Singapore — Industry analysts have said that customers shouldn’t expect reimbursements from banks when they lose money due to scams, which is a view not many netizens share.

OCBC’s announcement that it would fully reimburse customers who lost their money due to a phishing scam was undoubtedly a welcomed one, but analysts say this move should not be seen as a precedent.

There are ramifications to this type of reimbursements, some analysts were quoted in a Jan 21 article in TODAY. It carries the risk of customers becoming complacent against such scams.

Moreover, it could also draw more cybercriminals to target banks in Singapore with their fraudulent schemes.

Analysts quoted in TODAY suggests that official guidelines be drawn for situations that qualify individuals to receive reimbursements when they’ve been scammed.

Having a reimbursement guarantee “might encourage cybercriminals to target Singapore banks’ customers more, since consumers are not so concerned about clicking on fraud SMS messages or emails, et cetera, knowing that they will get their money back regardless.

This could lead to more careless behaviour from consumers with respect to a phishing email or SMS messages they receive,” Mr Lim Yihao, head of intelligence for Asia Pacific at cybersecurity firm Mandiant, is quoted in TODAY as saying.

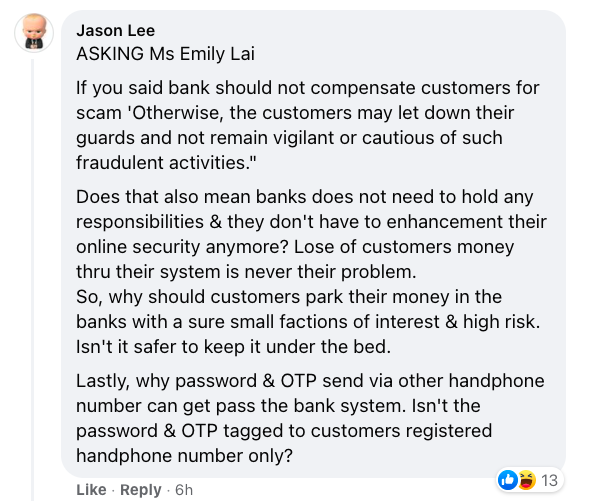

The article also quotes Ms Emily Lai, the business risk partner at Grant Thornton Singapore, as saying, “When scams occur due to one’s ignorance, fraudulent or negligent actions, like sharing bank tokens, ATM cards, PIN and passwords knowingly to another person, then the onus should not be on the banks to reimburse the affected victims for the lost money.”

Last month, almost 470 OCBC customers were victims of a recent phishing scam that began with an SMS claiming to have been sent by the bank.

Loses from the scam have totalled at least $8.5 million, with some people having seen their entire life savings lost to the scam.

Commenting on the article in Today, some netizens disagreed with the analysts.

Several wrote that the phishing scam may point to possible lapses in the bank’s security systems.

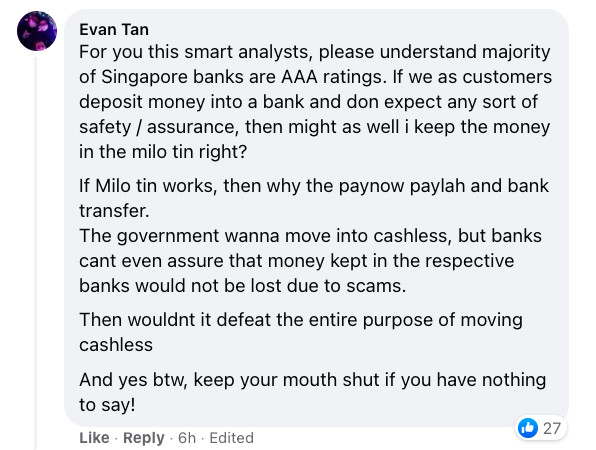

Another said that if banks choose not to reimburse clients who lose money in a scam, this could result in a loss of trust.

Some commenters believe that banks should have better protection to prevent scammers’ schemes.

One netizen wrote that if analysts themselves get scammed, they may just end up with a different opinion.

Another even posted a question in the comment section for Grant Thornton Singapore’s Ms Lai.

One commenter wrote that if money is not safe in their banks, “then might as well i keep the money in the milo tin right?”

/TISG

Read also: Public concerned how elderly can tell difference between genuine SMS and messages from scammers

Public concerned how elderly can tell difference between genuine SMS and messages from scammers