JLL said in its report on the data released by the Urban Redevelopment Authority (URA) on 18 June 2018 that no new executive condominium projects were launched in the month of May. JLL, a global real estate services firm, noted that: “Rivercove Residences which was launched in April continued to move sales at a brisk pace, selling 108 units at a median price of $993 psf in May. In total, it has sold 610 of its 628 units i.e. a take-up rate of 97 per cent.”

It added: “Among other Executive Condominium projects, Northwave sold 19 units at a median price of $835 psf. A few other EC projects recorded very low sales as these were their few remaining units. Altogether, 136 new Executive Condominiums were sold in May, much less than the 596 sold in April when Rivercove Residences was launched.”

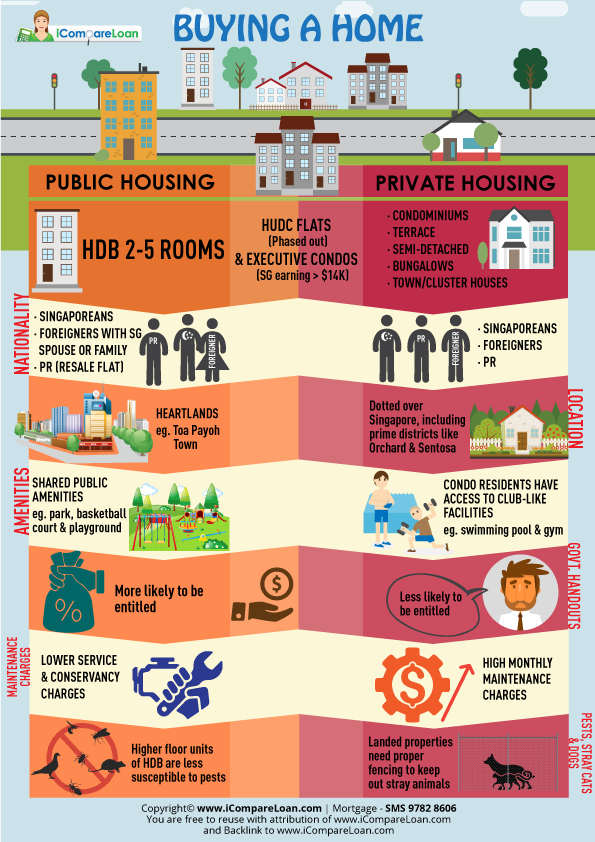

Executive condominiums are hybrids between public and private housing and only Singaporeans earning below $14,000 may apply for it. The property becomes private after 5 years of ownership.

Rising private home prices and record low unsold Executive Condominium developer inventory have triggered a demand for such hybrid property.

Colliers International, another prominent real estate services company, noted that the demand for Executive Condominiums were driven by their relatively affordable price points for the ‘sandwiched’ class.

The Government has recognised this demand and has opened for application a site on its reserved list for Executive Condominium development at Tampines Avenue 10. In the 3-year period from 2015 to 2017, only four Executive Condominium land parcels were sold by the government. This translated to only 1.3 sites per year. Judging from the keen participation seen for similar sites and development in recent times, the Tampines Ave 10 site can be expected to be triggered for sale.

Developers’ hunger for Executive Condominium sites is evident in the 17 bids and record-breaking top bid attracted by the Sumang Walk Executive Condominium Government Land Sale site when tender closed in February 2018.

Underpinned by a hiatus of Executive Condominium Government Land Sale tenders for one-and-a-half years prior to the launch of the Sumang Walk site, the absence of Executive Condominium site in the East of Singapore, since the Sea Horizon site was sold in November 2012, rising private home prices and record low unsold Executive Condominium developer inventory, the Tampines Ave 10 Executive Condominium land parcel holds high potential.

But just a few years ago, with an oversupply of Executive Condominiums, the story was quite different. In the 4th quarter of 2014, 2,505 new units were added as a result of a spillover from 4 new Executive Condominium launches. This situation further worsened with the launch of 10 new Executive Condominium projects (comprising of 5,544 units) from January 2015 to April 2016. This surge was attributed to the government’s series of property cooling measures.

The demand for Executive Condominiums however improved with the positive sentiments in the residential property market after the government relaxed some of the market curbs in March 2017.

With the positive real estate market sentiment, developers sold 1,121 private residential units in May. This was a significant increase of 53.1 per cent over the 732 units sold in April and also 7.9 per cent more than that in May last year. The tally for the first five months of the year is estimated at 3,434 units, about 38 per cent below the 5,568 units which developers sold for the same period in 2017.

The 1,060 new private homes launched during the month is 59.6 per cent more than the 664 released in April. Private homes launched from January to May 2018 totaled an estimated 2,645 units, well below the 3,935 units launched for the same period last year by about 33 per cent.

JLL noted that launches picked up steam in May with five new private residential projects placed on the market:

- Twin Vew launched all of its 520 units for sale with 454 units taken up at a median price of $1,385 per square foot (psf).

- Amber 45 launched 100 of its 139 units and sold 86 at a median price of $2,378 psf.

- Sixteen35 Residences launched its 60 units, disposing of 45 at a median price of $1,511 psf.

- The 56-unit 120 Grange launched 50 units for sale with no sale recorded in May but caveats to-date reveal 37 transactions at a median price of $3,141 psf.

- Sea Pavilion Residences was also launched with 14 of its 24 units taken up at a median price of $1,852 psf.

The top selling private residential projects in May were:

- Twin Vew (454 units at median price of $1,385 psf)

- Amber 45 (86 units at median price of $2,378 psf)

- Le Quest (73 units at median price of $1,462 psf)

- The Tapestry (59 units at median price of $1,388 psf)

- Seaside Residences (59 units at $1,896 psf)

Mr Ong Teck Hui, National Director of Research & Consultancy at JLL commented:

“The market pick-up in May is mainly due to increased launches with the five new private residential projects launched, accounting for 71 per cent of the total launch volume, which in turn contributed to stronger sales performance during the month. Twin Vew alone, which sold 454 units, accounted for nearly 41 per cent of the 1,121 new private homes sold in May.

At $1,385 psf, the median price of Twin Vew appears attractive to buyers interested in a suburban location. In the current market, suburban projects priced around $1,400 psf have been achieving steady sales progress, even if they are not near MRT stations.

Despite buoyant market sentiments, the launch and sold data for January to May 2018 lag those for the same period last year – an estimated 2,645 units launched in the first five months of 2018 against 3,935 for the same period last year and 3,434 units sold from January to May this year versus 5,568 units correspondingly last year. The implication is that sales will have to pick up strongly especially in the second half of 2018 if 2017’s new home sales of 10,566 units is to be matched or surpassed.”

—

If you are a home hunting, our Panel of Property agents and the mortgage consultants at icompareloan.com can help you now.

Our affordability assessment and best home loans will put your heat at ease and the services of our mortgage loan experts are free. Our analysis will give best home loan seekers better ease of mind on interest rate volatility and repayments.

Just email our chief mortgage consultant, Paul Ho, with your name, email and phone number at [email protected] for a free assessment.