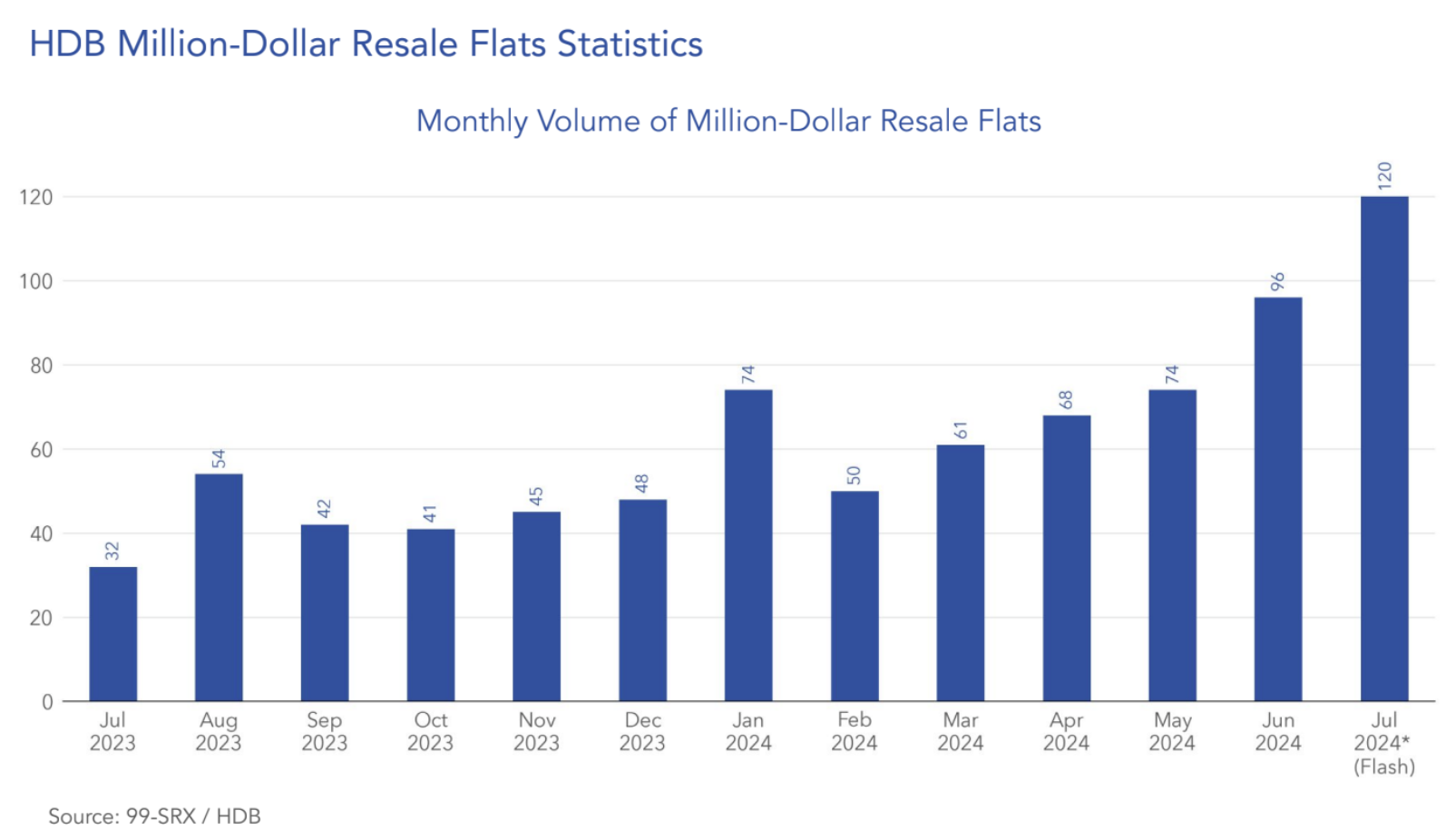

SINGAPORE: Last month, HDB resale transactions for flats priced at over S$1 million reached a new peak, marking the highest volume since 2010.

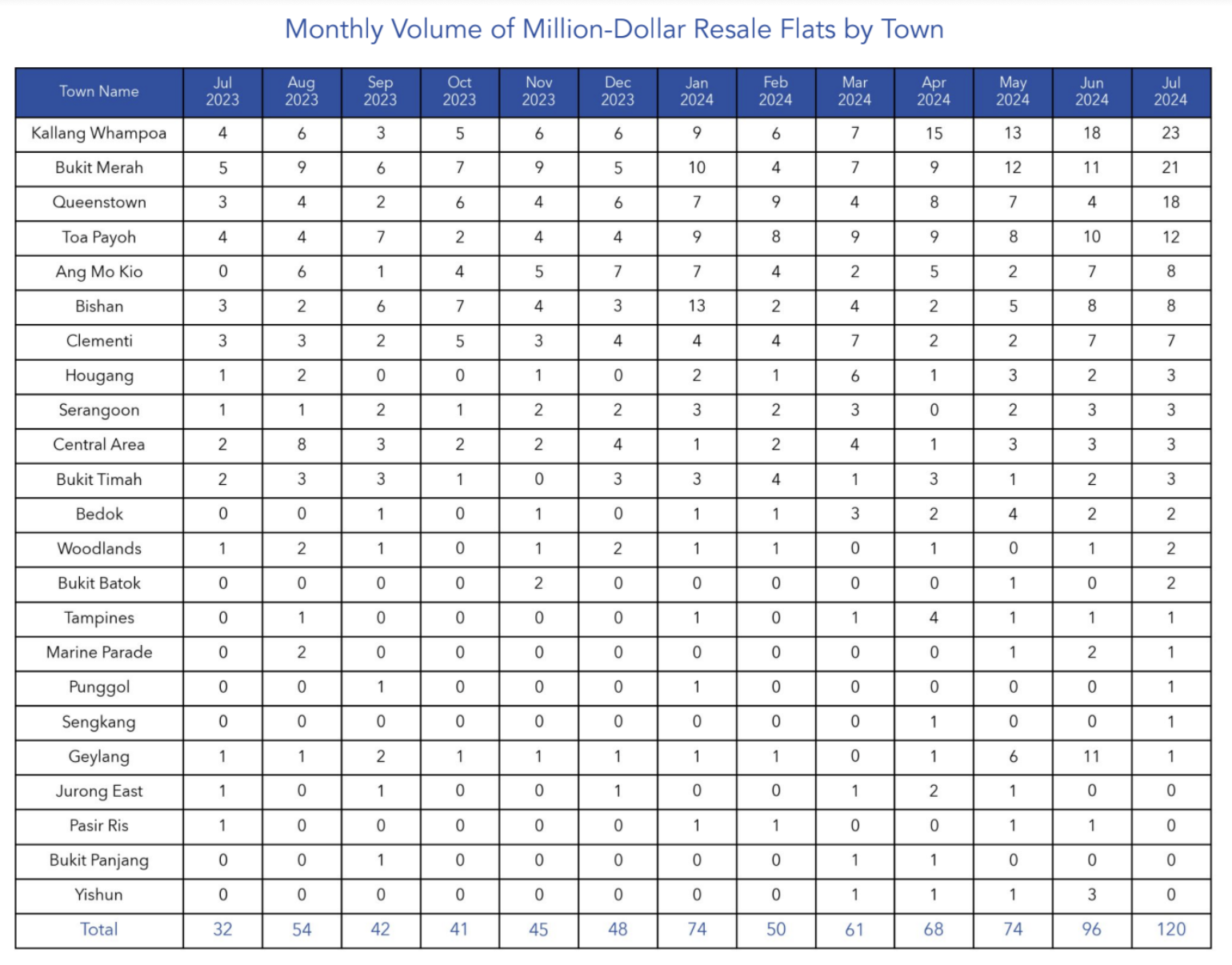

According to the 99-SRX Media Flash Report, there were 120 transactions of million-dollar HDB flats in July, up from 96 transactions in June, surpassing the 100-transaction mark.

This represents 3.9% of all transactions in July. So far this year, there have been 543 million-dollar HDB transactions, exceeding 470 for all of 2023.

The uptick in million-dollar transactions can partly be attributed to new HDB projects recently reaching their Minimum Occupation Period (MOP).

Developments such as Ghim Moh Edge, St. George’s Tower, and McNair Towers, which began their leases in 2017, contributed 47 of the 120 million-dollar transactions in July.

July also saw a significant increase in overall HDB resale activity. With 3,049 flats sold, the month recorded the highest transaction volume since June 2010.

While July typically sees a rise in resale volume after the June holidays, this year’s increase is more pronounced, suggesting that more private property owners are moving to higher-end or well-located HDBs.

Mr Luqman Hakim, Chief Data & Analytics Officer at 99.co noted that an anticipated interest rate cut later this year could ease the demand for HDBs by making condominiums more affordable for higher-income households.

Until then, current economic conditions are likely driving more homeowners from private properties to upscale HDBs.

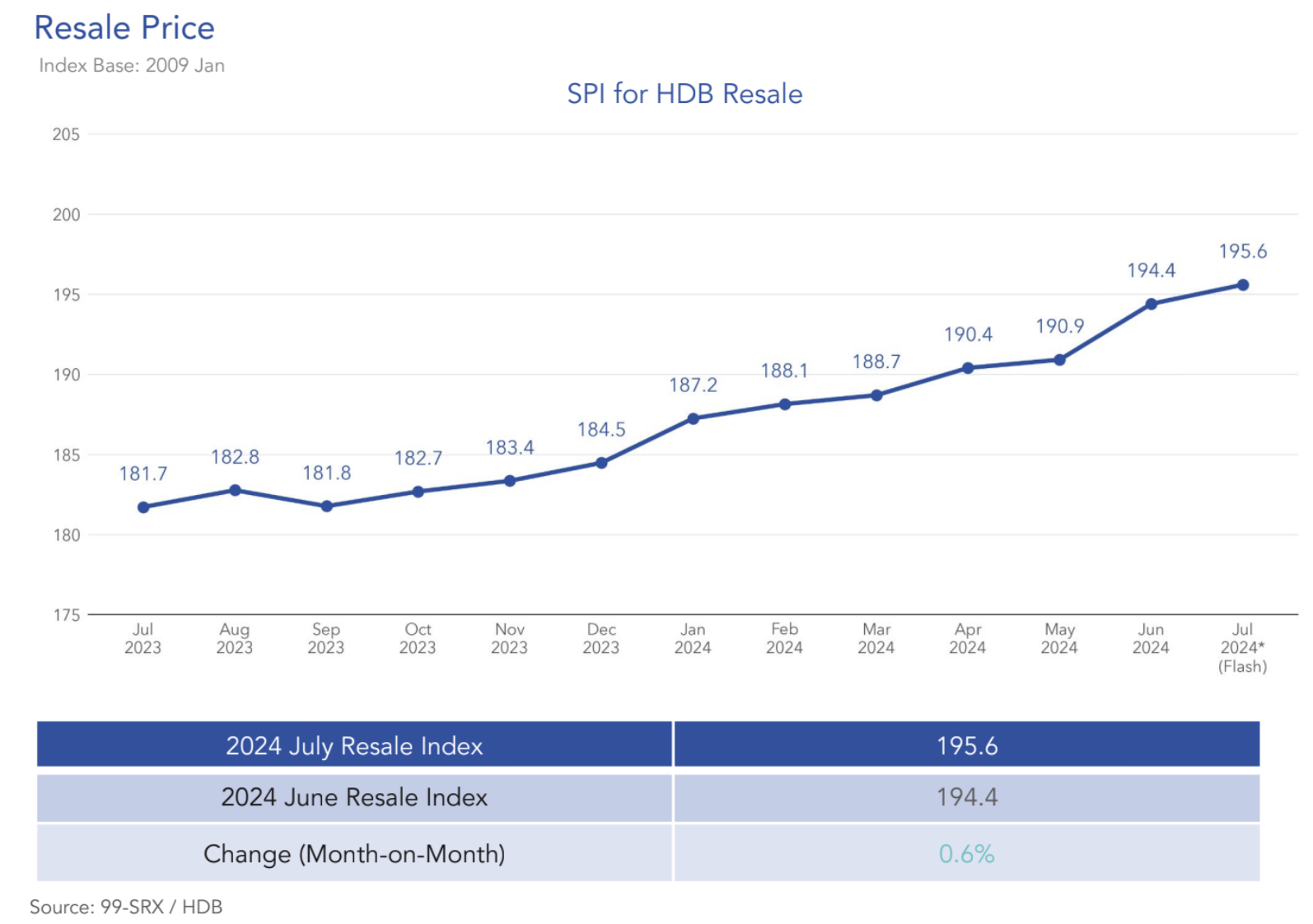

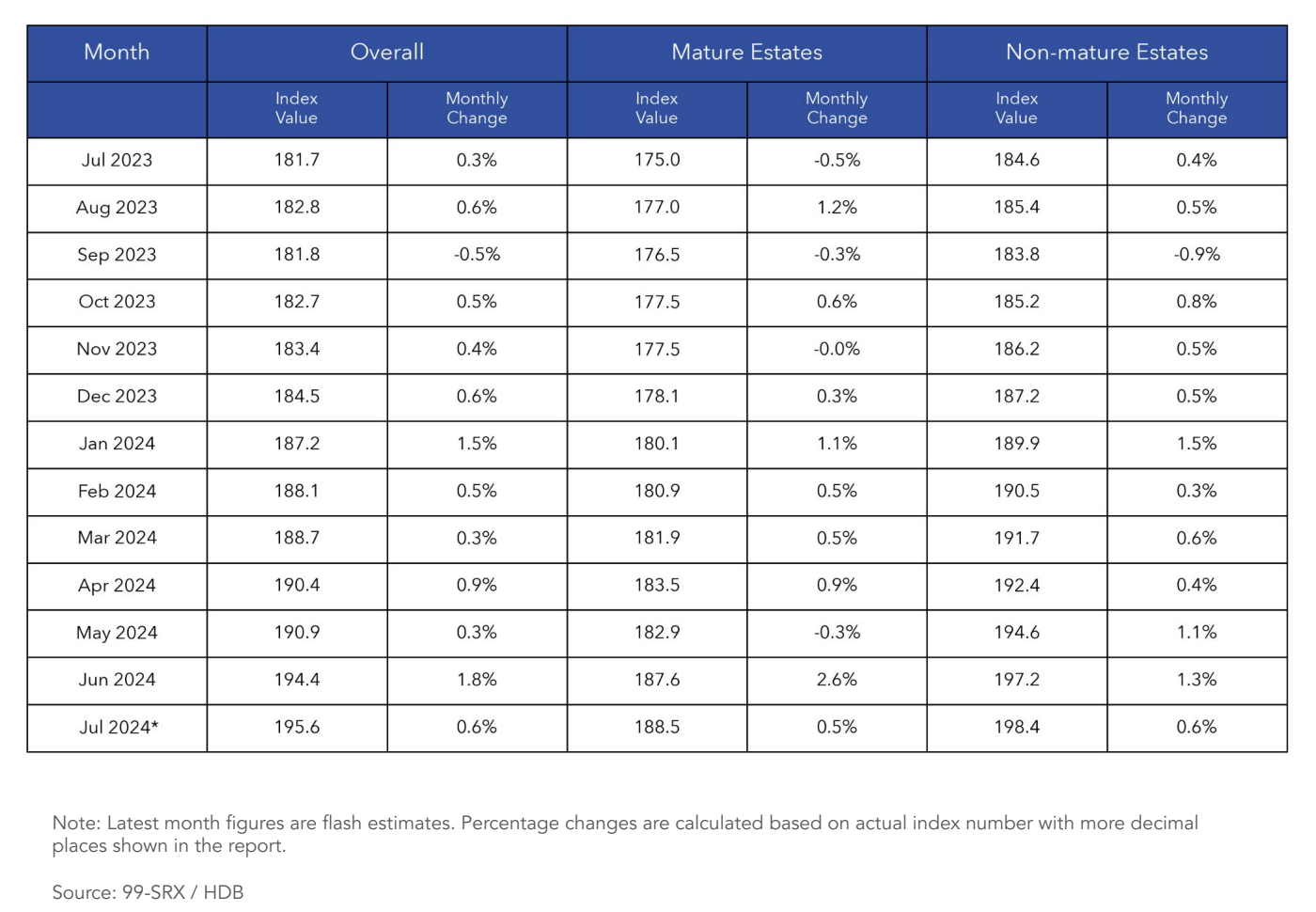

In July 2024, HDB resale prices increased by 0.6% compared to June. Prices in both Mature and Non-Mature Estates rose by 0.5% and 0.6%, respectively.

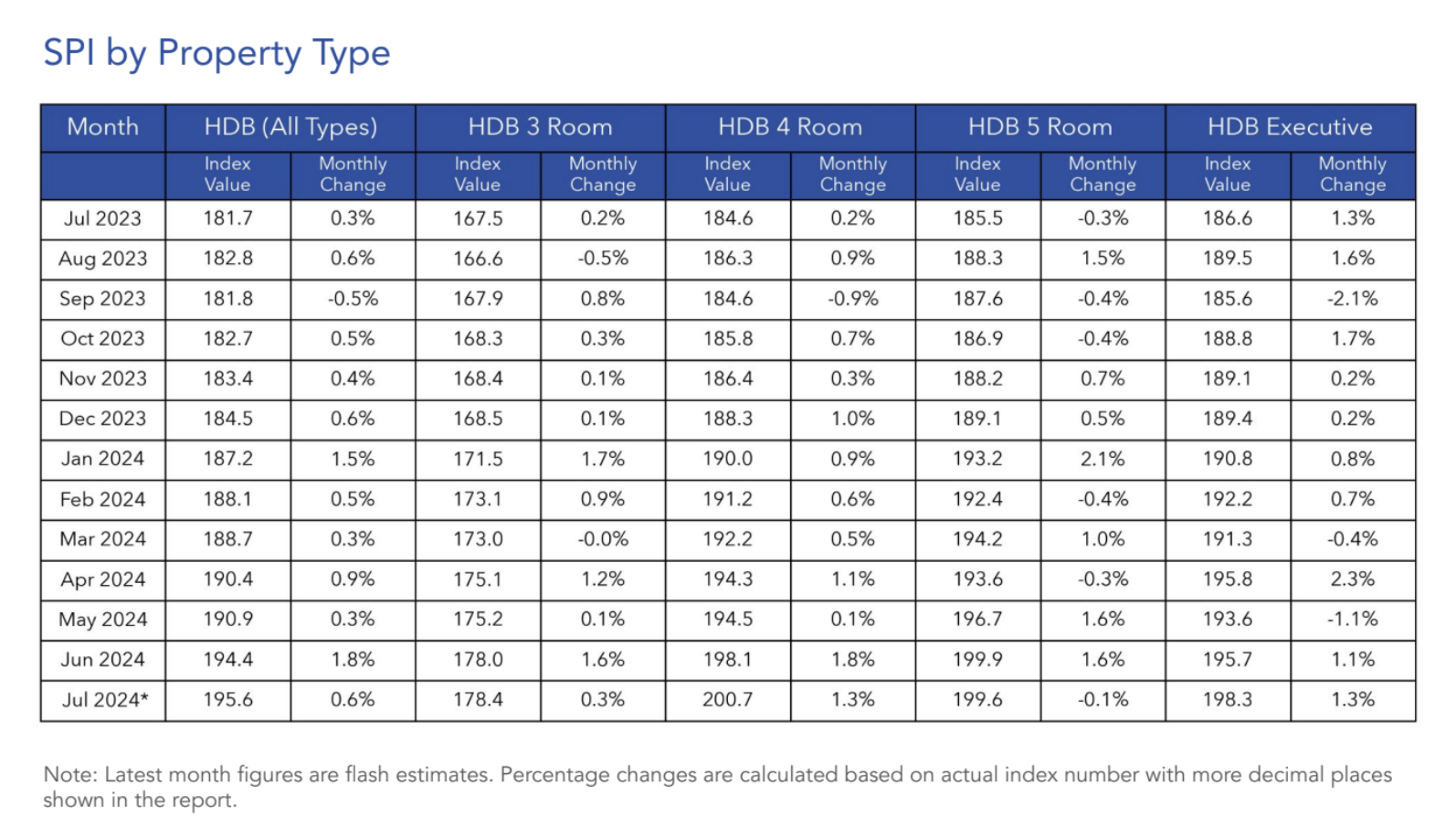

Among room types, 3 Room prices increased by 0.3%, 4 Room prices by 1.3%, and 5 Room prices decreased slightly by 0.1%. Executive flat prices saw a rise of 1.3%.

The SRX Property Price Index for HDB Resale shows a 7.6% increase in overall prices from July 2023. Prices for all room types have risen year-on-year: 3 Room by 6.6%, 4 Room by 8.7%, 5 Room by 7.6%, and Executive by 6.3%.

Prices in both Mature and Non-Mature Estates also increased by 7.8% and 7.5%, respectively, compared to the previous year.

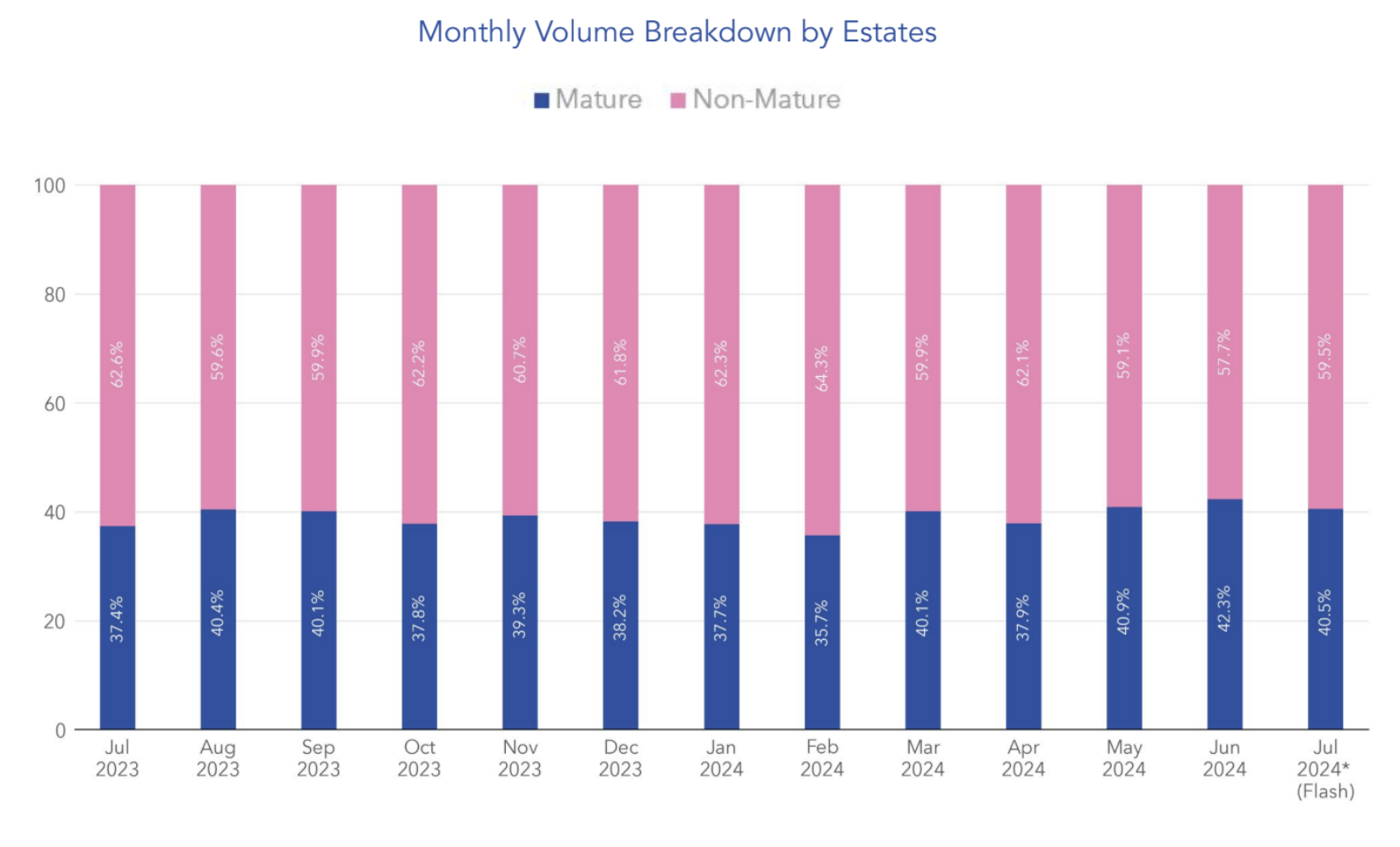

The resale volume in July 2024 was 48.3% higher than the previous year, with Non-Mature Estates accounting for 59.5% of transactions. Meanwhile, Mature Estates made up the remaining 40.5%.

The highest price for a resale flat in July was S$1,568,000 for a 5 Room unit on Bishan Street 24. In Non-Mature Estates, the top transaction was a 5 Room flat at Punggol Field, selling for S$1,228,000.

In terms of million-dollar transactions, Kallang/Whampoa led with 23 units sold, followed by Bukit Merah with 21 units and Queenstown with 18 units.

Other areas with notable sales included Toa Payoh, Ang Mo Kio, Bishan, Clementi, Hougang, Serangoon, Central Area, Bukit Timah, Bedok, Woodlands, Bukit Batok, Tampines, Marine Parade, Punggol, Sengkang, and Geylang.

/TISG

Read also: Over 53,000 HDB flats to be upgraded with S$742 million investment under home improvement program

Featured image by Depositphotos