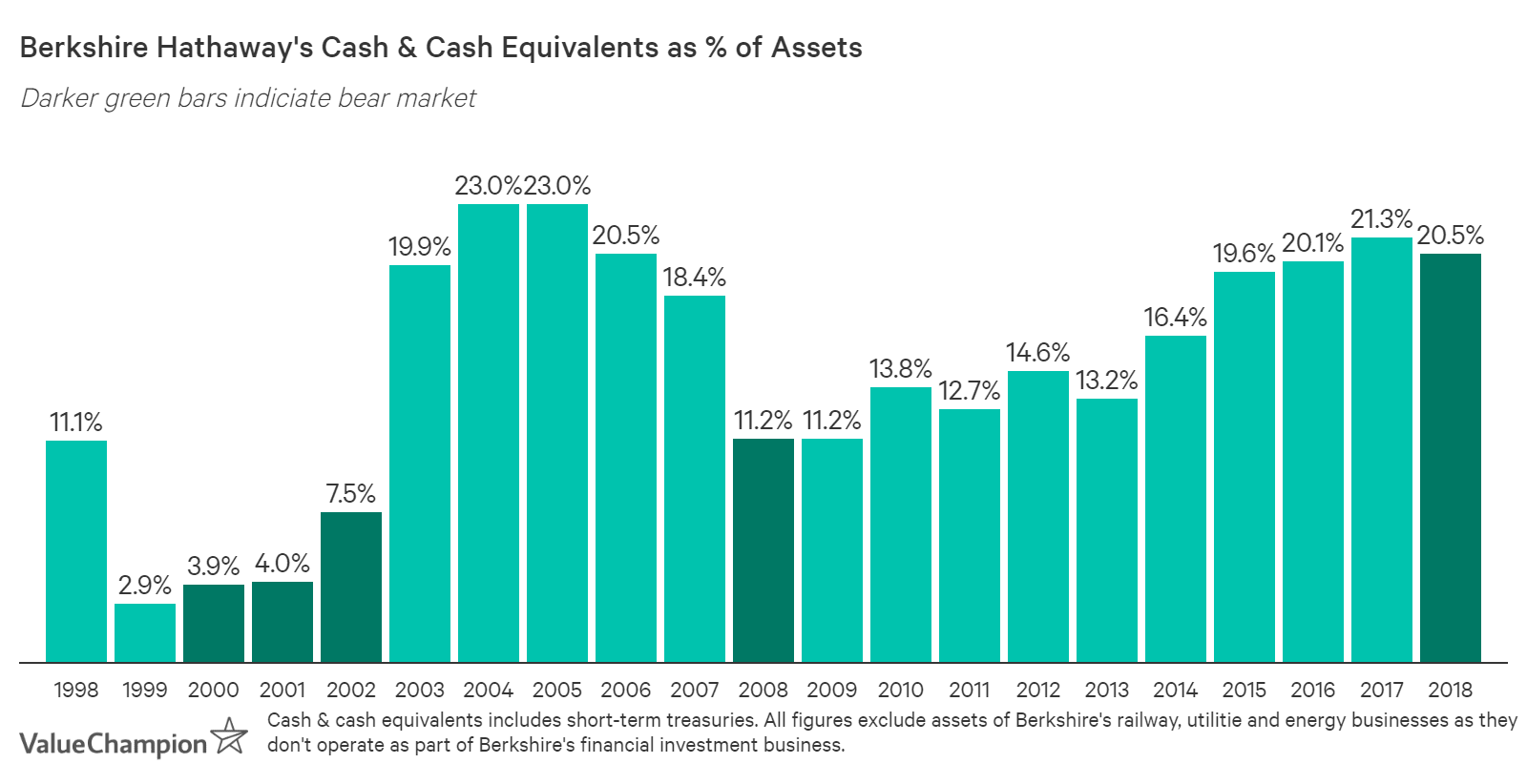

In this sense, Warren Buffett’s cash holding can be a great window to his evaluation of the market. If he is able to find a lot of attractive investment opportunities, he should be actively deploying his “dry powder,” resulting in a low cash balance. Conversely, his cash will grow if he isn’t seeing many attractive investments, as he would prefer to build up his ammunition as he waits for a better opportunity. In fact, both Berkshire Hathaway’s cash & equivalents (including short-term treasuries, which can be readily sold to be deployed) as a percent of total assets have shown this exact tendency in previous cycles.

For example, Berkshire Hathaway’s cash was as low as 4% of total assets during the early 2000’s as he actively made investments in the midst of market downturn. Afterwards, it readily soared up to about 20% of assets until 2008, when he again brought this ratio down to about 10% as he gobbled up assets in the aftermath of the global financial crisis. However, this ratio against soared above 20% since 2015. That he has kept cash as a % of his portfolio so high for the past 4-5 years could be a strong signal that he isn’t finding many attractive investment opportunities and that he views current market valuation to be rather unattractive. Buffett himself confirmed this view in his 2017 letter where he said the lack of “sensible purchase price” proved to be “a barrier to virtually all deals we reviewed in 2017.”

Timing the Market vs Conserving Dry Powder

Does this mean a massive market downturn is impending? To answer this question, Buffett’s own quote is quite useful: “I don’t know anybody that could time markets over the years.” The dark art of accurately predicting market will crash has proven to be quite elusive for both the smartest and luckiest people in the world. Therefore, that Buffett’s cash holding is at all time-high shouldn’t be a signal to be short or to completely stay out of the stock market. Afterall, it’s worth noting that, though his cash position is high, Buffett is still investing in the market.

Instead, here’s another quote from Buffett that could be helpful: “1974 was the best year for buying securities in my lifetime. That’ll happen from time to time, but you can’t sit around and wait for it. You’re never gonna catch the bottom anyway and everyone will be terrified at that time.” A countless number of studies have shown that it’s financially positive to be invested in the stock market over the long-run. Given this, the high market valuations and Buffett’s growing cash arsenal should encourage us to be more careful about the way we pick our investments. If you want to buy stocks, be extra conservative about the price you pay and stay away from chasing the hottest stocks, a lesson that recent IPO of Lyft has soberly reminded many investors of. It’s times like these that it can pay off to conserve some dry powder so that you can readily take advantage of the market should there be a downturn.

The article Actions Speak Louder Than Words: What Warren Buffett’s Balance Sheet Might Tell Us About the Market originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Source: VP