Are we really recovering?

- Global economic growth prospects have been affected by Russia-Ukraine conflict with world output projected to expand at a slower rate of 3.6% in 2022.

- Although Russia and Ukraine combined account for less than 3% of global exports and less than 2% of global imports, the conflict and subsequent sanctions have frayed trade connectivity by disrupting transit routes, particularly for maritime container shipping and air freight traffic

- Russia’s war in Ukraine has created “immense human suffering”, but it is also damaging global trade, the World Trade Organization (WTO) is warning. Disruptions to food supplies could have “potentially dire consequences” for poor countries, it says. The WTO has downgraded its forecasts for goods imports and exports, and is calling on governments and partners to help facilitate trade.

Below are the implications of the conflicts:

On 24 February 2022, Russia invaded Ukraine. It is important to note that, this war is causing food and fuel crises. The war also threatens supplies of essential goods from Russia and Ukraine, including food, energy and fertilizers. The halting of grain shipments through Black Sea ports could have “potentially dire consequences” for food security in poor countries as WTO warns.

The increased in geopolitical risks induced by the Russian invasion of Ukraine has weigh adversely on global economic conditions throughout 2022. Such effects are seen in related countries GDP and boost inflation significantly, exacerbating the policy trade-offs facing central banks around the world.

Below are the implications of the conflicts

1. Increase in oil and energy prices

Analysts said the continuous tight supply situation caused by the Russia-Ukraine conflict and a decision by the Organization of Petroleum Exporting Countries (Opec) to reduce production by 100,000 barrels per day (bpd) this year, against their earlier pledge to raise it by 275,000 (bpd) would keep prices up for now. Price has increases from USD90/bbl. to USD 105/bbl. in July 2022 as shown in figure 1.

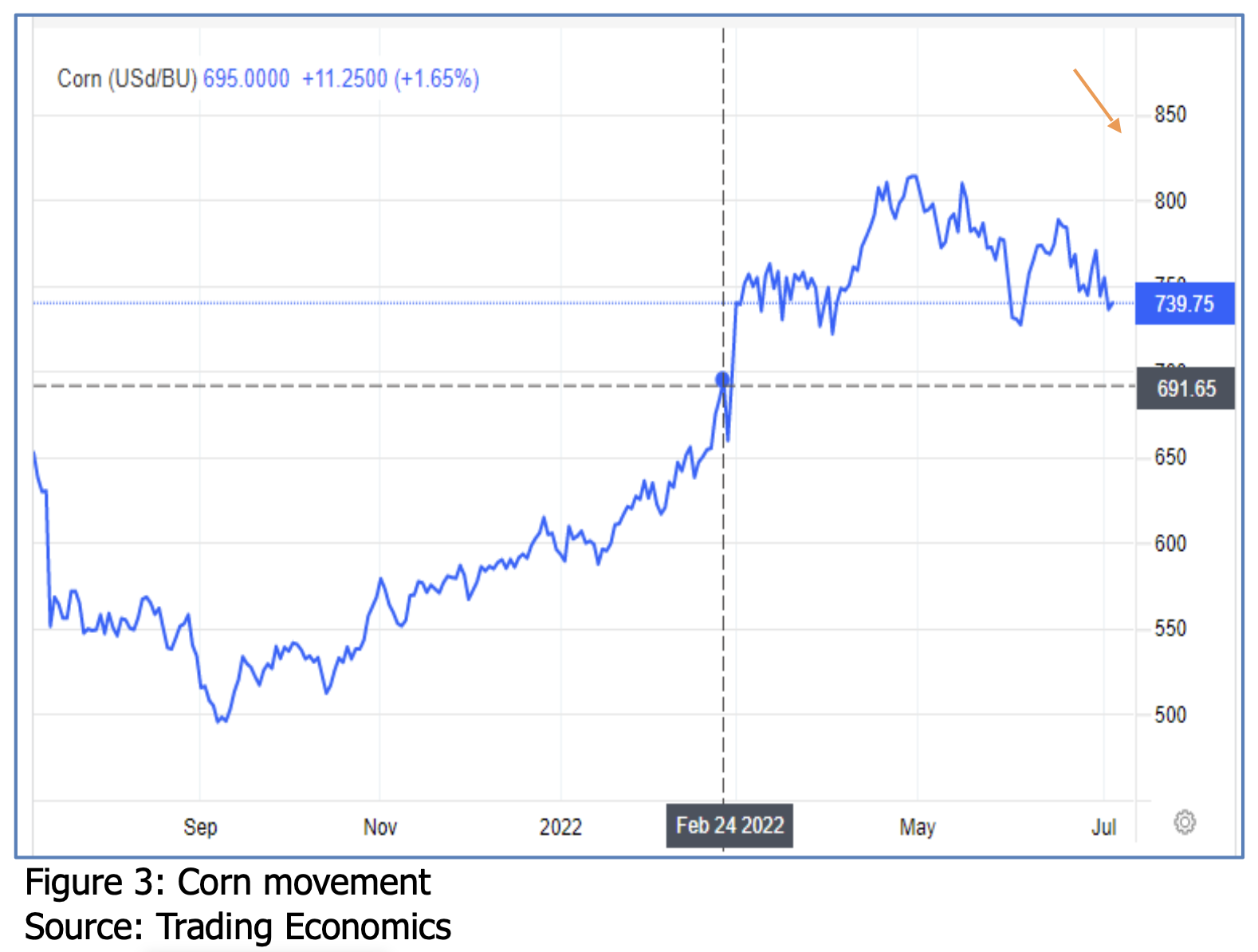

2. Increase in commodity prices

The war in Ukraine is no longer shocking the wheat market. As shown in Figure 2, the drop is due to the markets responding to Russia and Turkey saying they want to discuss a safe passage to ship Ukrainian grain through the Black Sea.

Corn and soybean prices also have started to fall, due largely to expectations of favorable weather for these crops. The US Department of Agriculture will release reports on June 30 emphasizing on rising for corn and soybean price while wheat falling.

The wheat and corn market are expected to stabilized as other areas will compensate for any losses from Ukraine, and it is happening across the board. Australia, one of the biggest wheat exporters, is forecast to produce another huge crop this year, while Brazil’s biggest-growing area has so much corn it’s piling up outside bins.

3. Global supply chain disruptions affecting local companies and multinational companies operating in Malaysia.

To this end, the EU is assisting Ukrainian exports by returning millions of tons of grain back onto global markets via other routes through the “Solidarity Lanes Action Plan”. EU are also employing various long-term strategies to address the negative consequences of climate change on food security, such as degradation of fertile land, loss of biodiversity, and increasing risk of local agriculture production.

Looking forward, the EU aims to match the demand for long-term investments in food value chains through sustainable agricultural and ecological innovations. Compounding this, the industry requires reform in areas of land governance and need provide smallholder farmers with access to green financing. This able to strengthen access to healthy foods while reducing our dependence on fossil fuels. The EU will accompany Malaysia on this path of jointly developing new strategies of sustainable and secure food structures.

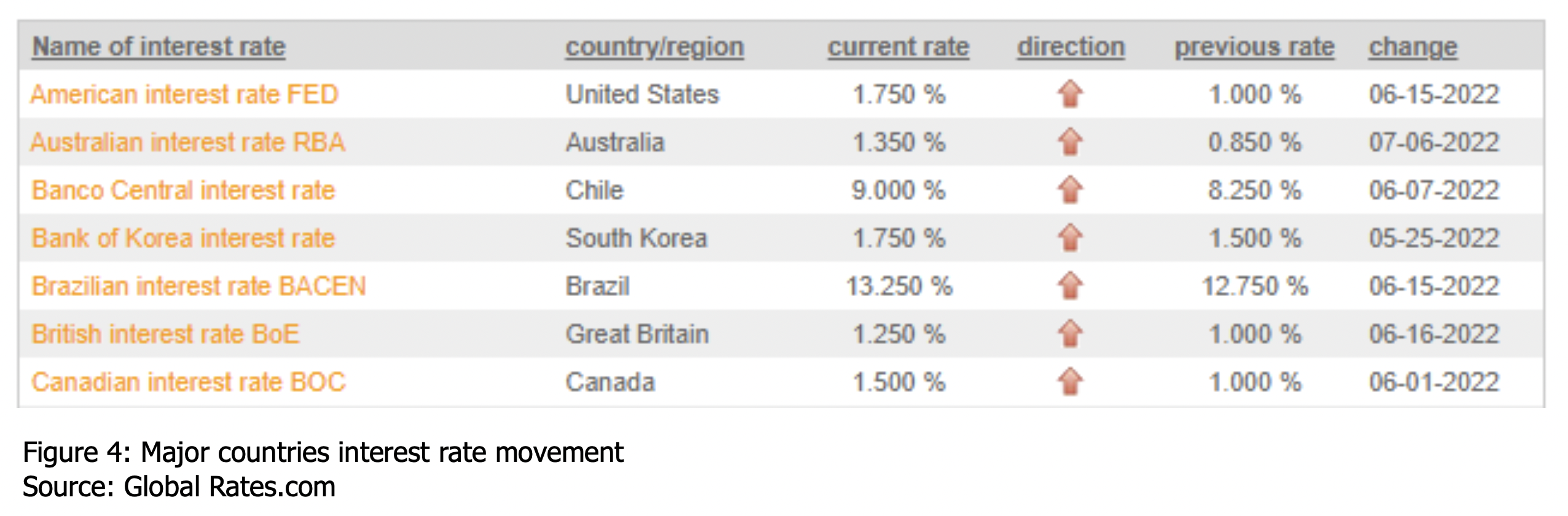

4. Pressure on global and domestic interest rates

The outlook for the UK and global economy has “deteriorated materially” due to inflationary pressures largely stoked by Russia’s invasion of Ukraine, putting extra strain on British household and business finances, reported by the Bank of England (BoE). The worsening economic outlook has caused volatility in global markets in recent months with more turbulence likely, the Bank said in its quarterly health check on the UK’s financial system.

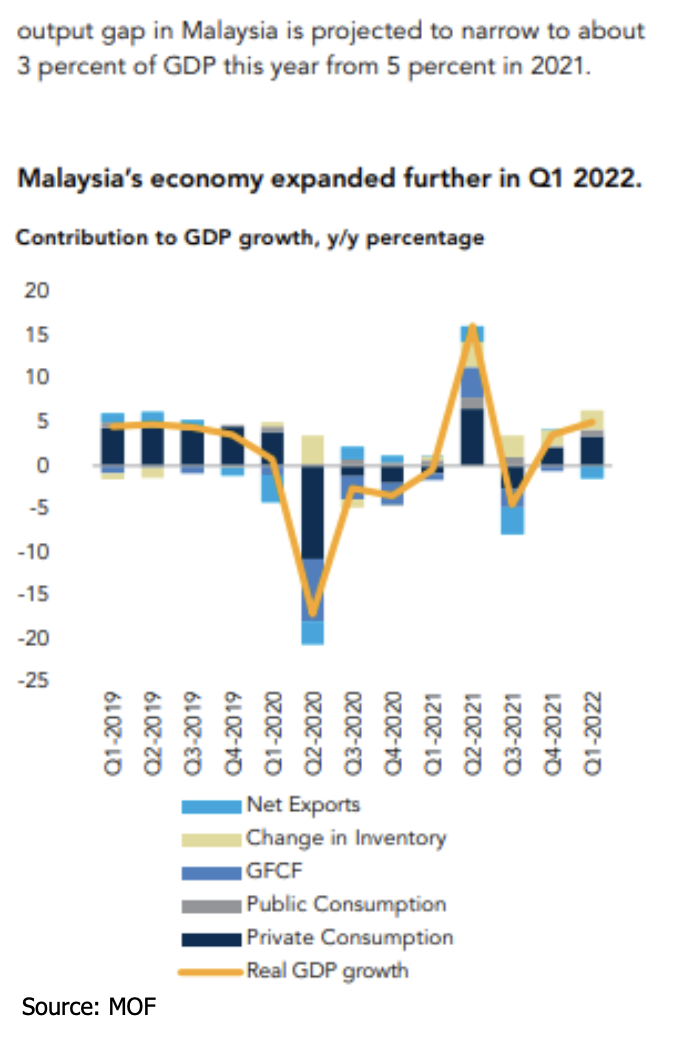

Malaysia

BNM hiked the rate again in July, lifting it from the record low where it had languished for nearly two years. The decision to raise OPR is driven by the upbeat momentum in domestic economy performances as reflected in key indicators such as unemployment rate, distributive trade sales, industrial production and external trade trends.

It is important for us to look into the key risks as mentioned below:

- The market may expect an increase in corporate defaults, especially for firms and sectors that have not yet fully recovered from the pandemic. Moreover, highly indebted firms and those with lower credit ratings may struggle with tighter financing conditions.

- Prices for commodities and energy have remained elevated and volatile, which has caused some stress in derivatives markets for these products. Despite recent adjustments, some assets remain at risk of further corrections should the growth outlook weaken further and/or inflation turn out to be significantly higher than expected.

- Vulnerabilities may increase due to the uncertain path of the Russia-Ukraine war and shifting expectations of policy normalization in advanced economies. Other potential global developments, such as a broader resurgence of the coronavirus (COVID-19) pandemic, weaknesses in key emerging market economies or a sharper slowdown in Chinese economic activity, could also affect risks to growth and inflation.

Recommendations

- It is important for the people to start saving and to be debt free as possible

- We might be in financial crisis if debt and inflation keep on increasing with declining real purchasing power

- Encourage our youngsters to be in agriculture field to detach themselves from being dependent on others for food

- Be more rationale and be more long term minded in making decision today, be mindful about the food crisis and expected financial crisis

Sharifah Azzahra

Certified Risk Advisory

Selangor