Choon Kim House, a freehold collective sale site at Upper Serangoon Road, has just been relaunched for sale by tender by sole marketing agent, JLL.

The property was first launched for sale in April 2018 at the asking price of $55 million but the tender closed without a deal. The Collective Sales Committee (CSC) initiated a proposal to lower the reserve price to $50 million. This was duly approved and over 80 per cent of owners have consented to the lowering of the reserve price.

Completed in the early 2000s, the freehold 4-storey cum attic development consist of 20 commercial units and 10 residential units with 19 basement carpark lots. Under the 2014 Masterplan, the 14,988 sq ft site is zoned ‘Commercial and Residential’ with a gross plot ratio of 3.0. The site may potentially support a total GFA of 47,661 sq ft (inclusive of the 10% bonus gross floor area for the residential component, subject to approval).

Choon Kim House is easily accessible, being 700m away from Serangoon bus and MRT interchange, by both the Central Expressway (CTE) and Kallang-Paya Lebar Expressway (KPE).

Choon Kim House is easily accessible, being 700m away from Serangoon bus and MRT interchange, by both the Central Expressway (CTE) and Kallang-Paya Lebar Expressway (KPE).

Future residents of the development are also able to enjoy the convenience of a wide range of amenities at the nearby Nex megamall and Kovan Heartland mall as well popular dining enclaves located along Upper Serangoon Road. In addition, the site is surrounded by reputable primary and secondary schools. Paya Lebar Methodist Girls School is within a 1km radius while Maris Stella High School, St Gabriel’s Primary School, CHIJ Our Lady of Good Counsel and more are within a 2km radius.

Choon Kim House also offers an appealing opportunity for organizations/institutions and business owners who are looking to own and occupy their building for naming rights and brand awareness, or an investor/developer who wish to explore other forms of development like a boutique hotel or student hostel, subject to change of use and planning approval.

At the Reserve Price of $50 million, Choon Kim House reflects a land rate of $1,173 per sq ft per plot ratio (psf ppr) or $1,149 psf ppr after factoring in the 10 per cent bonus GFA for the residential component, subject to approval.

Choon Kim House is popular amongst families and young couples who appreciate the convenience, ready amenities and one of a kind dining options in the Serangoon area. It also has an excellent 50m front road frontage along the busy Upper Serangoon Road and is relatively well maintained. Investors are able to explore asset enhancement plans to potentially increase the lettable area or convert it to a higher value use.

The property along Upper Serangoon Road also offers an appealing opportunity for owner occupiers who are looking for a freehold building at a manageable quantum in a central location. For instance, schools and/or institutions looking to house their corporate offices and residential needs under one roof.

The tender for Choon Kim House closes on Wednesday, 30 January 2019, at 2.30pm.

About 3 months after Choon Kim House was first launched for en bloc sale, the Government announced a fresh round of residential market cooling measures, increasing the rates of the Additional Buyer’s Stamp Duty (“ABSD”) and reducing the mortgage loan-to-value limits across the board.

In addition, for residential land purchases, there would also be a non-remissible ABSD of 5 per cent. The property cooling measures took the market by surprise and the en bloc sales market collapsed soon after. The Government’s property cooling measures caused the en bloc sales market to collapse. The en bloc sales market collapse have been amplified by developers being less active in the collective sale market, while new homes sales at some recent launches have moderated.

Mr Paul Ho, chief mortgage consultant of iCompareLoan said owners of Choon Kim House have to act quickly and decisively. Whatever decision owners facing en bloc sale make, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners. One way he said was to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on.

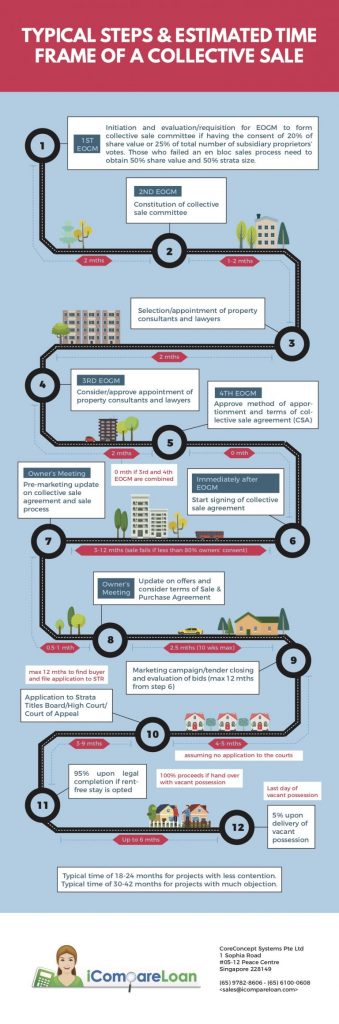

En Bloc Sales Process Singapore – A Definitive Step-by-step Guide

As collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

Mr Ho pointed out that the rules are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

He said that many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

Mr Ho suggested that if one’s home is at risk of en bloc, the owner could consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

How to Secure a Home Loan Quickly

Are you planning to invest in properties like Gilstead Mansion but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.