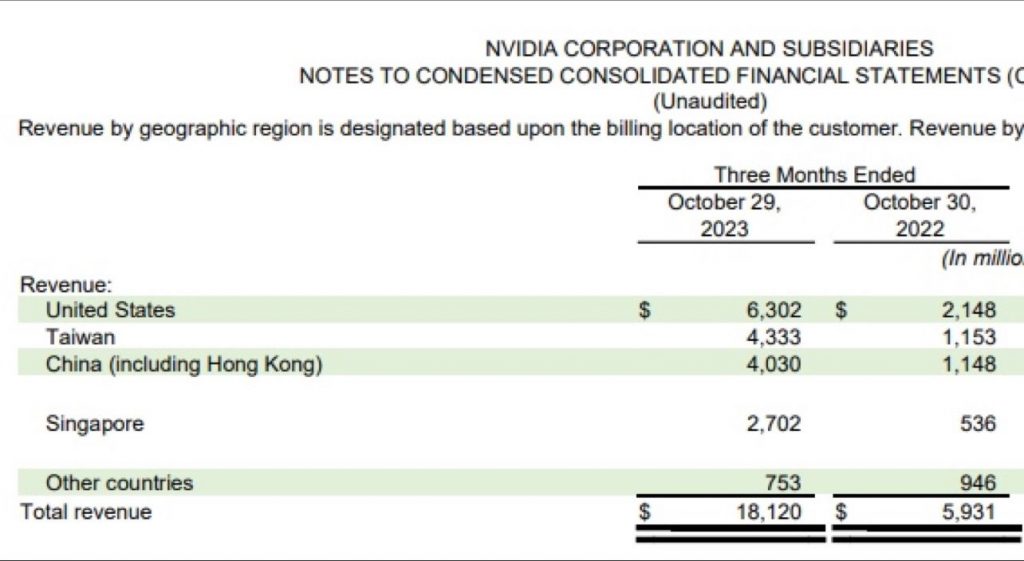

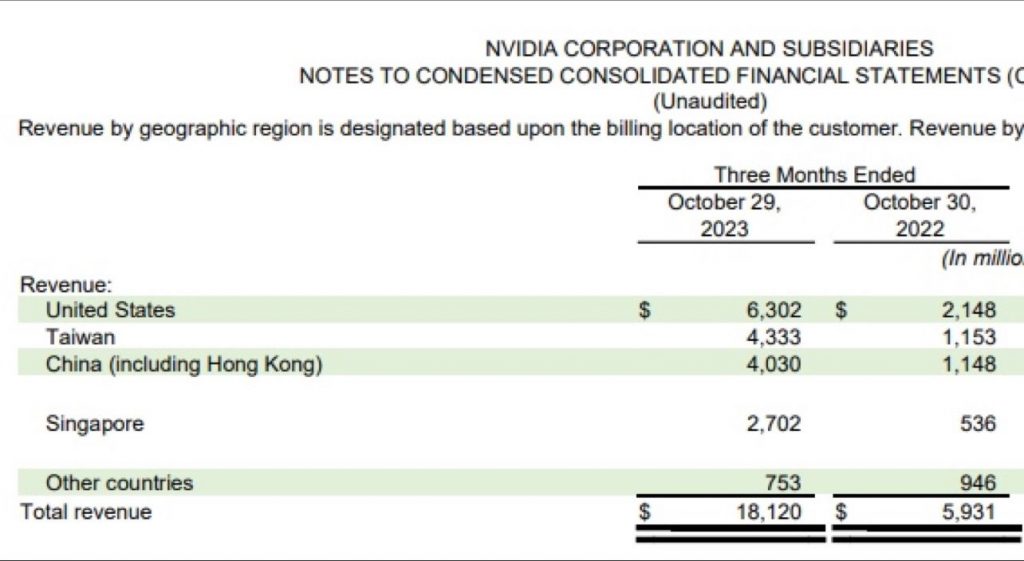

SINGAPORE: Nvidia, the U.S. chip giant, celebrated stellar third-quarter results last week. Observers of the industry noted that 15% of Nvidia’s revenue came from Singapore and was worth $2.7 billion for the quarter ending in October. Singapore’s revenue jumped to a staggering 404.1% increase from the $562 million recorded in the same period a year ago, surpassing Nvidia’s overall revenue growth of 205.5%, CNBC reports.

Singapore secured its position as a significant contributor, trailing only behind the U.S. (34.77%), Taiwan (23.91%), and China, including Hong Kong (22.24%), in Nvidia’s third-quarter sales rankings. Analysts speculate that the prominence of data centres and cloud service providers in Singapore may be a driving force behind this impressive figure.

Maybank Securities analyst Jarick Seet suggested that the influx of revenue could be attributed to the region’s abundance of data centres and cloud service providers. Seet further speculated that Nvidia’s chips might be shipped to Singapore for final assembly, incorporating them into various products dispatched globally. Additionally, the chips could be instrumental in applications such as artificial intelligence, computing, and electric vehicles.

Former Temasek and GIC executive Sang Shin pointed out in a LinkedIn post, “What’s a tiny city-state doing with all those chips? Building data centres, of course!” Mr Shin added: “But why in a terribly hot environment with no land to spare? Because the nation is stable and secure, there is a lot of talent, the digital infrastructure is solid, and the government policies are conducive to digital and data services. That’s why.”

A breakdown of Nvidia’s third-quarter sales revealed that 80% of revenue came from the data centre segment. Cloud service providers were major contributors, driving approximately half of the data centre revenue, while consumer internet companies and enterprises comprised the other half.

Despite not specifying the business segments contributing to Singapore’s revenue, Citi analysts noted that a consumer internet company in Singapore purchased data centre solutions in Q3. Singapore is also becoming a hub for specialized cloud service providers, establishing regional data centres.

The January 2022 lifting of a moratorium on land release for data centre use, coupled with the awarding of rights to key players like Equinix, Microsoft, GDS, and collaboration between AirTrunk and ByteDance, underscores Singapore’s commitment to fostering data centre growth. By July 2022, more than 70 operational data centres were in Singapore, representing 60% of Southeast Asia’s total data centre capacity.

Recognized globally as the third-largest data centre market and the leader in the Asia-Pacific region, Singapore’s digital landscape is flourishing. The International Trade Administration anticipates sustained high demand for data centres, driven by the rapid growth of digital apps, e-commerce, the internet of things, artificial intelligence, crypto-trading, blockchain activities, online gaming, and the global shift to hybrid working and business digitalization.

So, what’s in store for Singapore in the chip industry? Looking forward, as Mr Shin said, “This Nvidia financial statement is proof to me that Singapore is correctly pivoting away from what worked so well for it the past 50 years into a new digital world that will work well for it in the next 50 years.”/TISG