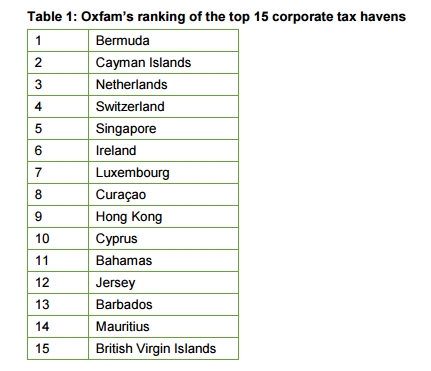

Oxfam, an international confederation of charitable organizations focused on the alleviation of global poverty, has named Singapore as the world’s fifth worst corporate tax haven. In exposing the world’s worst corporate tax havens, the report called on governments to put a stop to extreme examples of a destructive race to the bottom on corporate tax which has seen governments across the globe slash corporate tax bills in an attempt to attract business.

The report in pointing out that just 62 people own the same wealth as the bottom 3.6 billion people, said that this stark statistic illustrates the scale of an inequality crisis that is undermining economic growth and the fight against poverty, and destabilizing societies across the globe.

The report placed Singapore at fifth spot ahead of its economic competitor Hong Kong for providing tax incentives, lack of withholding taxes, and evidence of substantial profit shifting.

The Ministry of Finance (MOF) in describing parts of Oxfam’s report as inaccurate, defended Singapore’s tax regime.

“We note that the report cites the lack of withholding taxes as one of the characteristics of our regime. This is inaccurate. Withholding tax (for example, interest, royalty, services, etc.) is applicable for payments made to non-resident persons. Singapore does not impose withholding tax on dividends due to our one-tier corporate tax system. Under this system, profits are taxed at the corporate level and is a final tax,” the MOF said on Monday (12 Dec).

“Singapore’s tax policies are designed to support substantive economic activities, in order to create skilled jobs and build new and enduring capabilities in Singapore. We do not condone any tax evasion activities or actions aimed at base erosion and profit shifting. Singapore is able to keep the headline corporate tax rate competitive at 17 per cent because we are fiscally prudent and have a diversified tax base,” the Ministry added.

The Oxfam report also had harsh words for Base Erosion and Profit Shifting (BEPS) initiative of which Singapore is an associate member of, and charged that it “has resulted in an acceleration of the race to the bottom on tax rates.”

“As a BEPS associate, Singapore has committed to implementing the four minimum standards under the BEPS project, namely the standards on countering harmful tax practices, preventing treaty abuse, transfer pricing documentation, and enhancing dispute resolution. In keeping with this commitment, Singapore will implement country-by-country reporting for financial years beginning on or after 1 Jan 2017,” the MOF said.