SINGAPORE: Singapore Treasury Bills, or T-bills, are a good option for a short-term and low-risk investment while trying to diversify portfolios. But why should you invest in Singapore T-Bills?

According to MoneySmart, T-bills are gaining attention because it is a good time to invest in them. As of 2023, T-bills have proven to be an attractive investment option, particularly due to the prevailing high-interest rate environment and frequent rate hikes by the US Federal Reserve.

Yields on T-bills have crossed the 4% mark multiple times this year, presenting an enticing opportunity for investors seeking secure returns.

Also, you simply invest your money and wait for the T-bill to mature without the need to keep an eye on the market.

Understanding T-Bills and How they work

T-bills, also known as Singapore Government Securities (SGS), are known for their AAA credit rating, which means they are one of the world’s safest and most creditworthy institutions.

This, in turn, positions T-bills as an appealing choice for risk-averse investors seeking stability in their financial ventures.

When an individual invests in a T-bill, they are guaranteed a fixed interest rate, which serves as the yield on the investment. However, the interest is acquired differently from government securities like the Singapore Savings Bonds.

T-bill investors receive a discount off the full price during the purchase, and upon reaching maturity, the government repurchases the bill at its full value. The difference between the purchase and repurchase prices represents the earned interest.

While T-bills offer a transparent way to earn interest, potential investors should be aware of its certain limitations. Unlike bonds, T-bill holders do not receive periodic interest payments but must wait until the bill matures, which occurs after 6 months or 1 year.

So, T-bills are best suited for those who can commit their funds for the entire investment duration.

Purchasing T-bills

Although it is a safe investment plan, purchasing T-bills may involve a little inconvenience. Unlike online stock trading, individuals cannot place orders at their convenience. Prospective buyers must wait for specific auction dates and apply for T-bills through local ATMs or Internet banking accounts. The minimum bid amount of $1,000 may also deter those looking to invest smaller amounts.

For those considering short-term investments, the 6-month T-bills offer a compelling option.

6-month T-bills

6-month T-bills provide a quick six-month investment option, making them attractive for those seeking a shorter commitment.

The latest closing levels as of Dec 19 indicate a price of 98.192 and a yield of 3.77%.

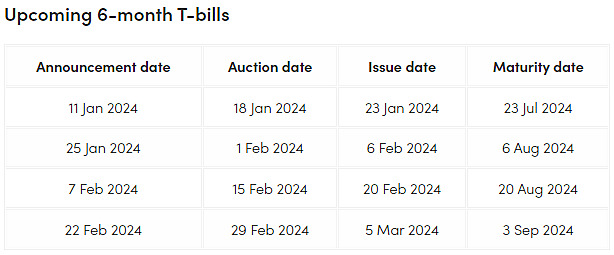

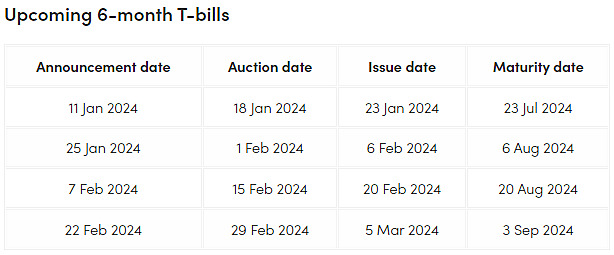

For the upcoming 6-Month T-Bills:

Alternatively, individuals with a slightly longer investment horizon can explore the 1-year T-bills.

1-year T-Bill

The current 1-year T-bill, as of Dec 19, boasts a price of 96.827 and a yield of 3.76%. Scheduled auctions for 1-year T-bills with diverse maturity dates allow investors to tailor their investment strategies.

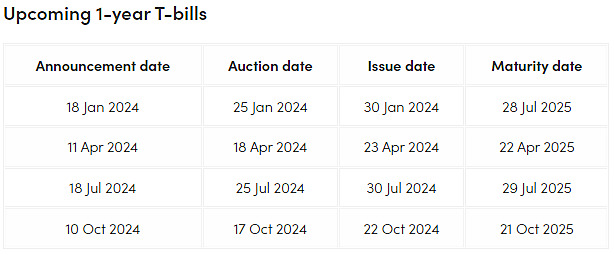

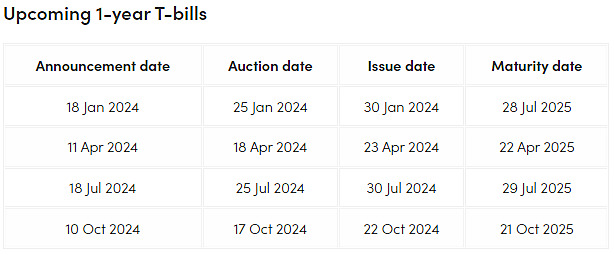

For the upcoming 1-Year T-Bills:

These upcoming T-bills provide a roadmap for potential investors to plan their investments in alignment with their financial goals.

Investors can make informed decisions based on the available data, whether opting for the quick returns of the 6-month T-bills or the extended interest gains of the 1-year T-bills.

Want to invest in Singapore T-Bills? For more information, check it here. /TISG