Singapore—2020 has been a hard year indeed for one of the country’s biggest oil trading companies, Hin Leong Trading.

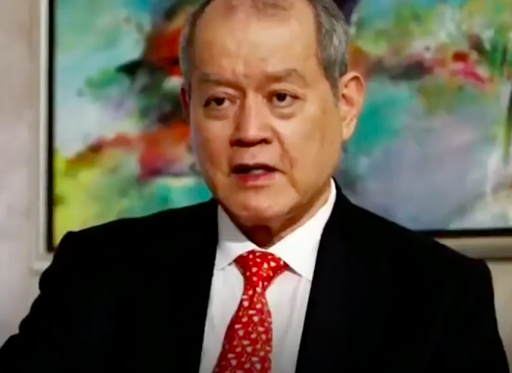

In April, owner Lim Oon Kuin, popularly known as OK Lim, filed for bankruptcy, taking to court for protection from his company’s creditors. But at that point, Hin Leong’s troubles were only beginning.

On Dec 14 (Monday), Bloomberg reported that Bank of China Ltd. has sued BP Plc in Singapore for the part the company reportedly played in arranging oil deals with Hin Leong. Bank of China is only the most recent of creditors that has endeavoured to get back its losses in the oil trading scandal involving Hin Leong.

Bank of China is asking BP for a repayment of $125.7 million (S$168 million). Documents provided by the Supreme Court of Singapore showed that this amount had been withdrawn based on sales of gasoil cargoes to Hin Leong which had never actually taken place, but were merely a part of a “fictitious purchase scheme conspiracy” to maintain Hin Leong’s liquidity.

The bank is also asking for a repayment of $187.2 million (S$250 million) from OK Lim and his two children. This amount is comprised of the deals with BP as well as payments on short-term loans that are overdue, and letters of credit.

However, BP denied the Chinese bank’s allegations and said that it will defend its position.

In early February, BP withdrew $125.7 million (S$168 million) from Bank of China on three letters of credit. Hin Leong bought 1.5 million barrels of gasoil from BP, with Hin Leong presenting the needed documentation to prove the legitimacy of the trades.

However, Hin Leong’s judicial managers later told Bank of China that the trades had been mere fabrications.

“HLT fabricated documents on a massive scale. The forged documents enabled HLT to mislead banks into extending financing to it and also acted as supporting documentation for fictitious gains or profits,” wrote the bank in its suit.

HSBC and Singapore’s DBS Group Holdings Ltd., among Hin Leong’s other creditors, are also seeking to get back funds from the oil trading company, already in debt for $3.5 billion (S$4.7 billion).

In November, HSBC sued OK Lim and his two children with the intent of recovering $85.3 million (S$115.8 million) of the $111.7 million (S$149 million) they received using fake invoices and documents.

In September, Mr Lim was slapped with abetment of forgery for the purpose of cheating, the second such charge against him, because in August, Mr Lim was charged with instructing Mr Freddy Tan Jie Ren, an executive at his trading company, to forge a document.

The police statement said that “the charge, which arises from investigations by the Commercial Affairs Department into Hin Leong, relates to Lim Oon Kuin instigating a Hin Leong employee to forge an email purportedly sent by Hin Leong to China Aviation Oil (Singapore) Corporation Ltd on 26 February 2020 in relation to a sale transaction of Gasoil 10PPM Sulphur.

This email, along with the Inter-Tank Transfer certificate mentioned in the first charge, was submitted to a financial institution to secure more than US$56 million (S$77 million) in trade financing.”

The two counts of abetment of forgery for the purpose of cheating, which is punishable under Section 468 read with Section 109 of the Penal Code, Chapter 224, could mean that Mr Lim could end up in prison for as long as 10 years and be fined.

Mr Lim was first charged with forgery on Aug 14, for having Mr Tan forge a document allegedly issued by UT Singapore Services that stated that the company had transferred over one million barrels of gasoil to China Aviation Oil (Singapore). —/TISG

Read also: Embattled oil tycoon OK Lim slapped with second abetment of forgery charge