As many retail investors feared, Hyflux revealed today (4 Apr) that the rescue deal with Salim-Medco has been terminated. Hyflux said in a statement that the deal is off the table despite its repeated attempts to meaningfully engage with the Indonesian consortium.

Revealing that Salim-Medco’s responses and conduct has led it to have “no confidence that the investor is prepared to continue to complete the proposed investment,” Hyflux said that the “restructuring agreement is therefore terminated.”

In Oct 2018, Indonesian consortium SM Investments (which is made up of the Salim-Medco Groups) agreed to buy a 60 per cent stake in Hyflux as part of a rescue deal. Securities Investors Association Singapore (SIAS) chief David Gerald called Salim-Medco a “white knight” and the only hope for the investors of Hyflux who have been left high and dry.

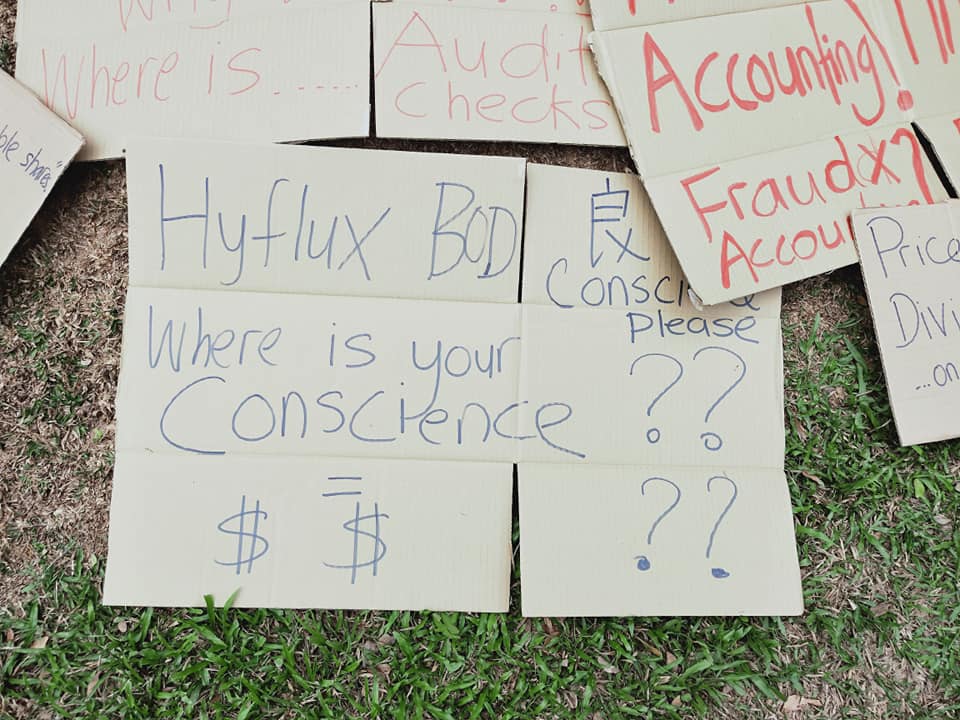

About 34,000 perpetual securities and preference shareholders who invested in Hyflux are owed a total of S$900 million, but only stand to receive a recovery rate of 10.7 per cent comprising of 3 per cent in cash and 7 per cent in equity.

Many of these retail investors are ordinary Singaporeans who invested their savings into Hyflux as they considered the firm’s water desalination plant a “national asset“.

These retail investors faced greater uncertainty when the Public Utilities Board (PUB), a statutory board under the Ministry for Environment and Water Resources, jumped in and announced that it will take over the water plant for “zero dollars” if Hyflux cannot resolve all defaults by tomorrow.

SIAS chief David Gerald had earlier pointed out that PUB’s takeover plans could impact retail investors since the move seemed to cause Salim-Medco to consider backing out of the deal. These fears have come true and the “white knight” has walked away from the table mere weeks before the expiry of Hyflux’s court-sanctioned reprieve from creditors.

This latest setback comes days after Environment and Water Resources Minister Masagos Zulkifli announced in Parliament that there will be no Government bailout for the investors of the debt-ridden firm.

Masagos said that the Government is aware of the plight of Hyflux’s retail investors, however, it “cannot use taxpayers’ money to help investors recoup their investment losses,” though it is “saddened by their plight”.

Despite these events, Hyflux assured its stakeholders today that it will “relentlessly pursue all other viable strategic opportunities” and that it “intends to work closely with the key creditor groups and relevant stakeholders to find mutually acceptable bases to enable the company to pursue such alternative opportunities.”

Hyflux also painted the PUB’s decision to acquire Hyflux’s beleaguered water plant for “zero dollars” as a positive development, claiming that the acquisition would help it find a new white knight who wants to invest in the firm without the water plant.

It said: “(This) development could potentially enable the company to reach out to a wider pool of investors which may not otherwise have been interested in an investment in the group had this asset remained within the group and for which PUB’s approval for a change in control of such asset will be required.”

Retail investors, however, could still be left in the lurch. Hyflux cautioned: “There can be no assurance that the company will be successful in securing a new investor or in finding a viable alternative to execute the restructuring.” /TISG

https://theindependent.sg.sg/we-invested-in-hyflux-because-of-strong-govt-support-and-because-temasek-invested-hong-lim-park-protestor/

https://theindependent.sg.sg/temasek-subsidiary-director-continues-to-sit-on-hyfluxs-board-even-after-temasek-pulled-out-of-the-firm/

https://theindependent.sg.sg/sias-chief-urges-pub-to-consider-the-plight-of-50000-singaporean-investors-of-hyflux-in-open-letter/