By Tommy Wong

For a “normal” human life, it comprises three phases: (1) learning, (2) working, and (3) retirement. Typically, a person earns during the working phase so that he can pay his own living expenses during the second and last phases, as well as his children’s living expenses during their first phase.

For a person who has “good” earnings during the working phase, he should not have financial problem during the retirement phase. Indeed, this phase is commonly referred to as the “golden years” in which the person doesn’t work, has no financial worries and can truly do what he pleases.

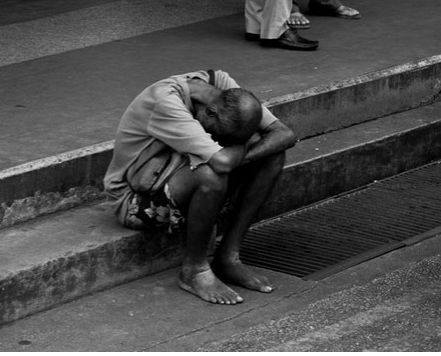

On the other hand, for a person who doesn’t have “good” earnings during the working phase, he enters the retirement phase with little or no savings. For whatever reasons, he may not be able to return to the workforce to earn more. Since the savings are insufficient to cover his living expenses during the retirement phase, he has to rely on external help. If his family or government is willing to help him, then his life may not be too bad. But if he doesn’t get any help, instead of “golden years”, he faces “down trodden years” (i.e. he has to beg, steal or borrow to survive). And these “trodden years” are likely to last for the rest of his life. Hence for some, this prospect is so unappealing that they end it all by ending their lives (suicides). This is how crucial to have sufficient financial support during the retirement phase.

In Singapore, to prepare its citizens for the retirement phase, the government has set up a retirement fund known as the CPF. It has been further enhanced with a minimum sum scheme. If the great majority of the CPF members can receive an income that is sufficient to cover their living expenses during the retirement phase, the CPF and the minimum sum scheme can be said to work well.

For those who enjoyed “good” earnings during the working phase, the workings of the CPF and the minimum sum scheme are not important because they have other savings to support their retirement lifestyle.

On the other hand, for those who did not enjoy “good” earnings during the working phase, the workings of the CPF and minimum sum scheme can become critical. For instance, if a person doesn’t have enough savings outside his CPF to support himself and yet, he cannot withdraw his savings inside his CPF because of the minimum sum restriction, what is he going to do? Hence, instead of being a help, the minimum sum scheme can become a hindrance. In fact, if a person doesn’t have enough savings to support his retirement, then it doesn’t matter how the government tweak his CPF, he still won’t have enough (because except for the interest, CPF doesn’t grow). Further, by using the minimum sum restriction to delay his CPF withdrawal, it is simply moving the insufficiency from his later retirement years to his earlier retirement years. The irony is that without the minimum sum scheme, the person may not have to suffer the insufficiency at all, if he dies “early”. In any case, even if he dies “late” and has to suffer the insufficiency, it is a consequence of his own doing. So, he can’t blame the government (if the government doesn’t intervene). However, with the present CPF system, he can clearly (easily) blame the government for his suffering during his early retirement years because he is prevented from withdrawing his CPF. And yet he still won’t have sufficient savings for his later retirement years. A lose-lose situation? No wonder there is so much unhappiness over the minimum sum.

Dr. Tommy Wong is the author of the book series “Wisdom on How to Live Life”, and other philosophical, self-help books.