According to a residential market analysis by Orange Tee, Downtown Core is one of the highest sought-after location for non-landed homes in Singapore. The business hub at Shenton Way and bright lights of Boat Quay / Chinatown give District 1 (D1) and District 2 (D2) gives Downtown Core a strong appeal, the report said. According to the Urban Redevelopment Authority (URA), D1 covers Raffles Place, Cecil, Marina, People’s Park, and D2 covers Anson and Tanjong Pagar.

“The continuous route along the waterfront that links up the necklace of attractions at the Marina Centre, Collyer Quay and Bayfront offers buyers both panoramic views of the promenade as well as direct access to connecting malls like Marina Bay and Suntec City.”

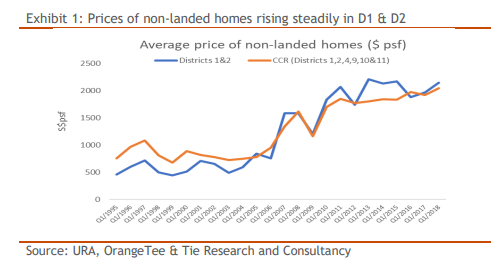

Based on Orange Tee’s analysis of URA’s caveats downloaded on 05 April 2018, prices of non-landed luxury homes in the Core central Region (CCR) rose 6.2% y-o-y to a historical high of $2,046 psf in Q1/2018. The analysis added that comparatively, the average price of non-landed homes in D1 and D2 rose faster at 9.3% year-on-year to $2,147 per square feet (psf) in the same quarter.

Not all home loans in Singapore are created equal but you can find the best one

On a quarterly basis, D1 and D2 prices rose 3.5% Quaker-on-Quarter. Other high end districts saw prices fall in Q1/2018. District 4 for example saw a 2.6% decrease to $1,521 psf, while District 11 saw 9.6% decrease to $1,646 psf. This price is also nearing the peak of $2,207 psf registered in Q1/2013, the report said.

Their analysis of Q1/2018 further showed that D2 saw a larger y-o-y price increase of 14.5% as compared to D1, which only saw a 5.6% increase. The price increases in D2 were mainly attributed to projects like Wallich Residence, Icon, 76 Shenton and Lumiere. The second and third priciest homes transacted in the same quarter are from Wallich Residence. The price increase in D1 is mainly attributed to One Shenton and The Sail @ Marina Bay.

5 telling signs that you are working with a great mortgage broker

Demand picking up

The report suggested that the average sales prices of non-landed homes in D1 and D2 have been increasing over the last four quarters.

“Sales were transacting above the five year average of 85 units. In fact, 493 caveats were lodged in 2017, a 153% increase from 2016 (195 units). 89 caveats were lodged in Q1/2018.”

Other Findings from the Research:

- New sale and subsale prices were at historical highs, with price of non-landed new homes reaching a historical high at $2,653 psf in Q1/2018. Price of subsales has also reached a historical high at $2,319 psf in this quarter. Resale prices held steady at $1,875 psf in Q1/2018.

- More pricey homes are being sold, with the highest price non-landed home by psf basis sold in Q1/2018 is a 355 sqm unit at Le Nouvel Ardmore, transacted at $4,098 psf or $15.7 million. The next highest priced are two

high floor units at Wallich Residence; a 89sqm unit sold at $3,894 psf and a 160 sqm unit sold at $3,832 psf. Another 57 sqm unit at Wallich Residence was sold at $3,677 psf. - Rents are holding steady despite the overall market sliding by 1.7% for the whole of 2017, after falling 3.6% in 2016. Comparatively, rents of private homes in D1 & D2 have been holding steady since 2013, hovering between $5 – 6 psf per month. Median rents was at $5.34 psf per month in Q1/2018.

Orange Tee expects prices of non-landed homes in D1 and D2 to continue to rise by about 8-12% this year as more units from Marina One Residences and Wallich Residences are slated to be released in later phases.

—

For the best way to compare home loan Singapore, inquire with iCompareLoan mortgage broker. With their help, you can have your home in the sky within the next year or so.

For advice on a new home loan.

For refinancing advice.