By Augustine Low

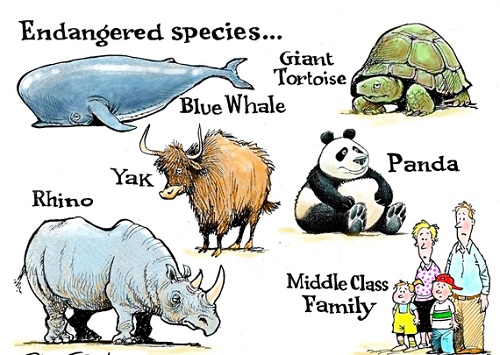

Not much has changed in the last ten years since this piece was first published. Some great points here to think and ponder about. What exactly are we fighting for?

Middle-class parents walk a constant tightrope. One the one hand, there is the need to cope with Singapore’s over competitive education system. On the other, there is the danger of our children taking extravagance and self-indulgence for granted.

I hear that kids as young as six or seven already engage in one-upmanship about family holiday destinations.

My son, who is 13, claims that many of his classmates change their smartphones every year. I use a six-year-old model, so it’s not that hard convincing him that his three-year-old one is more than adequate. But I don’t know how much longer I can delay getting him that $500 pair of Beats headphones which are apparently a must-have.

It can only get more trying for the middle class, with Singapore being modelled as a hotspot for the super rich. PM Lee Hsien Loong himself has said as much – he would find it hard to resist opening the door to the super rich who want to come here.

Already, we have Singaporeans who become an Internet sensation showing off Hermes home and designer bags that each cost a year’s income for many people. With more super rich in our shores, they could bring with them their extravagant lifestyle and excessive culture of consumption.

At best, this breeds envy. At worst, this weakens social fabric and breeds discontent.

Beyond ostentatious spending, what else do the super rich, especially the mega entrepreneurs, bring to Singapore? Conventional thinking is jobs creation. But it may not be so. In a provocative new book Who Owns The Future?, author Jaron Lanier says that the digital revolution has led to wealth concentration in fewer people, with fewer jobs than ever before.

Lanier cites the example of Instagram, the new face of digital photography, which was sold to Facebook for US$1billion last year. It employed a total of only 13 people! Not that the 13 were extraordinary employees, but the value of companies like Instagram come from the millions of users who contribute to the network without being paid for it.

So the super rich, especially those who make their bucks from the digital revolution, do not necessarily spur the economy.

In fact, Lanier argues that the concentration of wealth in fewer people has led to the collapse of middle-class financial security in the US and many parts of the world.

What about Singapore?

If you are rich (foreign passport accepted), the government will be happy to work with you and woo you to set up home and business. You are also welcome to enjoy the tax breaks.

If you are poor, the government will give you grants and put you on some form of welfare or credit scheme. But you will lead a life of hand-to-mouth and may have to clean public toilets or clear food court tables in your old age.

But, if you are in the middle? The term “middle-class squeeze” then applies to you.

You will be straddled with housing and car debt. You expect your two (or maybe just one) children to enter university from the time they were born. So you give them the best, you invest heavily in enrichment classes and tuition and try to get them into what you think is a good school – although MOE says every school is a good school.

You and your spouse work really hard, maybe on a salary of $5,000-$6,000 each a month.

Some of it probably goes to the maid every month. And if you live in a condominium, it’s your maid (and pet dog/children) who spend more time enjoying the facilities than you and your spouse because you are both too busy working.

Your hope is that you will save enough money for your retirement (by 60 or 65, because you do not wish to think about living till 90, or worse still, work till that age). And you worry if you are able to see your children through university, if they can’t make it to a local one.

Good old-fashioned financial security for the middle-class? It could just be a pipe dream now.

Augustine Low is a communications strategist.