SINGAPORE: The Singapore Police Force issued an advisory concerning a new impersonation scam variant of Chinese services such as Tencent, WeChat, or UnionPay on Tuesday afternoon (Sept 10).

In less than two weeks, there have been at least 46 cases of this new scam, with total losses amounting to at least S$958,000. With this variant, scammers purporting to work for Tencent, WeChat, or UnionPay would call unsuspecting victims.

The impersonators would tell them that a free trial they had subscribed to was about to expire, including insurance coverage, the WeChat application anti-harassment function, and the WeChat subscription itself.

They would then “inform” the victim that they needed to cancel their subscriptions; otherwise, the fees for the services would be deducted automatically from the accounts they linked to the service platforms.

However, to cancel their subscriptions, the victims needed to verify their identities and bank accounts by providing their personal information and transferring money to various bank accounts.

Also, scammers sometimes cause the victim to increase the bank transaction limit and perform bank transfers by guiding the victim through WhatsApp’s screen-sharing function. There were also other ways the scammers would deepen their deception of their victims.

They would have a scammer impersonating a customer service staff via WhatsApp or a video conferencing app to talk to the victims.

The scammers would also redirect the victims to a phishing website with a live customer service chat function. The Police said that the phishing website impersonated UnionPay in some cases.

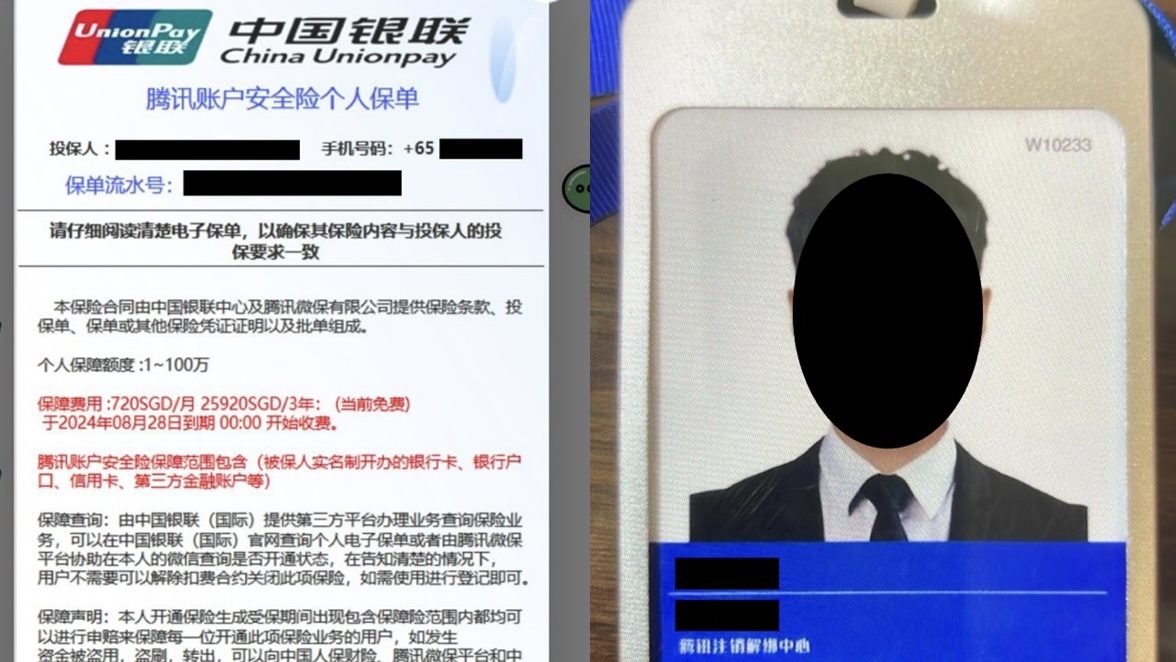

Scammers also presented fake customer service staff employment passes from the service companies and fake documents of victims’ alleged subscriptions that contained their victims’ personal information.

At times, they told victims that their WeChat accounts had been frozen or provided refunds for test transfers before asking the victims to transfer funds.

The victims would only realize they had been scammed after they made several fund transfers but never received the refunds they had been promised.

The police are again asking the public to adopt the following scam preventive measures:

ADD: Add the ScamShield App and set security features (e.g. set up transaction limits for internet banking transactions, enable Two-Factor Authentication (2FA), Multifactor Authentication for banks).

“Do not send money to anyone you do not know or have not met in person before. Do not disclose your personal information, bank/card details, and One-Time Passwords (OTPs) to anyone,” the Police added.

CHECK – Check for scam signs with official sources (e.g. www.scamalert.sg). Look out for tell-tale signs of a phishing website. Do not click on dubious URL links provided by anyone you do not know or have not met in person before.

TELL – Tell the authorities, your family, and friends about scams. Report any unauthorized transactions to your bank immediately.

Members of the public can also visit www.scamalert.sg or call the Anti-Scam Helpline at 1800-722-6688 for more information regarding scams. Those who need urgent Police assistance may call ‘999’. /TISG

Read also: More than 12 victims lose over $9K in FairPrice phishing scam involving fake $500 gift card offers