SingHealth polyclinics and hospitals is allegedly working with debt collection agencies in order to reclaim unpaid fees.

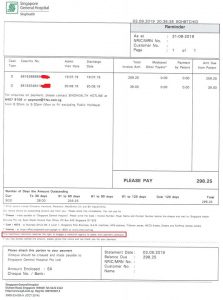

In images circulating online of a bill from Singapore General Hospital (SGH), the fine print reads, “The healthcare institution reserves the right to engage a collection agency to assist with payment collection”.

The bill, dated September 3, 2019, showed that the balance due was S$298.25.

The patient had visited SingHealth clinics or hospitals twice, once on July 19, 2019, with a bill of S$259.25, and another time on August 20, 2019, with a bill of S$39.

The bill showed that the number of days the amount was outstanding was between 31 and 60 days.

The netizen who submitted the images wrote, “Take note that SingHealth clinics or hospitals will allow patients to pay later. Fine print is that they “have the right to engage a collection agency to assist with payment collection”.

He also wrote, “Dear all, be careful when you next visit any SingHealth clinics or hospitals. If you are sick & has no money to seek medical assistance, don’t go SingHealth. Either you go other place to see or see private or don’t see.

Now, SingHealth clinics & hospitals will let you pay later. However, after few weeks, they will get the CREDIT company to come after you for the monies you owe them. Poor people really poor, especially those who needs to go every month. Then what happened?? The amount will snowball. Then, CREDIT company charge interest…. How to pay in the end???

Where did SGH spent the monies given to them??? By engaging a CREDIT company means SGH is very rich to the extend that they can get more & more 3rd parties to work for them. Then, over at the patients side, the charges going higher & higher.

Please share & let everyone know, how SGH is wasting everybody monies, including the yearly budget they have gotten. Where your monies gone to also…”

Along with the SGH bill was a letter from SGH that read, “You may have overlooked settling the account as the amount of S$259.25 remains unpaid. Let us know if you have not received the bill/s. We would appreciate it if you could arrange for payment immediately”.

The letter clarified that “all bills are payable upon receipt”, and added, “any unsettled bill/s will be transferred for management by our appointed service partner. They will be following up, on our behalf to enquire about the payment status”.

The letter also stated that their service partner was Pinnacle Credit Services Pte Ltd.

SingHealth also works with other debt collection agencies such as abacusCredit.

Many netizens said that they had seen these collection agencies before, and alleged that they behaved like loan sharks who looked rather intimidating.

TISG has reached out to SingHealth for clarification and comment.

Their response: We noted Mr Goh’s Facebook posting regarding our billing process. We have reached out to him to better understand his concerns and to offer our assistance.

We introduced our Drop and Go service for the convenience of our patients. This service allows our patients to leave our clinics after consulting our doctors, with the bill and next follow-up appointment sent to them.

For patients who use our Drop and Go service or have outstanding bills, we will follow up with SMSes and reminder letters. The Hospital will only refer outstanding bills to appointed collection agencies for further follow-up after 6 weeks.

Patients can opt to pay their outstanding bills through several methods – by ePay, internet and mobile banking, self-service automated kiosks, 7-Eleven stores and Singapore Post Office branches. These payment modes are listed on the bill and reminders.

We ensure that no patient will be denied the medical assistance they need due to financial reasons. At any time, should any patient express difficulties in paying his or her hospital bill, the Hospital would assess the case and explore all options such as instalment payments or financial assistance schemes if eligible.-/TISG