Because fundraising for a new startup can be extremely difficult, it can be a tempting idea to use your personal credit card to fund your new business. While rewards and immediate access to funds may make credit cards seem attractive, it is generally unnecessarily risky and costly to use your credit card as a source of long-term financing for a startup. In this article, we explain why this is and offer alternatives outside of traditional routes like finding venture capitals and angel investors.

High Costs

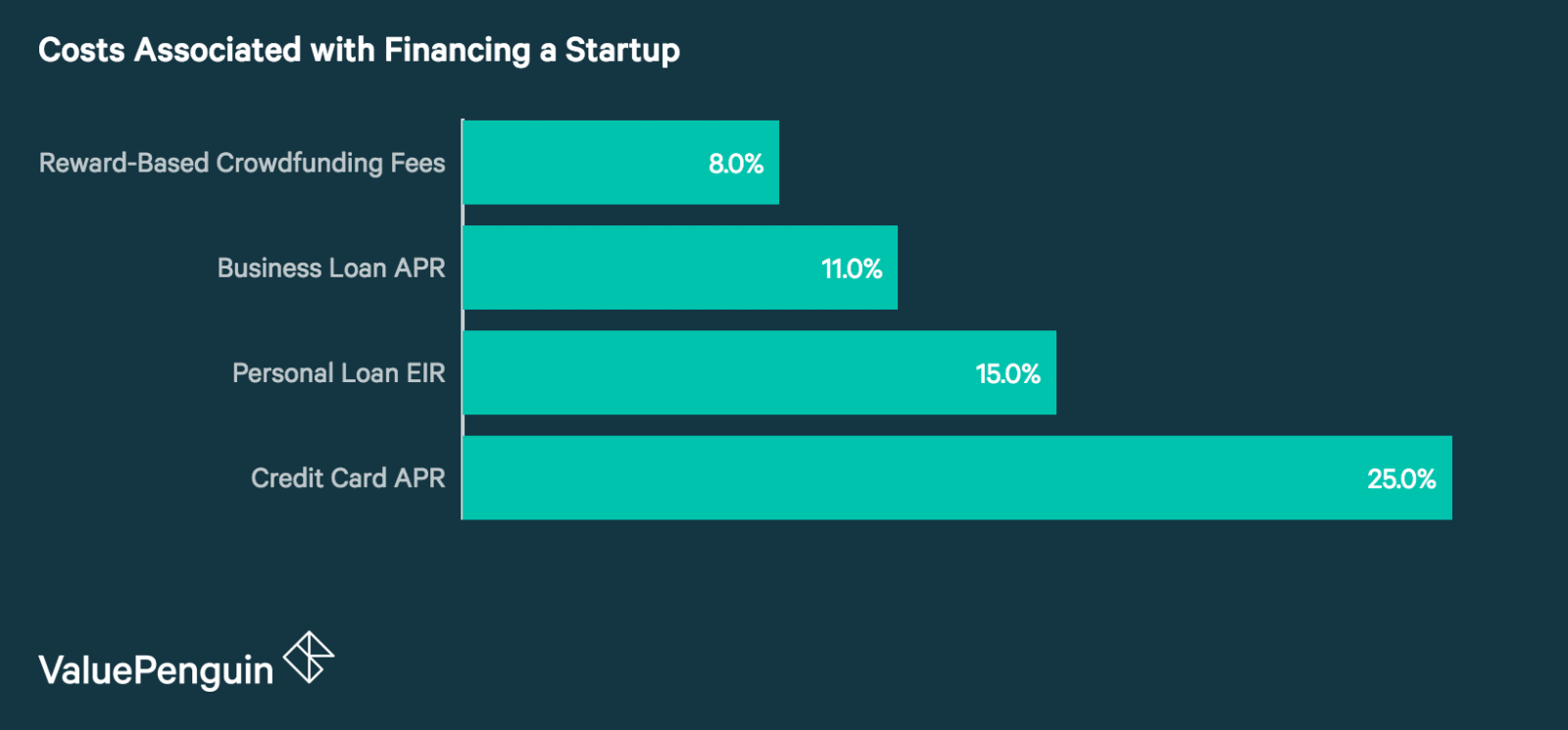

Credit cards are an expensive way to finance long-term debt, and should be used primarily for smaller costs that can be paid off quickly. When it comes to credit card usage, a good rule of thumb is to only use your credit card for expenses that you can repay in less than one or two months. This is because the average annual interest rate for credit cards is about 25%, making it very expensive to keep a balance from month to month. If you accumulate a balance of S$50,000 to S$100,000 on your card to start a business, you will quickly accumulate debt via interest and may not be able to pay it off unless your startup succeeds extremely quickly. In contrast, other sources of funding such as crowdfunding, business loans and personal loans are cheaper and thus better suited for testing out your business idea.

Personal Risk

In addition to the costly nature of using your personal credit card for business purposes, there is an additional risk associated with this practice. Generally, founders of limited liability company (LLC) are personally shielded from debts of the company. For example, if your firm defaults on its loans, you as its founder is still protected. However, using a personal credit card or loan to fund a startup means that the individual is accepting personal financial responsibility for the success of the business. If you are unable to repay the debt you’ve accrued for your business, your credit score will be harmfully impacted. This may make it difficult to obtain any loans in the future, which can negatively impact your ability purchase a home or a car.

Alternatives to Credit Cards for Early-Stage Startups

Using your own personal savings is the most advantageous way to finance your startup. These funds are interest free and don’t require ownership dilution. However, you will be limited by the amount you have saved. Luckily for Singaporean SMEs, there are variety of financing options for their businesses that are superior to using their personal credit card.

Reward-Based Crowdfunding

Through reward-based crowdfunding, businesses are able to raise funds from a large group of individuals by promising an early version of their product, a small gift or a simple thank you, depending on the donation amount. The fees associated with these platforms typically include platform fees (typically 3 – 5%), payment processing fees (about 4%) and a per donation fee (about S$0.30). These fees generally cost much less than interest rates from credit cards and loans. This method is easier for startups that sell consumer-focused products in order to raise money to test their market; however, other businesses might have difficulty raising funds this way. That being said, reward-based crowdfunding can be a great way for businesses to market their product and raise money to get some traction.

Personal Loans

Personal loans may be a decent, backup option if you are not able to obtain funding elsewhere. This is particularly true for individuals with strong credit scores that do not require a large amount of financing. These loans are generally available quickly, sometimes as soon as one business day, and charge lower interest rates than credit cards. However, personal loans should should only be used as a last resort as they make individuals personally responsible for repayment, similar to credit card debt. Defaulting on a personal loan will damage your personal credit score, which can have a significant financial impact on the rest of your life. For example, it may be harder to obtain low interest rates for home loans or car loans.

Alternatives to Credit Cards for Slightly More Established Businesses

Reward-based crowdfunding and personal loans are generally better options for financing a startup than using a personal credit card. Additionally, there are even more options for startups that have a slightly longer operating history.

Business Loans

Business loans are typically a great option for eligible SMEs that require financing. These loans generally charge lower interest rates than other types of debt and do not require businesses to sell ownership shares. In general, banks tend to offer the lowest rates for business loans, but have more stringent application processes than alternative lenders such as crowdfunding platforms.

Equity Financing

Through equity financing, businesses can sell shares of their business to investors in exchange for funding. Unlike a loan, this method does not require interest payments. However, businesses that are successful may pay more through lost ownership shares than they would have through interest rate payments. Additionally, selling shares of ownership can dilute existing ownership stakes. Still, equity financing is a solid option for young SMEs that require a large amount of funds and are not eligible for other types of financing.

The article Why You Shouldn’t Use Your Credit Card to Finance Your Startup originally appeared on ValuePenguin.

ValuePenguin helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValuePenguin:

Source: VP