The Singapore Police Force (SPF) has arrested eight individuals for their suspected involvement in phishing scams that targeted DBS bank clients. The police have observed an increasing trend of phishing scams where scammers would impersonate bank staff and target victims through SMSes.

In the latest variant, members of the public would receive unsolicited SMSes with alpha tags such as “SG-DBS” or “DBS-Notice”, claiming that their card had been blocked due to unusual activity or that their bank account had been frozen because of suspicious activities, said SPF in a news release.

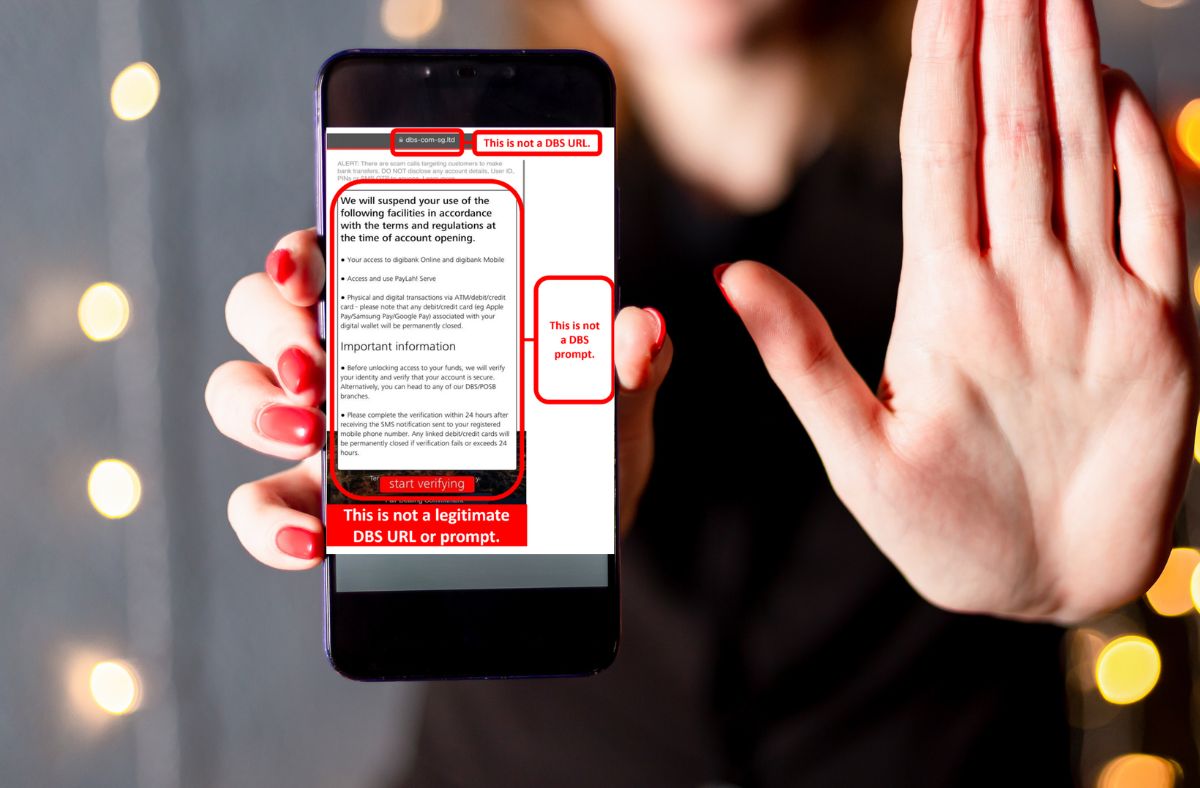

Upon clicking the link in the SMS, the victims would be directed to a spoofed internet banking log-in page. Once they input their usernames and passwords, the scammers would gain access to confidential information.

“Victims would realise that they had been scammed when they discovered unauthorised transactions made from their bank accounts.”

According to a Straits Times report on June 9, more than 60 victims had fallen prey to the phishing scams based on reports between June 5 and 8. More than S$60,000 in total was lost.

The eight individuals comprised seven men and one woman aged between 17 and 33. They are currently being investigated for the offences of cheating or money laundering.

“DBS would like to assure that their bank systems remain secure. However, given the widespread nature of this current campaign, it may be necessary for DBS to take short-term measures that may lead to friction or delay to transactions in order to disrupt the scams and protect their customers,” said SPF.

The Police and DBS advise members of the public to be on heightened alert and to follow these crime prevention measures:

- Bank officers will never ask for your banking details or OTPs over the phone or via SMS;

- Do not click on dubious URL links provided in unsolicited text messages. Banks do not send SMSes containing links;

- Always verify the authenticity of claims of problems with your bank account or cards issued by the bank with the official bank website or sources;

- Never disclose your personal or Internet banking details and OTPs to anyone; and

- Report any fraudulent transactions to your bank immediately.

Below are images of the phishing SMSes the victims received.

Customers who suspect they are a victim of a scam can call DBS’ dedicated fraud hotline at 1800-339-6963 (from Singapore) or (+65) 63396963 (from overseas) and speak to a DBS Customer Service Officer, or activate the Safety Switch to temporarily block access to their funds. DBS would assist those customers with necessary follow-up actions, including replacing their cards and lodging the fraud report. /TISG