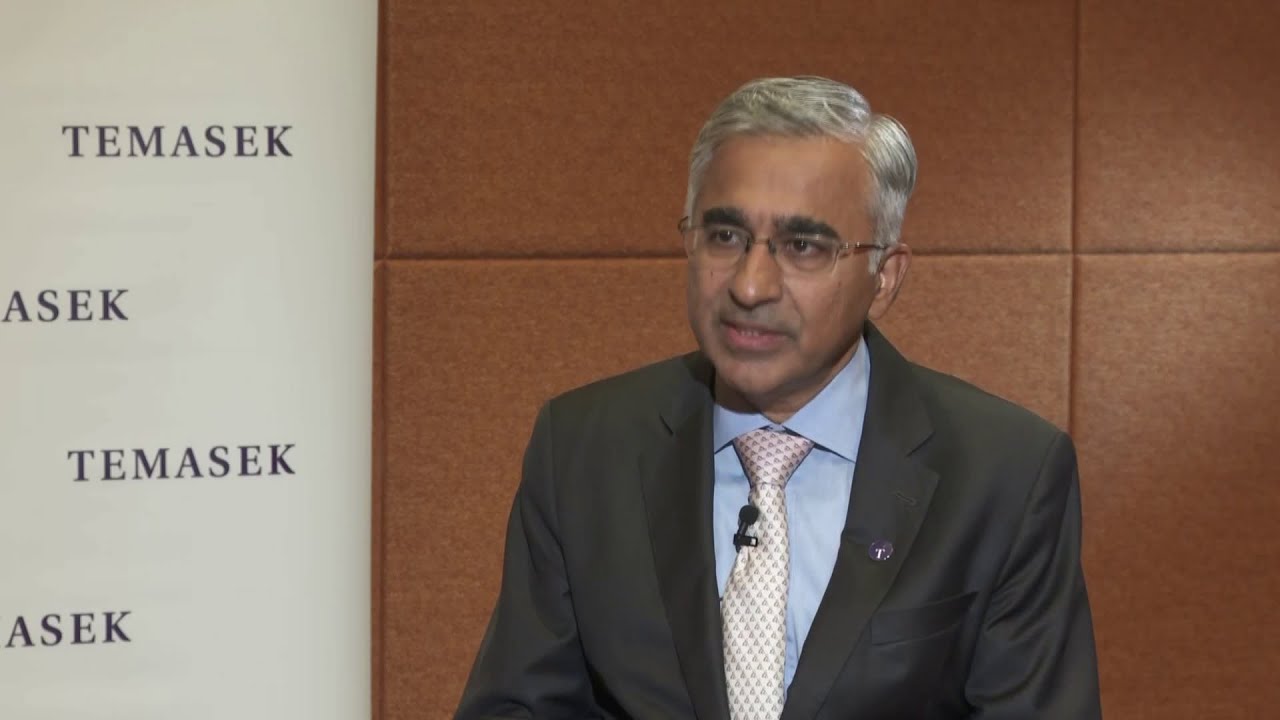

SINGAPORE: Temasek chief investment officer (CIO) Rohit Sipahimalani has expressed concerns over the potential re-election of former U.S. President Donald Trump in the 2024 presidential race. Speaking to Bloomberg, Mr Sipahimalani warned that a Trump victory could slow down global economic growth, creating unfavorable conditions for emerging markets.

While many investors hold the view that a Trump presidency would boost market conditions through lower taxes and deregulation, Mr Sipahimalani challenged this consensus. He argued that the broader economic outlook beyond 2025 is much less predictable if Trump wins.

His comments reflect apprehensions over the likely economic policies under another Trump administration, including potential tariffs and uncertainties, which he believes could disrupt markets worldwide.

The U.S. election, set to take place next week, has heightened anticipation among global investors. According to Bloomberg Markets’ latest survey, Trump’s victory is anticipated to benefit stockholders and cryptocurrency investors more than a win for the Democratic candidate, current U.S. Vice President Kamala Harris.

Despite this, Mr Sipahimalani expressed a preference for a Harris-led administration for its likely positive impact on emerging markets, while noting the potential negative effects of a Trump administration on the same economies.

A Trump win, Mr Sipahimalani suggests, might strengthen the dollar and potentially increase interest rates. However, he argued that tariffs and other protectionist measures could undermine global growth and create financial instability. In his view, such policies could negatively impact economies worldwide, slowing growth and posing a risk for both emerging markets and large multinational firms, especially those with substantial non-U.S. revenue.

Notably, 25% of S&P 500 companies’ revenues are generated outside of the United States, amplifying the potential effects of slower global growth on U.S.-listed corporations.

Temasek has ramped up its U.S. investment strategy, recently announcing plans to invest approximately S$40 billion in the American market over the next five years. However, Mr Sipahimalani cautioned that market volatility could increase in the coming years, especially as he believes “tail risks”—low-probability but high-impact events—have been underestimated by investors.

In addition, the CIO reiterated Temasek’s cautious approach toward China, emphasizing that how the Chinese government allocates fiscal stimulus is more crucial than the scale of spending. He highlighted structural challenges and China’s willingness to take risks as key factors shaping its economic outlook.

Looking ahead, Mr Sipahimalani forecasts a challenging market environment in 2025, characterized by volatility and high activity in both buying and selling, signaling an era of increased caution for global investors.