SINGAPORE: The Housing and Development Board (HDB) is tightening its loan limits as part of a new property cooling measure, according to a joint media release from HDB and the Ministry of National Development (MND) on Monday, Aug 19.

From today, Aug 20, 2024, the maximum loan-to-value (LTV) limit for HDB loans will be reduced from 80 per cent to 75 per cent.

According to National Development Minister Desmond Lee, this is to encourage more prudent borrowing and dampen the demand in the higher-end resale market.

He explained that while this change will affect a small percentage of buyers who currently borrow more than 75 per cent of their flat’s value, “(this) will in turn have a knock-on effect of stabilising the rest of the resale market.”

Mr Lee noted that this would not impact most HDB housing loan takers, as nearly nine in ten home buyers borrow at LTV ratios of 75 per cent or less. The remaining 10 per cent are borrowing from HDB at ratios 75 per cent to 80 per cent of their flat’s value.

He described this proportion as “not insignificant.”

Mr Lee explained, “That 10 per cent disproportionately buy the larger flat types, which drive up the overall market … They also disproportionately pay much higher prices.”

He noted that for this group, the median transaction prices can be S$20,000 to S$60,000 higher, depending on the type of flat.

He added, “(The lowering of the LTV limit) seeks to be a cooling measure in that by tackling the higher-end of the HDB resale market, we are seeking to moderate some of the prices that have an impact on the overall market.”

According to Channel News Asia, this adjustment marks the fourth set of property cooling measures since December 2021. Previously, the LTV limit was reduced from 90 per cent to 85 per cent and then to 80 per cent in September 2022.

Although the government observed that previous cooling measures and increased Build-To-Order (BTO) flat supply have slowed resale price growth, resale prices rose by over 4 per cent in the first half of the year due to strong demand “across all buyer groups” supported by rising incomes and escalating property prices.

The market is also experiencing “some tightness” in the supply of resale flats, with fewer flats reaching their minimum occupation period this year.

Mr Lee noted that high-profile sales of HDB flats at record prices influence “market psychology,” though these high-priced flats represent only a small proportion of transactions.

Over the past 18 months, flats exceeding the million-dollar mark accounted for only 2 per cent of resale transactions. These are mainly maisonettes, executive apartments, jumbo flats, or five-room flats in prime locations, on high floors, or with long remaining leases.

High-priced four-room and smaller flats are typically found in or near the city centre, well-served by transport and amenities, and often on high floors with good views.

“Flat sellers who are reading such news raise their expectations about how much their flat could bring, while flat buyers become anxious to secure flats before prices get higher,” he said. He warned that this could lead to a market bubble if not addressed.

Mr Lee noted that the property market is historically cyclical, and those who buy at higher prices with larger loans will face the greatest impact when the market cools.

“This is why we are moving now to dampen demand and encourage prudent borrowing, even as we continue to inject supply at a steady pace to meet demand,” he explained.

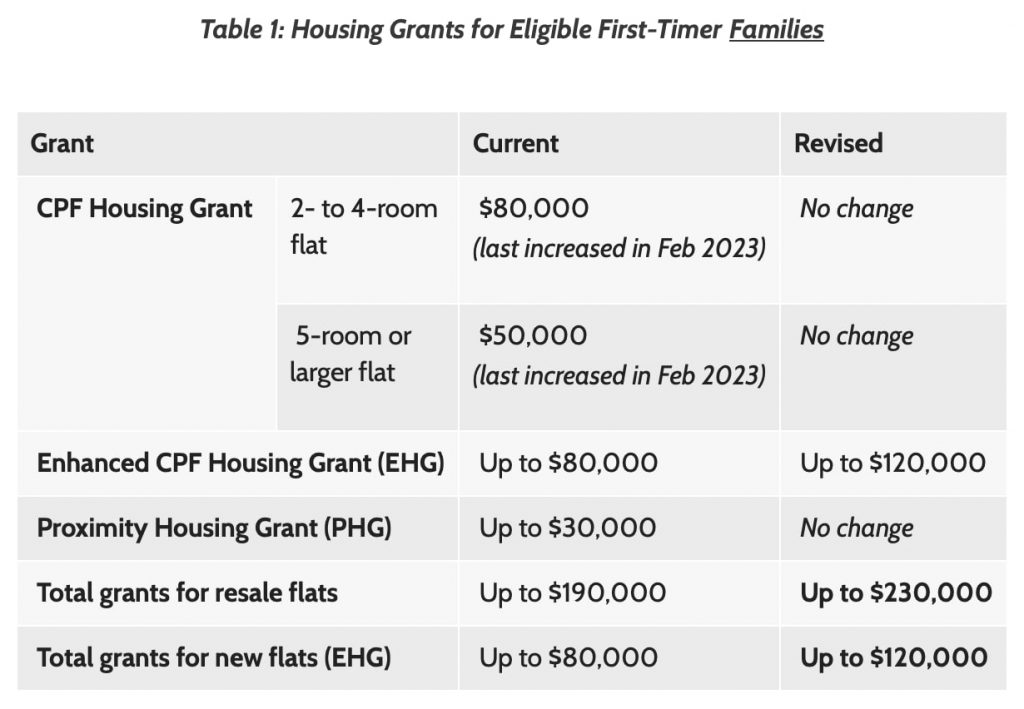

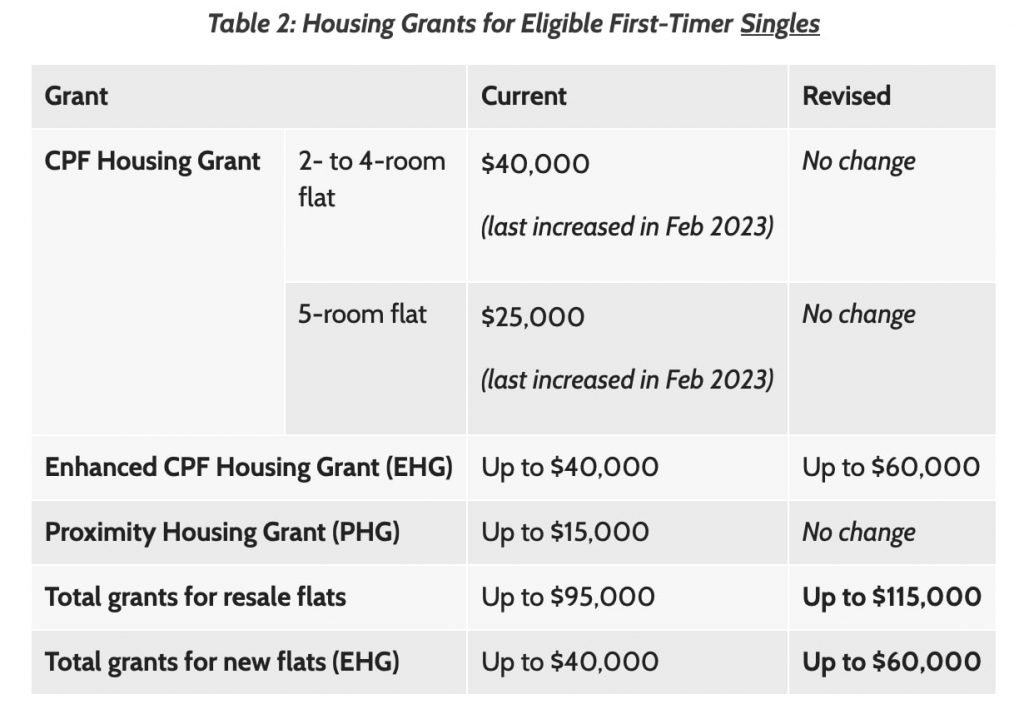

In addition, the government has increased financial support for first-time home buyers, especially those with lower incomes.

The Enhanced Central Provident Fund (CPF) Housing Grant will now provide up to S$120,000 for families and S$60,000 for singles, up from S$80,000 and S$40,000, respectively.

Mr Lee stated, “This is a significant increase from what we provided previously and will help first-time home buyers afford their first home.”

He assured that the grants are “means-tested” and progressively tiered to provide more support to those in need without unintentionally raising overall market demand.

The Enhanced CPF Housing Grant, introduced in September 2019, has already benefited around 72,300 first-time households, distributing more than S$2 billion in aid.

According to HDB and MND, in the first half of 2024, approximately S$204 million was allocated to about 7,000 first-time households.

Among the 72,300 first-time households who have received the grant so far, 40 per cent purchased resale flats, while the rest bought HDB flats through various sales methods, including Build-to-Order (BTO), Sale of Balance flats, and open bookings.

The new grant will be available to first-time households who:

- Apply for a new flat from the October 2024 BTO exercise onwards

- Submit a resale flat application on or after Aug 20, 2024

- Apply for an HDB Flat Eligibility (HFE) letter on or after Aug 20, 2024

/TISG

Featured image by Depositphotos