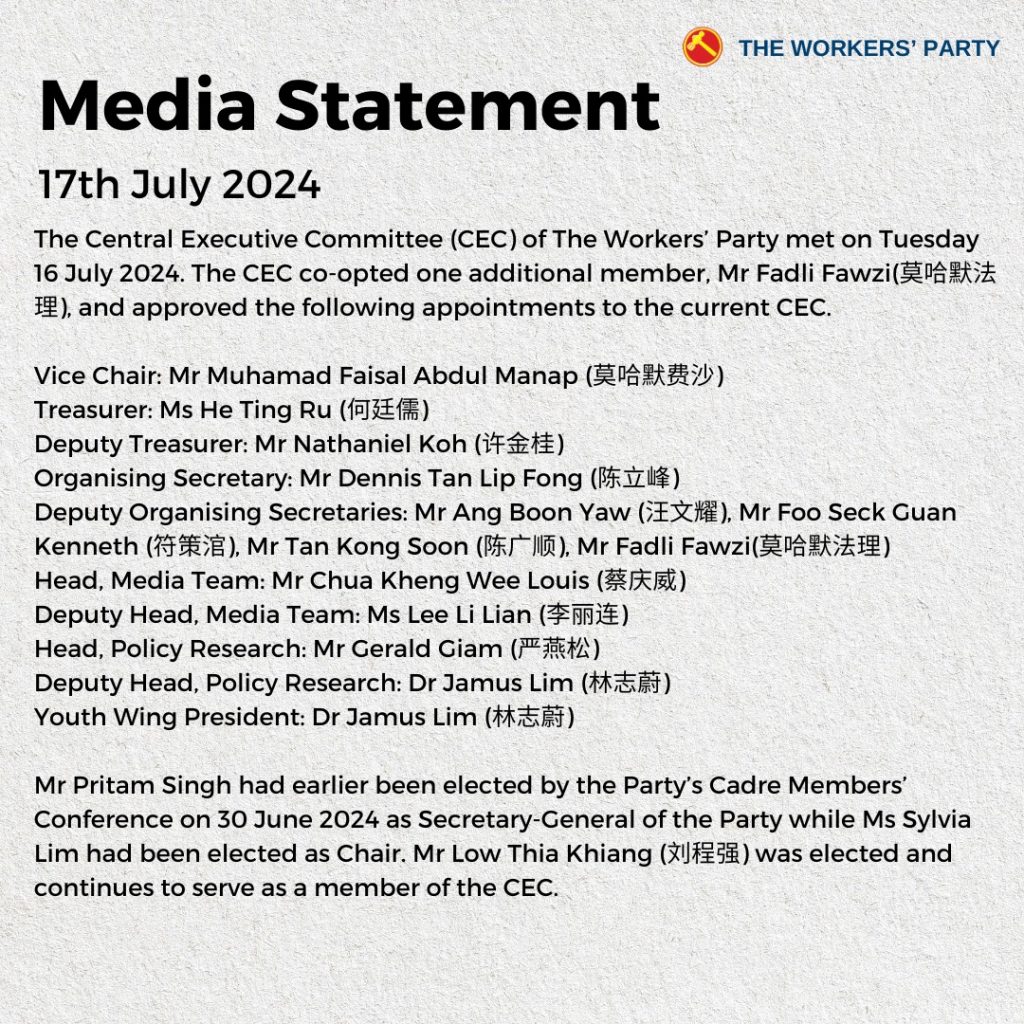

SINGAPORE: The Workers’ Party announced in a statement on Wednesday morning (July 17) that its Central Executive Committee (CEC) has co-opted an additional member, Fadli Fawzi.

The statement also said that Sengkang MP Jamus Lim is the party’s Youth Wing President.

Mr Fawzi, a lawyer with Inkwell Law Corporation, has been with the WP team and active on the ground at Marine Parade over the past few years.

He was fielded as part of the WP slate in Marine Parade GRC in the last General Election.

The release from the WP Media Team also announced the following appointments to the current CEC after the WP had said on June 30 that its leadership going into the next election remains essentially the same, with Sylvia Lim elected again as Chair and Pritam Singh as Secretary-General.

The July 17 announcement affirmed that Member of Parliament Muhamad Faisal Abdul Manap (Aljunied GRC) is also staying on as Vice Chair, and Sengkang GRC MP He Ting Ru is still the party’s treasurer.

Similarly, Nathaniel Koh is still Deputy Treasurer, and Hougang SMC MP Dennis Tan is still the party’s Organising Secretary.

The WP’s current Deputy Organising Secretaries, Ang Boon Yaw, Kenneth Foo, Tan Kong Soon have also kept their positions, but the party announcement shows that Mr Fadli has been added to their number.

Sengkang GRC MP Louis Chua, who used to be the Deputy Head for the Media Team and took over as head when former Aljuined GRC MP Leon Perera stepped down last year, is also staying in his role, while former MP for Punggol East SMC Lee Li Lian is the Deputy Head.

Sengkang GRC MP Gerald Giam and Sengkang GRC MP Jamus Lim remain the Head and Deputy Head of Policy Research, respectively.

Assoc Prof Lim, now the party’s Youth Wing President, takes over from Mr Koh, who in turn stepped into the role vacated by Nicole Seah, who had held the post for two years and resigned in July 2023.

“Mr Low Thia Khiang (刘程强) was elected and continues to serve as a member of the CEC,” the WP added.

On June 30, the WP announced the 12 members of its CEC after its Cadre Members’ Conference that day.

The CEC saw the return of Ms Lee, who served as MP for Punggol East SMC from 2013 to 2015.

It said at the time, “The new CEC has taken office, with a mix of members of different ages and backgrounds, and has started work with immediate effect.” /TISG

Read also: Sylvia Lim and Pritam Singh stay on to lead Workers’ Party into next General Election