The insurance industry around the world has been traditionally dominated by older and larger companies, with little to no new players that have been able to grow successfully.

However, Singapore has somehow seen a number of new entrants successfully grow their presence in the past few years. What is it about Singapore that creates such a great environment for newcomers and foreign insurers to succeed?

To better understand this anomaly, we analysed what makes Singapore’s insurance market so unique compared to insurance sectors of other developed markets.

Summary Points

- Singapore only makes up 0.70% of the world’s insurance market, compared to one of Asia’s largest players, South Korea (2.70%) and the world’s biggest player, the US (43.7%) in 2022.

- New insurers in Singapore succeed more easily due to its smaller market and the comparatively larger size of foreign entrants.

- Two of the newest entries to Singapore’s insurance market have seen marked growth in the past year alone, compared to the slowing growth of the major players.

The Importance of Economies of Scale in the Insurance Industry Around the World

Insurance is typically dominated by large well-established players with economies of scale. Because insurance products are typically very similar, underwriters mainly compete through price.

Under this dynamic, larger companies that are already established in the market usually find it easier to maintain low prices while still making a profit by spreading out their fixed costs over their large customer base. In contrast, smaller companies struggle to grow under the threats of diseconomies of scale and getting priced out. This relationship is best illustrated with the insurance markets in the United States and Korea, where the biggest insurers have the lowest premiums, making it difficult for new companies to compete and gain significant market share.

For instance, the US insurance market is a massive trillion-dollar market with almost 6,000 domestic insurance companies operating as of 2022. However, the top 10 non-life insurance companies control 47.9% of the market, with the top 3 taking up 21.59% of the market share. In other words, a mere 0.17% of the insurance industry controls almost half of the entire insurance market.

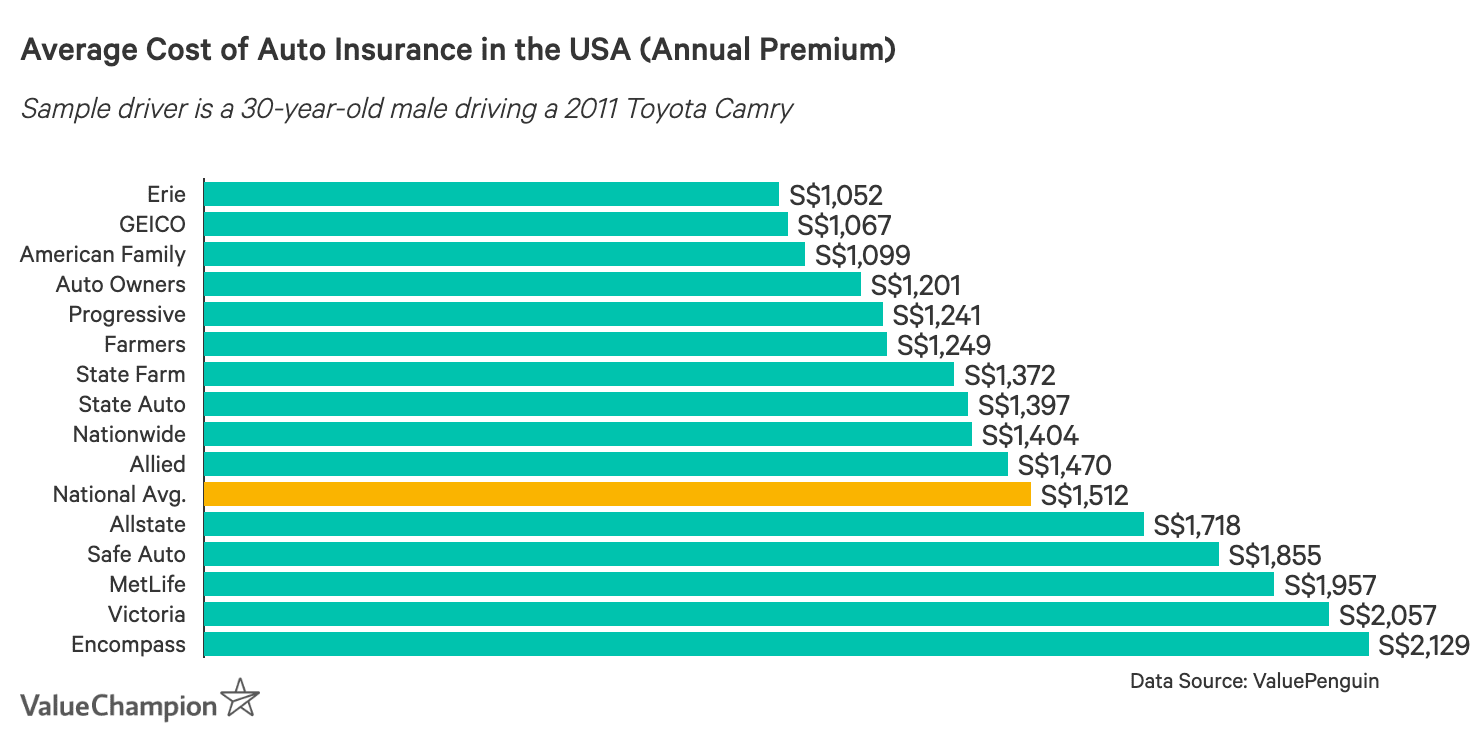

Part of this reason is because their massive profits can help them offer rock-bottom prices that are hard to compete against. For example, in the US car insurance space, we see that the three biggest players offer some of the lowest premiums. In particular, Geico, the second largest auto insurer controlling 14.05% of the auto insurance market, offers the 2nd cheapest premiums—30% below the nation’s average.

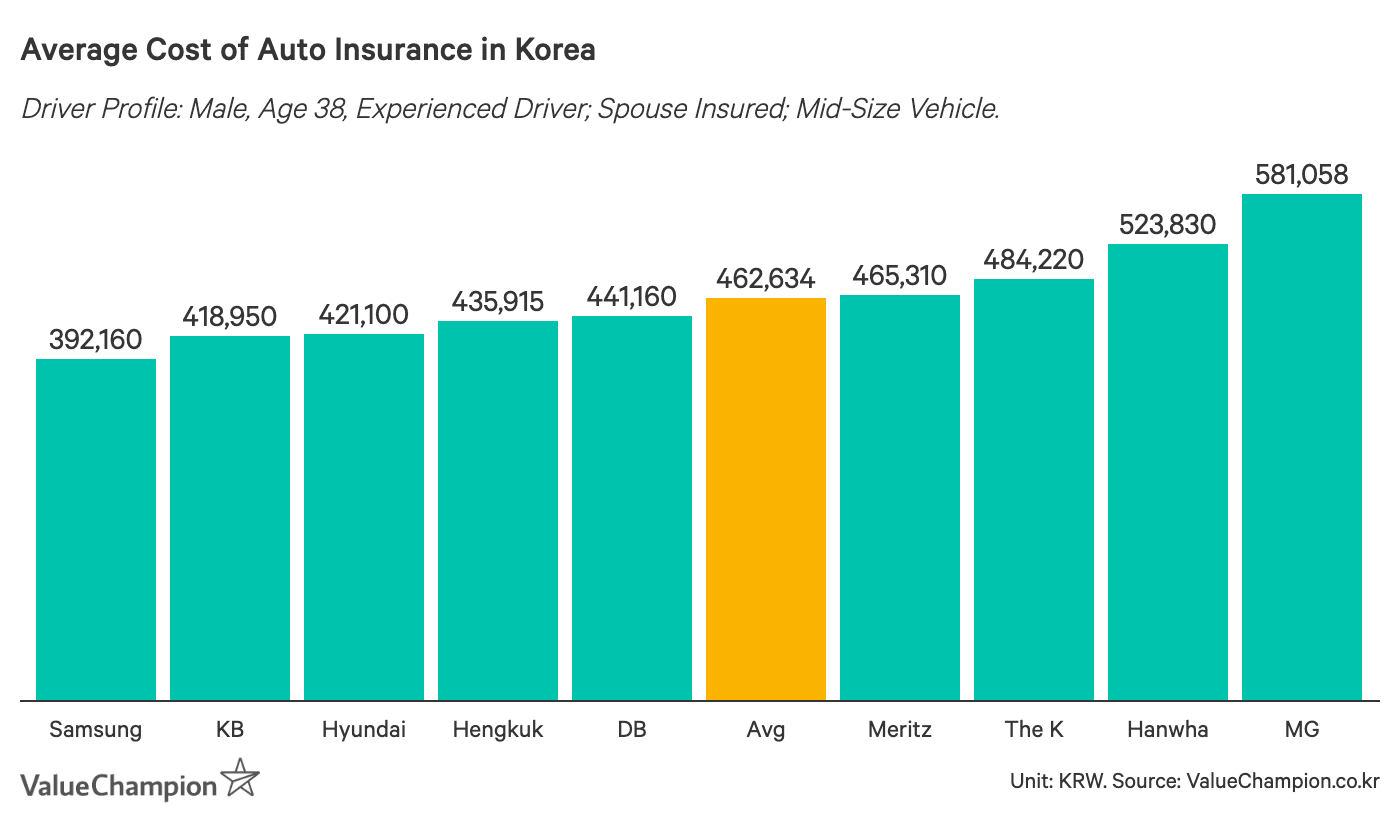

South Korea, the second largest insurance market in Asia, is slightly different but operates similarly to the United States. There were 32 non-life insurers as of 2022 in the country. Among these, the top 4 domestic insurers controlled 68.8% of the market. Similar to the US, these large domestic players also typically provide the lowest premiums.

For instance, the three major car insurance players, Samsung Fire & Marine, DB Insurance and Hyundai Marine & Fire, controlled 54.2% of the market (in 2021) yet offer premiums that are 8%-15% below the market average. Furthermore, they all differentiate to entice different demographics, making it difficult for a foreign company to attract uncaptured markets. This is evidenced by the fact that the market share of foreign insurance companies decreased in 2022 to 17.2% from 18.6% the year prior.

So why does this happen? As different insurers can easily replicate insurance products, insurance companies mainly compete through price, limiting their profit margins. The key to maximising profits, hence, lies in your ability as an insurer to achieve economies of scale.

The fixed costs associated with running an insurance operation are large and unavoidable. These costs do not vary much regardless of whether you are an established player or a new entrant. As large insurers can spread out their fixed costs, advertising budget and distribution channels more effectively than smaller players, they are still able to make a profit while offering low prices. In other words, new entrants would have to be able to suffer massive amounts of losses for a very long time before seeing any traction in the market.

Singapore Has Seen New Entrants Succeed Alongside Established Players

In contrast, Singapore’s insurance industry shows a very different situation: small, new entrants tend to provide the lowest premiums to consumers.

Because price is the most typically utilised differentiation factor, these companies have been able to capture market share quite quickly.

For example, FWD and Budget Direct are 2 companies that came into Singapore’s insurance market in 2016, and they have been offering some of the lowest premiums for motor insurance products. Both insurers offer motor insurance premiums that are 30-40% cheaper than average, and FWD is usually one of the cheapest general insurers across multiple products like travel, maid and home insurance. On the other hand, Budget Direct tends to focus on offering benefits that are not typically seen with other insurers, such as unique travel or medical benefits.

Due to their prices, their growth in the insurance space has been unprecedented. While FWD and Budget Direct’s market share in motor insurance—Singapore’s largest non-life insurance market—is still quite small, they have increased their market share by 2,704% and 7,400% since inception, respectively.

FWD increased their operating profit before tax in their emerging markets, Singapore included, by 56% in H1 2023. Budget Direct saw a 3.3% increase in their gross written premiums within Singapore from 2022 to 2023. Meanwhile, previously established insurance player AXA has completely exited the Singapore motor insurance scene in 2023 after seeing a steady decline in their gross premiums.

How Are These New Players Able to Survive Despite Low Prices and Large Losses?

So, what is so unique about Singapore’s insurance market? Simply put, we believe one of the main reasons Singapore has seen so many new entrants in its insurance market is that Singapore’s insurance industry is relatively small on a global scale.

Because of its size, large foreign players can enter the market with low prices, and stomach their losses as they gain shares from established local players. In other words, having much bigger, profitable businesses elsewhere makes losing money in Singapore for a few years an investment that is relatively easy to persevere through. Economies of scale are not nearly as difficult to achieve in a smaller market as they would be in markets like the US where major players are already massive.

For instance, while FWD is a small newcomer in Singapore, it is actually a fairly large corporation with operations in 10 countries and over US$63 billion in assets under management globally in 2021 (S$83.91 Bn). This makes it even bigger than the leading domestic insurer in Singapore, NTUC Income, which has S$47.3 billion in assets under management in 2021. FWD is large enough to compete even against the largest domestic players in Singapore. In a similar fashion, Budget Direct is owned by a larger overseas conglomerate, making it easier for them to compete aggressively on price in Singapore as well.

Why Does Competition in the Insurance Sector Matter?

Competition in insurance is important in providing competitive premiums and quality service. An insurance industry with only a few players controlling the market can lead to expensive premiums and a lack of choice for the consumer, resulting in consumers overpaying for lower-quality products.

A lot of competition means that insurers have to differentiate themselves via quality, innovation or price. For instance, as FWD launched its online insurance services, other insurers started launching online services as well, changing the landscape of traditional insurance. Some even started implementing FinTech to keep up with global changes in the insurance sector.

What’s good about the current Singapore insurance market is that there is still room for more competition in Singapore. This is evidenced in two ways. First, the Monetary Authority of Singapore liberalised the insurance sector in 2000, with the goal of encouraging foreign investment and increasing competition.

Second, Singapore’s large insurance players are still able to sustain underwriting profits even during downturns in the industry. Singapore’s motor insurance market leader MSIG enjoyed an underwriting profit of S$8.3 milllion in 2022 despite the whole Singapore motor insurance industry experiencing a loss of S$21.6 million.

Consistent underwriting profits from the major players can imply that there might still be some room for insurance premiums to come down.

In the case of Korea, most insurance companies suffer an underwriting loss due to competition and make up for the loss through investment gains. In fact, we found that Korean drivers pay some of the lowest car insurance premiums compared to the rest the world, spending only 1.1% of their annual salary on premiums. Comparatively, Singaporean drivers spend between 2%-4% of their annual salary on car insurance.

One factor that contributes to premium price is a market’s risk profile. Theoretically, higher motor premiums in Singapore could indicate that insurers feel like Singaporean drivers are riskier to insure and cars in Singapore are pricey, and hence keep the premiums at their current rate.

However, the data shows otherwise. The loss ratio for the direct motor insurance market in 2021 was 58.3 in Singapore but 79.4 in Korea. This means that for every $100 of premiums collected in motor insurance, Singapore insurers administer $58.3 in claims while Korean insurers administer $79.4 in claims, indicating that the Singapore motor insurance industry is more profitable than the Korean motor insurance industry. This once again bodes to the fact that the Singaporean insurance market can continue to sustain greater price competition in the future.

Methodology

To get our findings, we analysed the financial returns published by the Monetary Authority of Singapore of all the insurers in Singapore. We analysed their direct premiums, gross premiums and underwriting results, and industry data published by the General Insurance Agency. This helped us understand which insurer has the most market share and how quickly new players are growing.

We then compared this to other global insurance markets, primarily the US and Korea, to understand why the differences in competition were so great. We gathered financial data on the biggest players in these markets from their public filings, as most of them are publicly listed. We also gathered actual premiums of auto insurance policies in these countries to analyse price competitiveness of each players in their respective markets. While we looked at the insurance industry as a whole, we focused on motor insurance because information for it was most readily available for the majority of the insurers. It is also the largest insurance segment in Singapore, making it a good way to illustrate our analysis.