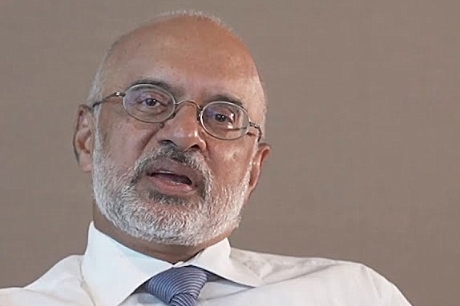

SINGAPORE: Singapore’s largest lender DBS Bank has revealed that its chief executive Piyush Gupta’s pay was slashed by a hefty 27 per cent, last year. Despite the bank’s record profits in 2023, Mr Gupta’s pay dropped from $15.4 million in 2022 to $11.2 million, last year.

The pay reduction is part of the bank’s promise to hold senior management accountable for the spate of digital service outages in 2023.

In its 2023 annual report, released yesterday (6 Mar), DBS said: “While the bank fared well against most priorities on its balanced scorecard, it fell short in technology resiliency. This and the resultant impact on customers and the franchise were taken into account when determining the scorecard performance of both the group and the CEO.”

DBS performed exceptionally well, in terms of profit, last year. The bank’s total income surpassed the $20 billion mark for the first time, with net profit hitting $10.3 billion and return on equity reaching 18 per cent.

Despite this, the digital disruptions impacted the bank’s overall scorecard, which is used to determine remuneration based on shareholder, customer, and employee indicators, as well as progress in transforming the bank, scaling growth across markets, and managing risks.

The bank said in its report: “The gaps in technology resiliency resulted in a lower scorecard appraisal by the board compared to the previous year.”

Mr Gupta, who remains one of the highest paid bank bosses across Asia, was not alone in facing a pay cut.

The total variable pay for senior management, including the CEO, was reduced by 21% to reflect accountability for the digital disruptions. Senior management’s aggregate total compensation, excluding that of the CEO, saw a decrease from $73.8 million in 2022 to $63.5 million in 2023.

While Mr. Gupta’s base salary of $1.5 million remained unchanged, he received a lower cash bonus of $4.1 million, compared to the $5.8 million he took home in 2022.

His deferred remuneration also saw a decline, totaling $5.6 million, with approximately 17.4% in cash and the remaining in the form of shares.