The Singapore Press Holdings acquired 14 UK student accommodation buildings for $321 million. Together, the 14 UK student accommodation buildings have a total capacity of 3,436 beds.

The announcement by Singapore Press Holdings (SPH) said that it bought the UK student accommodation buildings from developer and operator Unite Group PLC for £180.5 million ($321 million). The acquisition was carried out through its subsidiaries Straits One (Jersey), Straits Two (Jersey) Limited and Straits Three (Jersey).

The properties which consist of 10 freehold and 4 leasehold assets are located across six towns and cities in established university towns including London, Birmingham, Bristol, Huddersfield, Plymouth, and Sheffield. The 14 Purpose-Built UK Student Accommodation buildings was bought by SPH because it has growth potential, with demand expected from both domestic and international students.

SPH, which owns several media companies including The Straits Times, said that a rise in enrolment of first year international and postgraduate students and with enrollment in the United Kingdom (UK) projected to grow by 23 per cent by 2030, there is much potential for its acquisition of the 14 UK student accommodation buildings.

SPH chief executive officer Ng Yat Chung said: “This cash-yielding acquisition will generate recurring cash flow, and is part of our ongoing strategy to diversify our business to new growth areas. It will boost our real estate asset management portfolio, establish us as an overseas owner of PBSA (purpose-built student accommodation) in the United Kingdom, and allow us to pursue other growth opportunities in this sector.”

Student accommodation offers better returns as investment properties than offices and residential housing, are recession-proof and a great diversifier in any portfolio. Singapore was the largest cross-border investor in student housing assets globally in 2016, with our sovereign wealth fund GIC partnering global student accommodation specialists to buy such investment properties in Europe, Australia and America.

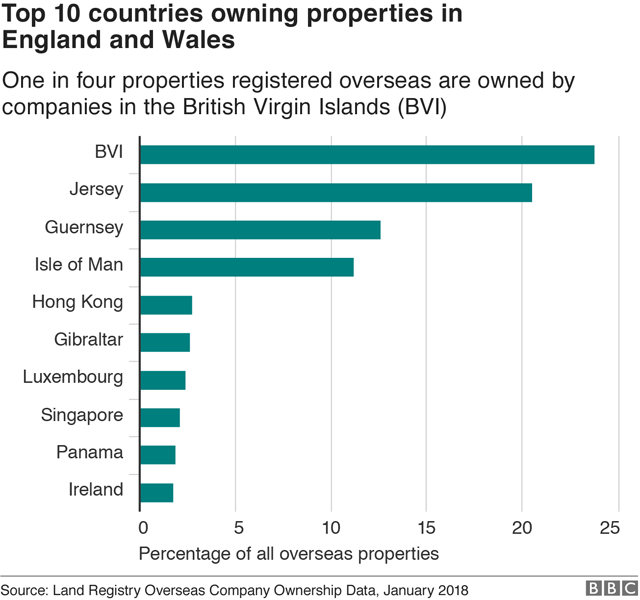

UK’s property market is a hot favourite with Singapore’s affluent individual and corporate investors. About 97,000 properties in England and Wales are owned by overseas firms, and Singapore is among the top 10 countries owning properties. The BBC made this analysis after the United Kingdom’s Land Registry made its data on Commercial and Corporate Ownership and Overseas Companies Ownership available at no cost.

This release of data in November last year follows the UK government’s commitment to fix a housing market they described as “broken”, a commitment which includes their aim to improve the availability of data to make it easier to identify those with interest in land. The Land Registry echoed this and explained that the change is “to promote economic development, financial stability, tax collection, law enforcement and national security.”

The analysis showed that out of 42,680 of the properties owned by foreign companies in England and Wales, some 44 per cent of the total, were in London, and that they had a value of £33.9 billion.

The UK property market has historically been a very open and accessible market for international investors, where it is also not unusual for investors to use intermediate centres to pool capital with other investors in collective structures (such as funds and real-estate investment trusts), to diversify their asset allocation across a wider range of projects and opportunities.

An annual survey of the Association of Foreign Investors in Real Estate also ranked London at the top (tied with Los Angeles) for stability and opportunity for capital appreciation. The Association’s members who are estimated to have more than $2 trillion in real estate assets under management also said that they were less worried about the impact of Britain’s exit from the European Union than they were a year ago.

In July last year, a study for the London Mayor showed that foreign investors are buying up thousands of homes suitable for first-time buyers in London and that they were using them as buy-to-let investments.

Foreign buyers led by Singapore and Hong Kong snapped up 3,600 of London’s 28,000 newly built homes between 2014 and 2016, the research said. About half of these homes were priced between £200,000 and £500,000.

More than 70 per cent of the homes bought by foreigners were as rental investments and in 15 per cent of cases, the properties were bought by companies. The London Mayor said that the Government would give local people “first dibs” on new homes, but stressed that “international investment plays a vital role in providing developers with the certainty and finance they need to increase the supply of homes and infrastructure for Londoners”.

London has always been seen as a safe haven for very wealthy foreigners to “park their money”, and for years they have been attracted to London homes as a stable investment.

Proptech to impact and disrupt traditional business operating models in real estate

The research also found that almost all of London’s largest residential development needed overseas investment to get under way, either through purchasers buying off-plan or through equity finance or investment in UK house-building companies. Singaporean buyers especially favoured properties in Westminster. It is estimated that four out of 10 new-build properties there were sold abroad over a two-year period.

The British pound’s depreciation against the world’s major currencies has also helped increase the attractiveness of UK real estate to overseas investors. London’s robust market fundamentals which translates into attractive yields over other global cities also boosts investor confidence in the London real estate market. With an average of 10 to 15 years, the city’s lease lengths are also significantly longer than many markets. UK’s robust legal system, along with its market transparency and liquidity all play a part in the appeal.

Are planning to acquire properties like SPH’s UK student accommodation buildings?

Speak to iCompareLoan mortgage brokers who can set you up on a path that can get you a commercial loan in a quick and seamless manner.

Alternatively you can read more about the Best Commercial Loans in Singapore before deciding. Our brokers have close links with the best lenders in town and can help you compare Singapore commercial loans and settle for a package that best suits your commercial purchase needs.

Whether you are looking for a new commercial loan or refinance, our brokers can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the loan. And the good thing is that all their services are free of charge. So it’s all worth it to secure a loan through them.

For advice on a new commercial loan or Personal Finance advice.

To speak to our distinguished Panel of Property agents.

For refinancing advice on your properties.