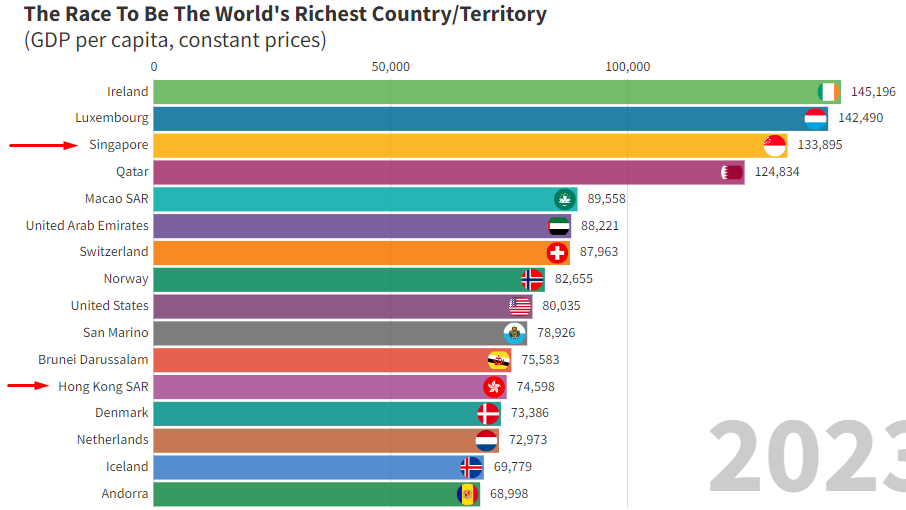

SINGAPORE: Singapore surpasses Hong Kong in wealth rankings, as reported by Dimsumdaily Hong Kong. The findings, revealed in an analysis by the Global Finance Magazine, show that Singapore ranks 3rd while Hong Kong ranks 12th.

Smaller states like Singapore(3rd) that also ranked in the top 10 include San Marino(10th) and Luxembourg(2nd), challenging the conventional notion that a country’s size dictates its wealth.

Wealth Beyond GDP

The traditional wealth metric, gross domestic product (GDP), is under scrutiny. Dividing GDP by the population yields wealth per capita. However, this shows a paradox of smaller countries boasting larger economies, given their population.

Critics argue that economic output alone fails to capture a nation’s well-being and that the decisive factor for its wealth lies in its purchasing power parity (PPP).

Accounting for inflation and the local cost of living, PPP translates economic output into the standard of living for the average citizen. Yet, a high PPP does not guarantee widespread affluence. Structural inequalities persist within nations, disproportionately benefiting the already privileged.

The pandemic has emphasised these disparities. While wealthy nations were better equipped to support their citizens, uneven resource distribution became evident. The economic downturn affected low-income workers, exposing vulnerabilities even in well-regarded welfare systems.

After the pandemic, new challenges arose, including inflation and geopolitical strife. Rising costs of essentials hit lower-income households harder, exacerbating the divide between economic classes.

According to the International Monetary Fund (IMF), the disparity between the poor and the rich has widened over the past year, with minimal gains for the poor and substantial increases for the wealthy. The purchasing power per capita of the poor is only $1,380 compared to the wealthy’s $105,000.

However, caution is urged when interpreting these figures. The IMF highlights the distorting effect of tax havens on GDP statistics, raising questions about the authenticity of reported affluence in many top-ranking nations. Despite global efforts to implement a minimum tax, opposition persists, and the effectiveness of such measures remains uncertain.

Forecasts predict that tax havens will continue to play a significant role in global investment flows, prompting reflection on the actual beneficiaries of this wealth. Amid the world’s economic disparity, small but wealthy nations show how to handle money well and also warn about inequality issues.

Hong Kong’s performance stands out in this context. Renowned for its economic dynamism, Hong Kong maintains its position as one of the world’s preeminent financial centres. Ranking 12th shows its enduring appeal to businesses and investors despite “pandemic-induced challenges”.

Global Wealth Rankings

In the broader rankings of global affluence, nations with financial structures, such as Luxembourg and Switzerland, top the list.

Countries enriched by natural resources, like Qatar and the United Arab Emirates, follow closely, thanks to their oil reserves.

Singapore’s economy and strategic location in Asia have solidified its position as a wealth powerhouse.

Despite recent challenges, Hong Kong remains highly ranked, with resilience in the financial services sector and its role in international trade and investment.

Smaller enclaves like Macao, with a thriving casino industry, and various Caribbean islands, acting as tax havens, disrupt traditional wealth distribution patterns.

These smaller entities often outpace some of the world’s largest economies in terms of wealth per capita.

Meanwhile, economic giants like the United States and China, with vast populations, grapple with the challenge of sustaining high per capita wealth alongside their massive GDPs./TISG