SINGAPORE: Income Insurance has launched FlexiTravel Plus today, Sept 10, as Singapore’s first and only hourly travel insurance. This new plan allows travellers to extend their travel protection hourly and is available for trips to 19 Asian destinations.

FlexiTravel Plus replaces FlexiTravel Hourly Insurance, which previously covered only Bintan, Batam, and Malaysia, offering more flexibility for those seeking short-term travel protection.

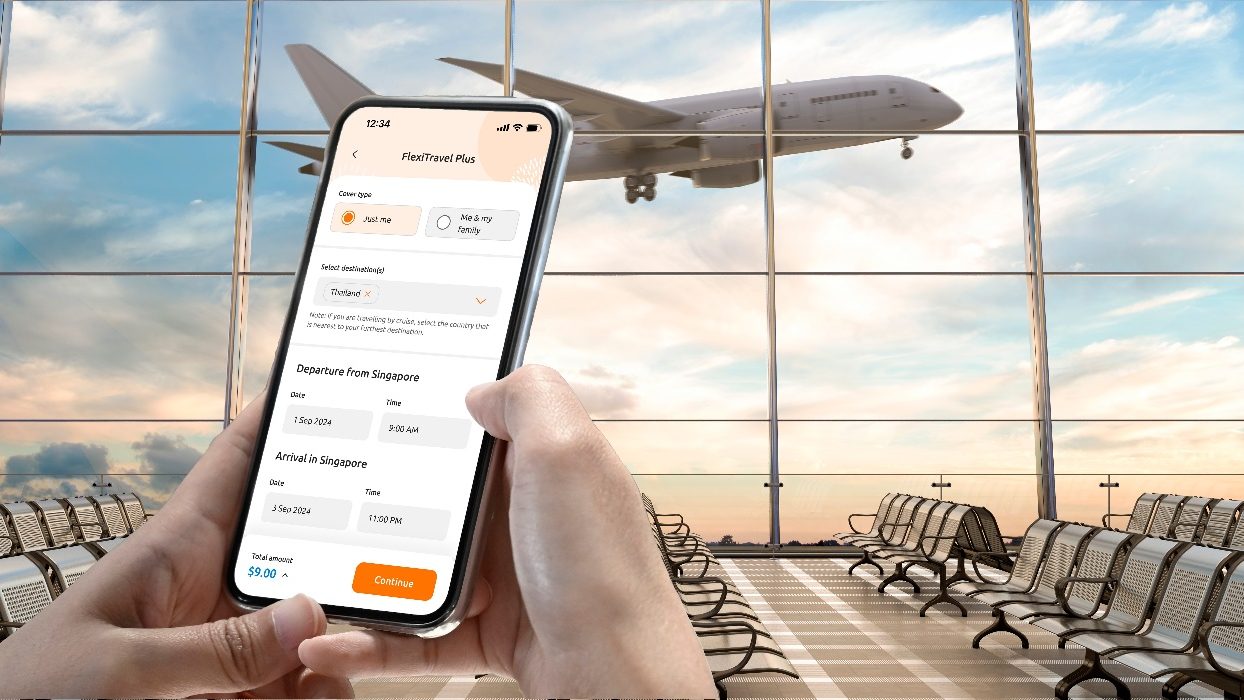

With FlexiTravel Plus, travellers can start with a six-hour coverage block for just S$1.80 and add extra hours at S$0.30 per hour, capped at S$3.00 per day. For example, a three-day, two-night trip to Thailand would cost no more than S$9.

Annie Chua, Vice President and Head of Key Accounts Management at Income Insurance, highlighted that FlexiTravel Plus was created to address gaps in travel insurance.

“We keep our travel insurance not just accessible but relevant and inclusive to meet real protection needs. Overseas travel has its risks.

Travellers may sometimes forget to purchase travel insurance for their trips, given their busy lifestyle, while some may not regard conventional travel protection as necessary, especially when going for a short getaway.

We aim to bridge these gaps by offering travel insurance options tailored for modern travel patterns and prevalent concerns so that travellers mindfully close their protection gaps and enjoy peace of mind,” she said.

Ms Chua noted that more travellers are recognising the importance of travel insurance, even for short trips like weekend getaways. She pointed out that the number of people choosing FlexiTravel Hourly Insurance in 2024 was three times higher than the previous year.

“This has motivated us to launch FlexiTravel Plus, the plus-sized version to protect short trips to 19 Asian destinations so that travellers have affordable and flexible travel protection options,” she said.

Aside from hourly coverage, FlexiTravel Plus also offers other benefits, including protection against trip disruptions, delays, overbooked transport, and travel agency insolvency.

Travellers are also covered for loss of personal electronics, such as phones and laptops, in the event of theft. In addition, those carrying sports equipment, like golf clubs or surfboards, can opt for extra coverage with a rider.

Travellers can use the My Income mobile app to activate, extend, or stop their FlexiTravel Plus coverage anytime, including if they return to Singapore earlier than planned.

Income Insurance also introduced a new feature allowing travellers to buy travel insurance online up to a day after departure. This post-departure option means travellers can get FlexiTravel Plus within eight hours after leaving Singapore, with coverage for at least 24 hours.

Previously, insurance needed to be bought before the trip began. The post-departure purchase feature provides travellers with greater flexibility, helping them close any coverage gaps and enjoy their trip with peace of mind, even if they forgot to arrange insurance in advance.

Income’s Enhanced PreX Annual Travel Insurance, the only annual travel plan in Singapore covering pre-existing medical conditions, also covers overseas telemedicine services.

Policyholders can access a doctor 24/7 via an emergency hotline while abroad. For non-emergency cases such as the flu or a cold, the doctor can guide travellers in purchasing medicine and provide translation services for local pharmacies to ensure they receive the necessary care.

For more information about FlexiTravel Plus insurance, find out more here. /TISG

Featured image by Depositphotos