A recent survey has found that 40% of Singaporeans are struggling to pay their mortgage loans due to the increasing interest rates. Because Singapore home loan interests are closely tagged to the US Fed rates, the multiple rate hikes in 2022 to reduce red-hot inflation have driven domestic rates up significantly enough to trigger mortgage debt stress amongst homeowners and buyers here.

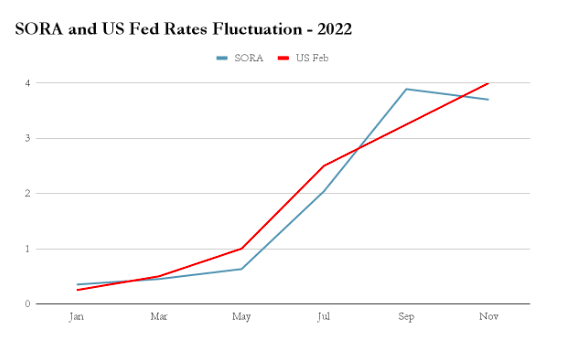

Taking the Singapore Overnight Rate Average (SORA) mortgage rates in Singapore as an example, since the first Fed rate hike in March this year, SORA has been rising exponentially from 0.35% in January to 3.7% at the end of November.

Based on these rates, homeowners who were initially making monthly repayments of S$1,740 for a S$500,000 home loan in January will now have to fork out at least S$2,500 every month.

The sharp and unexpected increase in loan repayment has been the source of tremendous stress for those with less disposable income and unable to access higher income to make ends meet.

As a result, more Singaporeans are now contemplating the need to sell or downgrade their homes to pay their loans.

Related: Best Home Mortgage Loan Refinancing 2022

How Long Will Mortgage Stress Last?

Will housing loan rates in Singapore come down any time soon? Not likely, because the US Federal Reserve has already signalled it will continue to increase Fed rates.

Property experts in Singapore have also speculated that the rates will continue to rise through 2024. If that happens, mortgage rates in Singapore may even go as high as 5% in 2023.

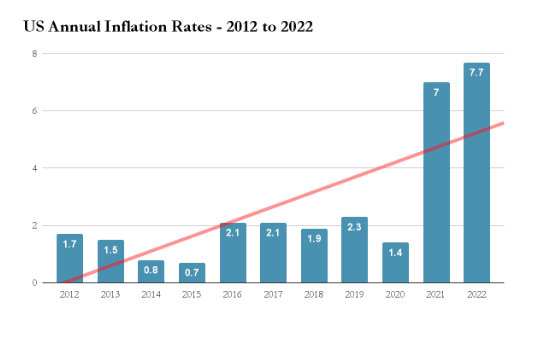

A closer look at the history of rate hikes and cuts offers a straightforward insight — rate hikes are used to combat inflation while rate cuts are meant to increase inflation and lower unemployment.

Given that the COVID-19 pandemic has dramatically driven US inflation upwards to 7.7% in 2022 from around 2% between 2016 to 2020, there is little doubt that the market may require more time to recover and for the Fed rates to ease back to a more manageable range.

Furthermore, with the Russia-Ukraine war still ongoing and oil prices skyrocketing to drive higher inflation, a Fed rate cut in the near future may seem rather remote.

That said, there is no certainty about which trajectory the US Fed will take as of now. According to Bank of America, if the attempt to control inflation using rate hikes becomes successful in the near term, it is possible that rate cuts may take place by the end of 2023. Similarly, a recession or any unexpected global crisis may also force rate cuts to happen earlier than expected.

Ways To Handle Mortgage Stress or Reduce/Consolidate Debt

If you don’t want to get caught in mortgage debt stress or be held hostage by the rising housing cost in Singapore, these four tips may offer you peace of mind:

Borrow Within Your Means

Not only should you borrow less but also borrow within your affordable limits. Some homebuyers attempt to overstretch their financial commitment in the view that they will get a raise to cover for the shortfall in future, however this is a risky strategy, especially in the current financial climate.

Always use a mortgage loan calculator to find the best home loan rates in Singapore before committing to buying a property. Such calculators offer housing loan options and monthly repayment estimates so that you can make an informed decision.

You can make use of our handy tool below to check the current home loan rates on the market, no matter whether you’re looking to get a new loan or refinance your current mortgage loan:

Find the Cheapest Home Loans in Singapore

Set Aside a Reserve Fund

Try to set aside a reserve sum of S$20,000 to S$50,000 in CPF or in cash as a safety net. The amount largely depends on the value of your monthly mortgage repayment but it should be enough to cover at least six months of the repayment.

Such a fund serves as a buffer should you get retrenched or decide to take a break from work. In a worst-case scenario, the six-month period will be enough to let you sell your property or rent it out for passive income.

Extend Home Loan Tenure for Lower Monthly Payments

Most people want to pay off their loans as fast as possible. But if you are experiencing mortgage stress, there is no harm in extending the loan tenure to give you some breathing space.

However, do note that the maximum loan tenure for housing loans is capped at 30 years for HDB flats and 35 years for private properties. If you intend to take up a loan from HDB to buy a new flat, the maximum loan tenure is only 25 years.

Debt Consolidation to Streamline Your Finances

If you have several high-interest loans and are finding it hard to meet all the repayments on time, debt consolidation may be a viable strategy to off multiple debts with a new personal loan and at a lower interest rate.

Interestingly, debt consolidation may improve your credit score as well. Even though applying for a new loan for debt consolidation may cause a temporary dip in your credit score, because you’re paying off revolving lines of credit, your score can improve soon after.

Conclusion

Don’t let mortgage stress or the rising home loan rates in Singapore get the better of you. Even though there is no clear sign of when housing loan rates will calm down to more affordable levels, many banks have measures in place to help existing homeowners manage their home loan repayments in the event of unexpected financial difficulties.

If you’re in the market looking to buy a new property, you’ll be wise to take a more prudent approach or seek the help of a financial advisor before signing on the dotted line.

Like what you just read? Follow us on Telegram, Instagram, Facebook, and LinkedIn to get up to date on fresh content!

Read More:

The article originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Average Cost of Housing in Singapore 2022

Best Home Mortgage Loans in Singapore 2022

Home Mortgage Loan Basics: How Much Can I Borrow?