SINGAPORE: Analysts at UnaFinancial predict impressive growth in the electronic money sector, with transactions reaching $246.3 billion by 2024 in Southeast Asia. In particular, Singapore e-money transactions are projected to reach $22.7 billion in 2024, making a significant contribution. This growth is attributed to several key factors, including the increasing popularity of e-wallets, QR codes and the rising levels of digitalization in the region.

The study, conducted by UnaFinancial, focused on electronic money transactions, including payments and transfers via QR codes, electronic wallets, and non-bank payment systems. The analysis includes several Southeast Asian countries, including Singapore, Indonesia, Thailand, the Philippines, Vietnam, and Malaysia.

Trends in Southeast Asia’s e-money market

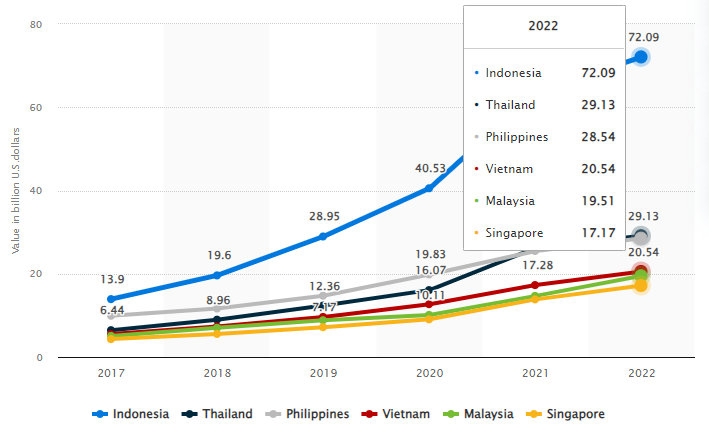

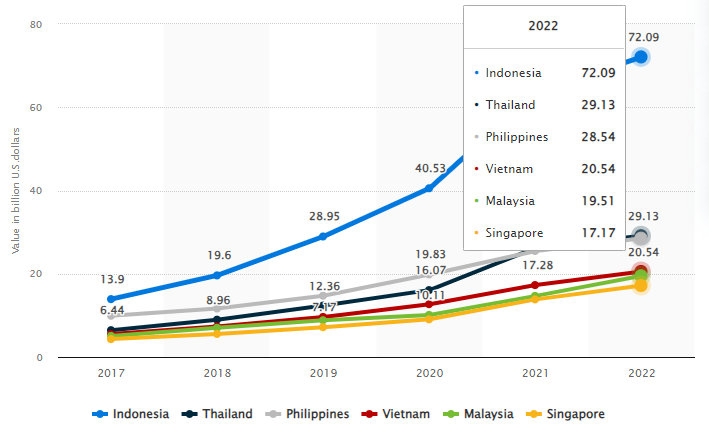

Since the start of 2018, the electronic money market in Southeast Asia has experienced consistent monthly growth, averaging a 2% increase.

In 2022, the market’s estimated worth had reached $187 billion.

- Indonesia accounted for the largest share at $72.1 billion

- Thailand at $29.1 billion

- Philippines at $28.5 billion

- Vietnam at $20.5 billion

- Malaysia at $19.5 billion

- Singapore at $17.2 billion

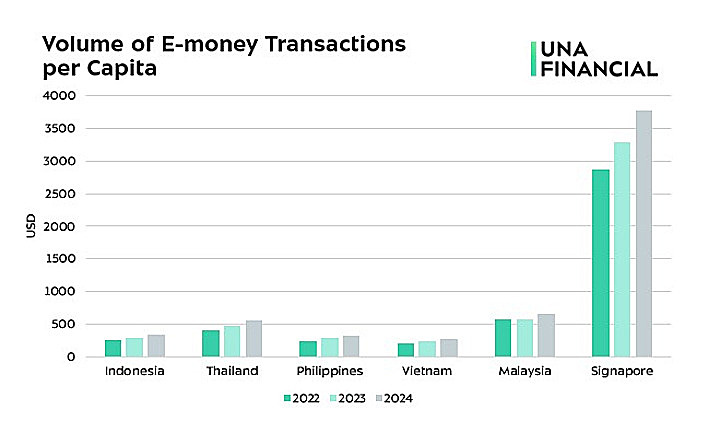

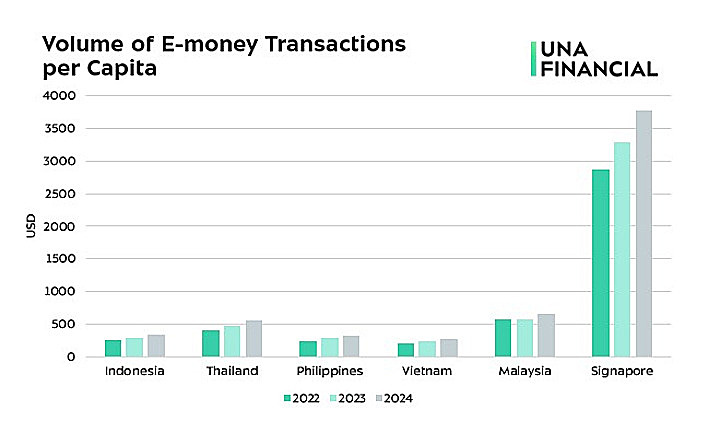

However, Singapore boasted the highest volume of electronic money per capita at $2,867, significantly surpassing Malaysia’s $567, Thailand’s $405, Indonesia’s $259, the Philippines’ $242, and Vietnam’s $207.

Singapore also stands out for having the lowest ratio of cash to electronic money, with electronic money surpassing the volume of cash by the end of 2022. In contrast, the rest of Southeast Asia had cash volumes exceeding electronic money by 18 times in December 2022, though this trend has been declining. In early 2018, cash outpaced e-money by 34 times in the region.

The circulation of non-cash dollars in Southeast Asia remains relatively low, with just four out of every 1,000 non-cash dollars in circulation. This may seem surprising given the upward trend in electronic payments, but the sheer volume of non-cash money supply can explain it.

Over time, however, e-money has been gaining ground. From the beginning of 2018 to the close of 2022, the share of electronic money in the total volume of non-cash funds grew threefold in Thailand and Singapore and 2.5 times in Indonesia.

What’s next?

UnaFinancial’s analysts expect the electronic money sector in Southeast Asia to continue its upward trajectory, reaching $213.3 billion in 2023 and climbing to $246.3 billion in 2024.

In Singapore, the market is expected to expand to $19.7 billion in 2023 and further to $22.7 billion in 2024. Singapore will maintain its lead in e-money per capita, reaching an impressive $3,783.

Several factors contribute to this growth. The rising popularity of e-wallets in Singapore is a significant driver. Additionally, central banks in many countries are committed to accelerating the transition from cash to online transactions by introducing national QR code systems. Indonesia, Thailand, Philippines, Malaysia, and Singapore have also entered agreements to enhance cross-border payments.

Southeast Asia presents tremendous potential for the development of the e-money market. The region boasts high levels of digitalization, with approximately 75% internet penetration and a 76% smartphone adoption rate, facilitating widespread online access to financial services.

Singapore leads the way in terms of digitalization, with a significant share of fintech users (73%) and high levels of smartphone (94%) and internet penetration (91%).

These factors contribute to high volumes of digital transactions per capita and create a conducive environment for the growth of the electronic money market in the country.

About UnaFinancial

UnaFinancial is a group of companies that develop user-friendly digital financial solutions in the Middle East, Asia, and Europe. They leverage AI-based, machine learning, and data-driven technologies and processes, providing precise and comprehensive risk management, convenience, and speed for their customers. In 2022, the group earned $139.1 million in revenues, with net profits increasing significantly to $13.1 million as of Dec 31, 2022.