By: Chris Kuan

No, it is not a new dance craze. A contango is a market condition in which the spot price of a commodity is lower than its forward or future price.

In normal times, the spot price should be higher than the future price because buying a commodity for spot or immediate delivery requires cash outlay or financing and cost of storage.

But these are not normal times, especially with low and now negative interest rates across most of the industrial world.

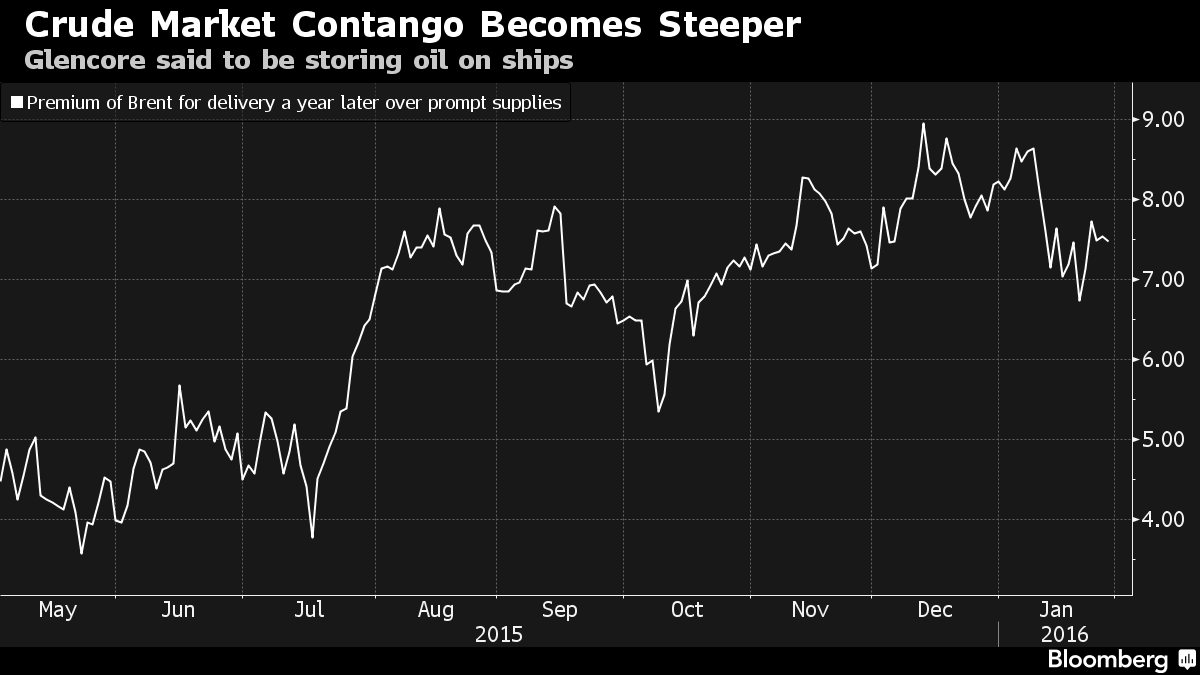

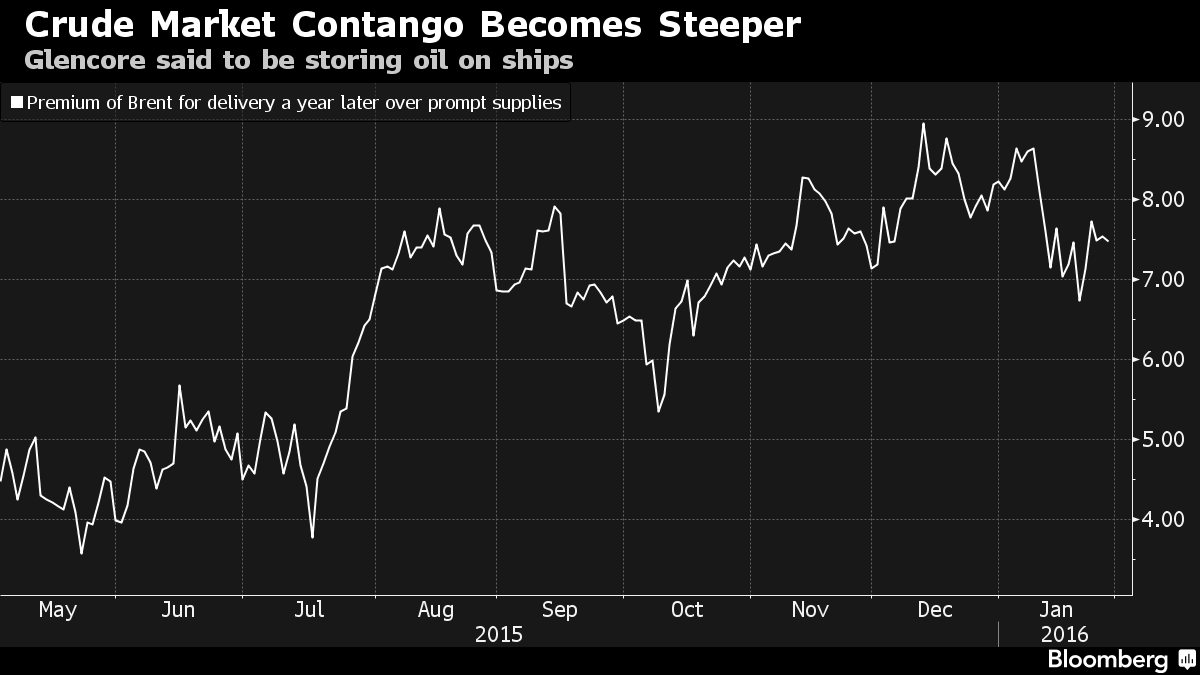

The biggest contango and no prize for guessing is in the oil market. The size of the oil contango, the difference between the spot price and the higher future price, is large, so large that it exceeds the cost of financing and storage.

Which, of course, attracts traders and speculators who profit from buying up oil at spot price, selling the oil at the higher future price for delivery at a future date and storing them in tanks until the contracted delivery date. This is called the cash and carry trade.

Normally the contango will not persist because the cash and carry trade will both drive the spot price up and the future price down.

Again this is not normal times. Oil companies are heavily indebted and oil producing nations are saddled by excessive expenditures from the days of expensive oil. Oil production remains elevated pumping out keeping the spot price depressed.

And the contango comes to Singapore in the shape of 4 super tankers or very large crude carriers as they are called these days. Holding a total of 8 million barrel of oil, they are kept floating off the coast of Malaysia and Singapore.

Bloomberg News reported that they are used by the commodity giant, Glencore for their oil contango cash and carry trade (http://www.bloomberg.com/news/artic…). The firm has declined to confirm this.

How long will this hold? Well as long as the oil contango persist – the cash and carry trade is very profitable and relative low risk or at least low when not incorporating environmental risk should one of the tankers sprang an almighty leak.

In recent days, some oil market analysts suggests that the rising cost of storage (because of the contango) and various market factors may cause the contango to collapse amidst rising oil prices in the next 6 months.

In meantime, fingers crossed nothing happens to those tankers.

—

Republished from Chris Kuan’s FB.