SINGAPORE: A recent post comparing the increase in prices of an HDB unit and that of satay caused a bit of a stir on social media, and commenters debated, among other things, whether it’s best to save or spend.

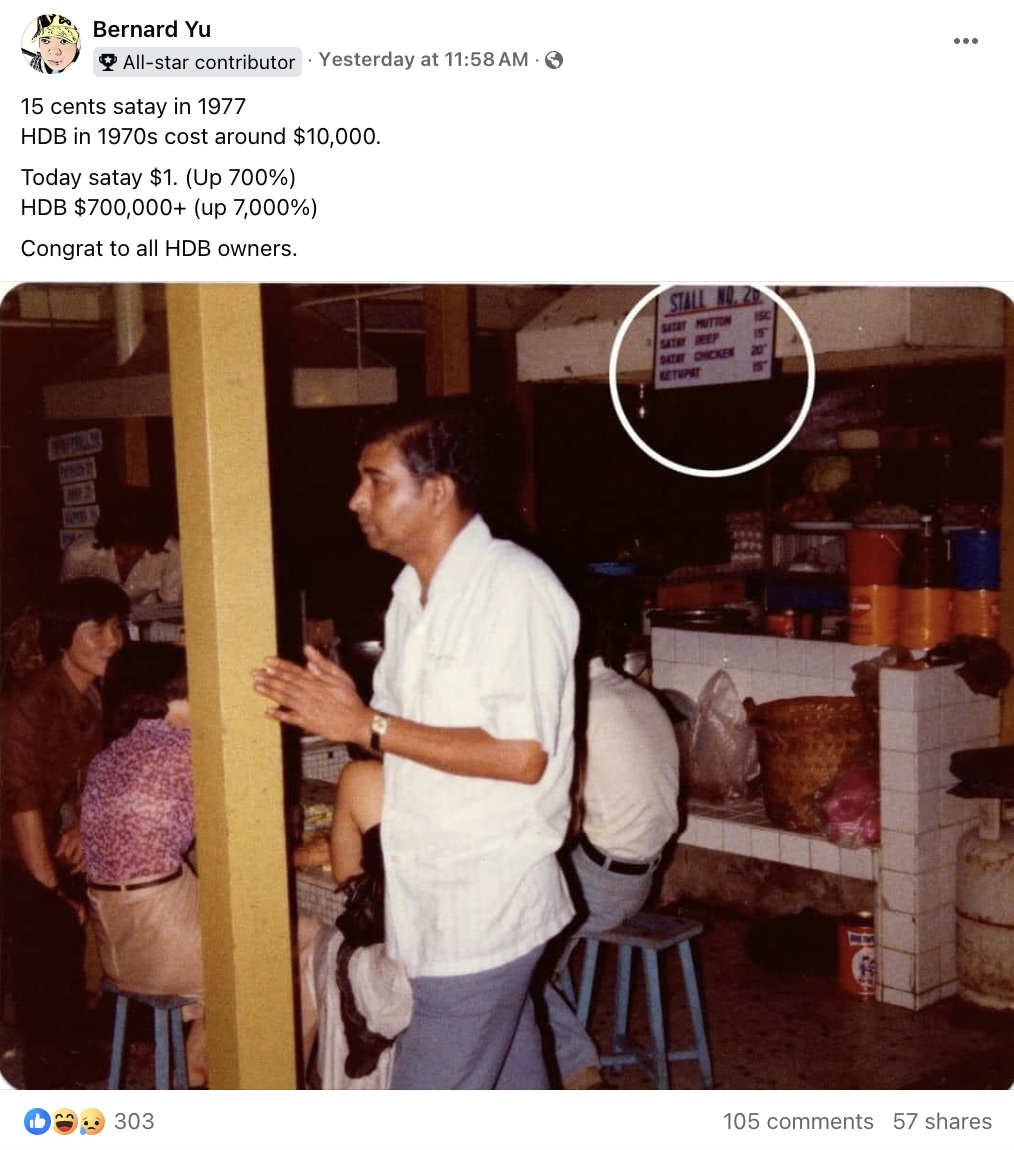

In a post on the Complaint Singapore Facebook page, group member Bernard Yu posted a photo of a man at an eatery. In the background was a stall sign that indicated the price of satay.

Mr Yu wrote, “15 cents satay in 1977. HDB in the 1970s cost around $10,000. Today satay $1. (Up 700%) HDB $700,000+ (up 7000%). Congrats to all HDB owners.”

For one commenter, the “moral of the story” is to “start investing as early and as young as possible.” However, not everyone agreed with this. “Invest after inflation 7000 per cent? What’s the point?

Better spend while you have it,” a group member replied.

Another group member wrote that he wished his father would have bought more HDB units when they only cost $9300. Of course, way back then, salaries were also much smaller, as others pointed out.

One wrote that the monthly salary for a hotel chef was only $280 in the 70s. One commenter had a “simple” explanation: “Land is finite, so property values will increase more.”

Another chimed in to say that in the 1980s, his father earned S1,000 each month working as a supervisor and could buy a four-room HDB unit for $20,000.

He now works as a supervisor and earns $3,000 monthly, but a four-room unit costs $700,000.

However, the comparison between the prices of housing and satay may be overly simplistic, as not everything increases in price at the same pace.

Historically, housing prices have risen faster than inflation, meaning housing becomes more expensive over time, even when adjusting for the effect of inflation.

Here is one example from the US:

“Since 1963, the first year for which the Federal Reserve Bank of St. Louis has data on housing prices, the Consumer Price Index has risen from 30.44 to 303.294, an increase of 896 per cent.

During that same time, the median sales price of a home rose from $17,800 to $436,800, an increase of 2,353.93 per cent.”

However, in the last few years, inflation and housing prices have increased not just in Singapore but practically everywhere else in the world, in no small part due to the COVID-19 pandemic. /TISG

Read also: HDB reports S$6.775B deficit for FY2023, higher than FY2022