Owning a car in Singapore is very expensive. For example, most sedans cost about 4 to 5 times more in Singapore than in the United States or Korea. Due to these high costs Singaporeans have reduced their reliance on driving and it has even become “fashionable” to not own a car. Instead, individuals can take advantage of the availability of ride-sharing, public transportation and other types of transportation such as bicycles and scooters. With that said, how much could you actually save by avoiding driving completely?

How Much Does it Cost to Own a Car in Singapore?

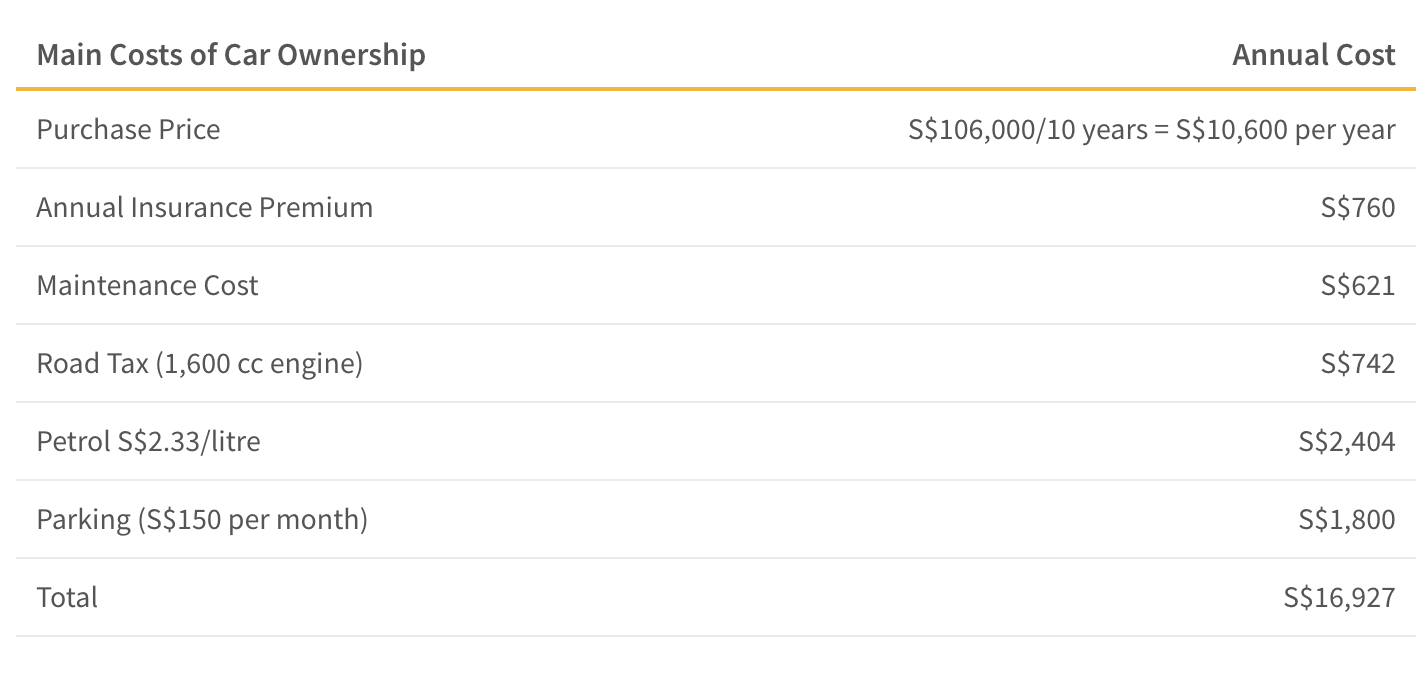

We estimate that the total annual cost of owning and driving a car in Singapore is approximately S$15,127. To calculate the this figure we added the purchase price of the vehicle, annual car insurance premium, annual maintenance costs, road tax and cost of petrol. However, we did not account for the cost of a car loan or the resale value of your car because these variables vary significantly depending on each individual’s circumstances and would likely offset each other. Additionally, we assumed that the average individual drives a Toyota Corolla Altis 1.6, which is one of the most popular vehicles in Singapore. This car averages fuel efficiency of 16.4 km/L. Finally, we also assumed that drivers travel 16,700 kilometres per year, which was the average mileage per driver in 2016 according to the Land Transport Authority (LTA).

Is it Cheaper to Take Grab Rides Instead of Driving?

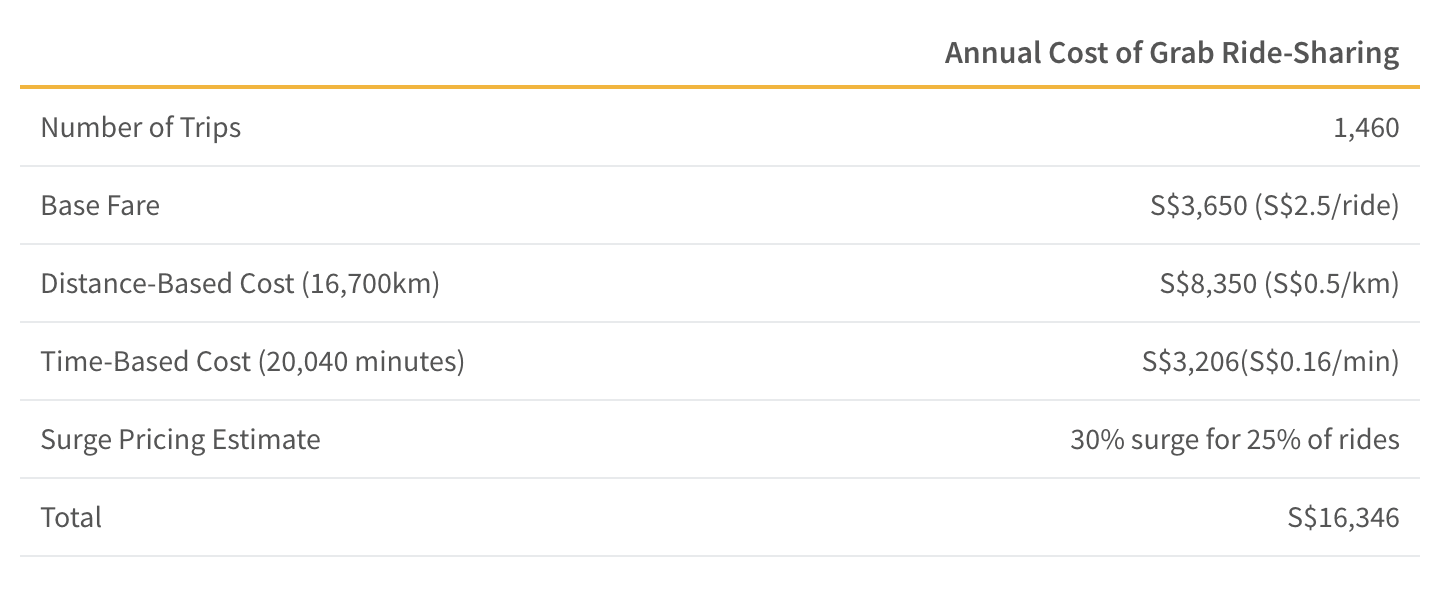

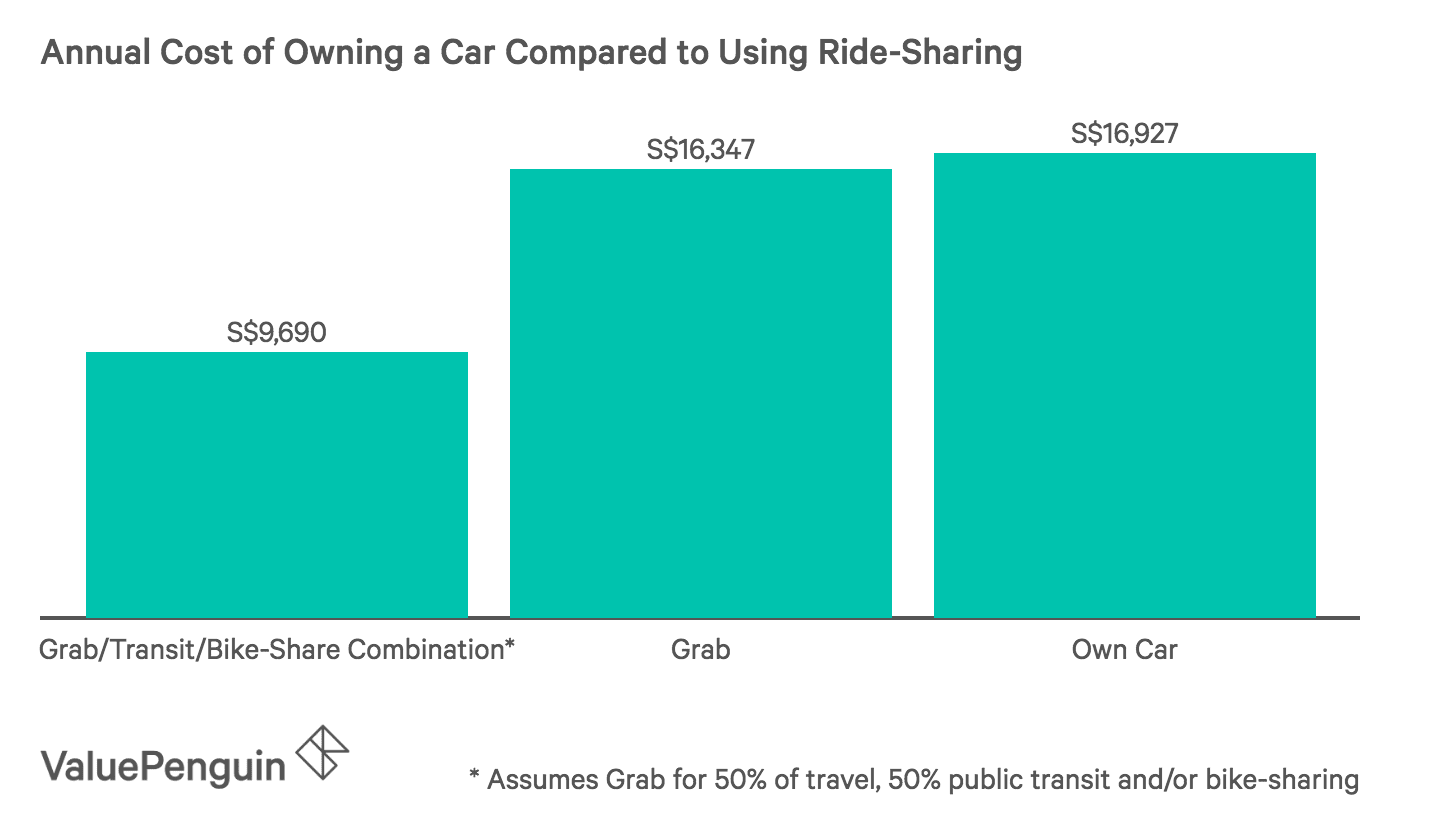

Our research and calculations indicate that the average Singaporean would save about S$580 per year by taking Grab rides instead of driving their own car. We reached this conclusion by using Grab’s rates and our own estimates about average travelling behavior in Singapore. First, we assumed that riders would need to travel the same distance as the average driver. Then, we estimated that these individuals would use Grab about 4 times a day, or 1,470 times in one year. Next, we calculated the time-based cost by using the average annual travel distance (S$16,700) and estimating that rides average speeds of 50 km per hour, which would take about 20,040 minutes in total throughout one year. Finally, to account for surge pricing, we estimated that on average about 1 in 4 rides will face surge pricing of about 30%. Based on these inputs and Grab’s pricing, we calculated that the total annual cost of ride-sharing to be approximately S$16,347.

Public Transportation & Bike-Sharing Can Significantly Reduce Commuting Costs

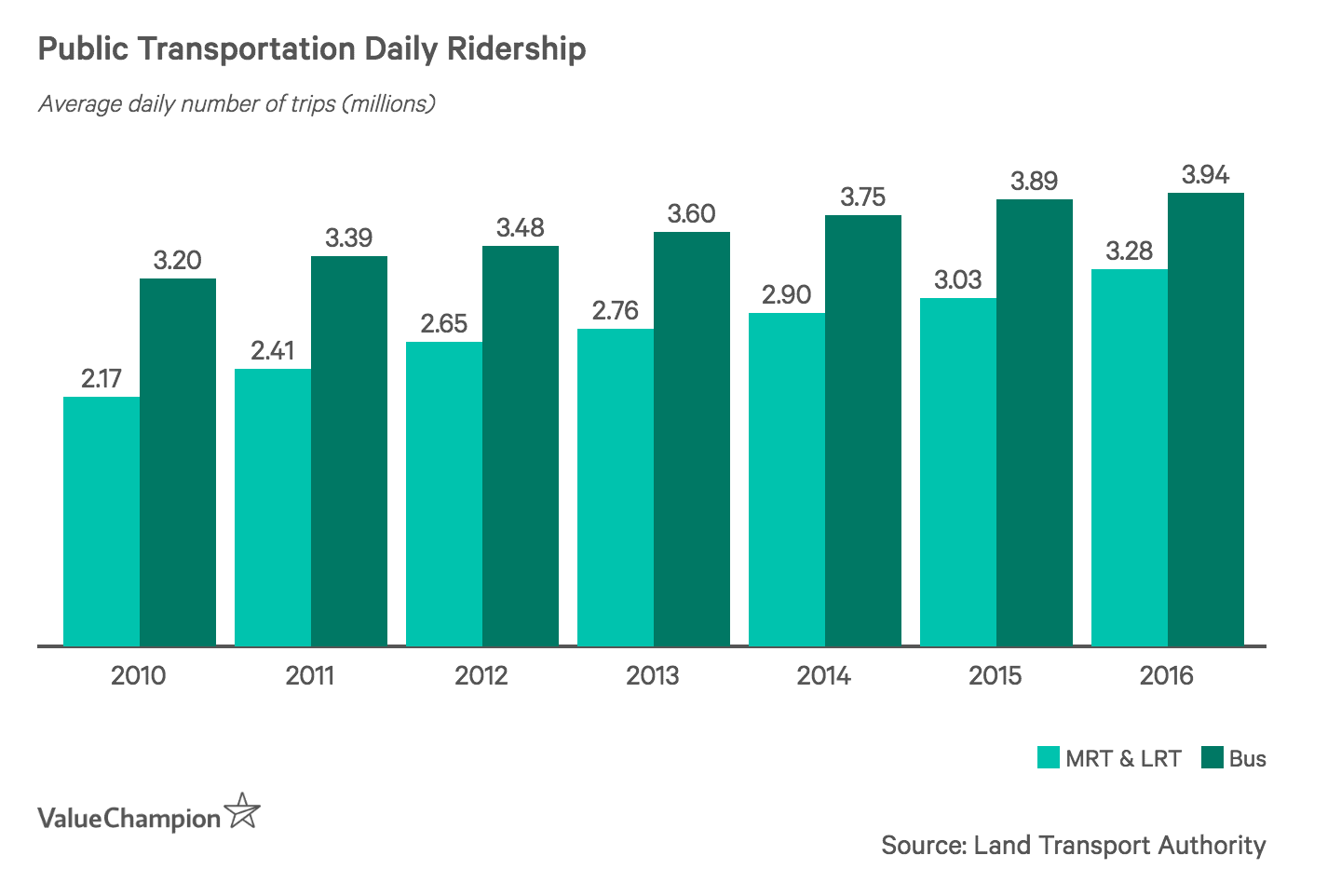

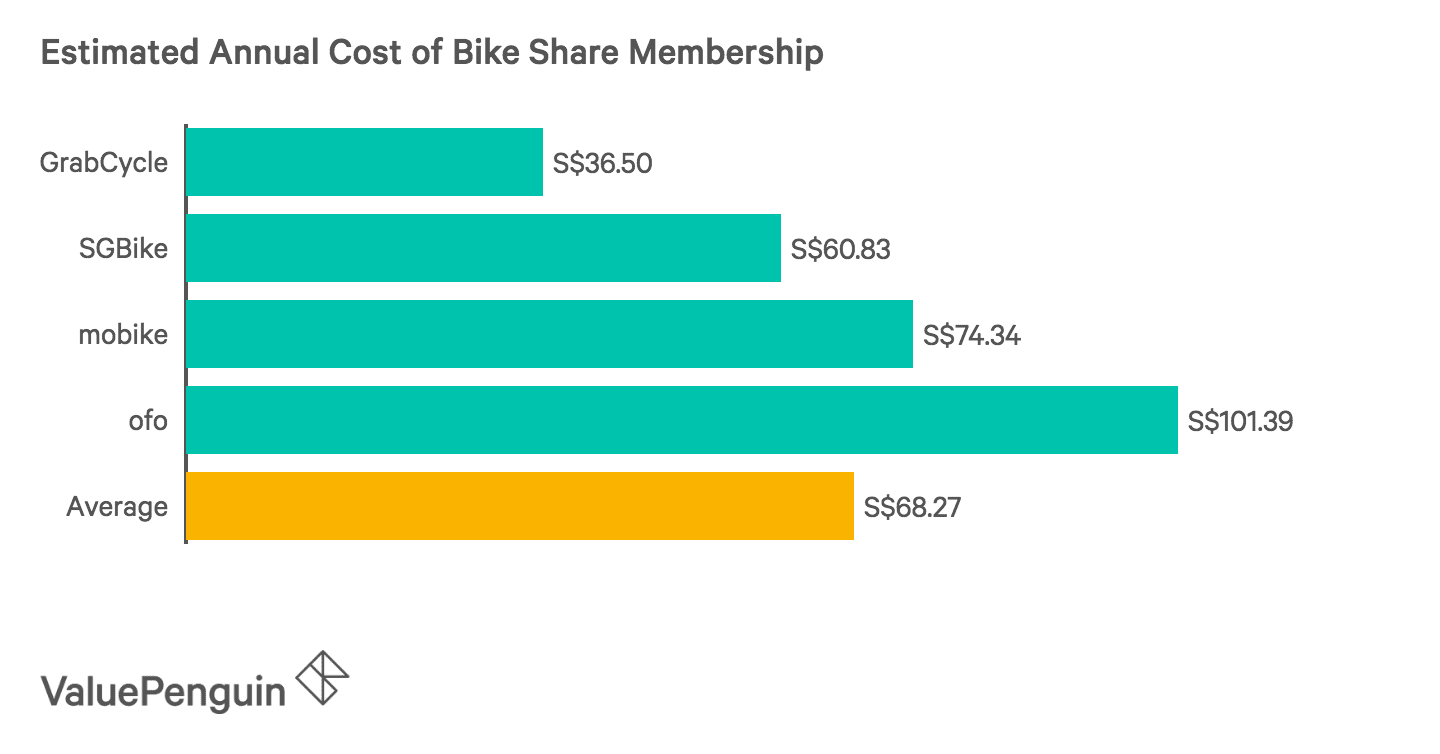

While you may not save an extraordinary amount of money by using Grab as your only alternative to driving, it is certainly possible to save even more if you are able to use other transportation alternatives such as public transportation or bike-sharing, in addition to using Grab from time to time. For example, an Adult Monthly Travel Card, which provides unlimited access to Singapore’s basic bus and rail services, costs S$120 per month, plus S$8.10 in initial fees. This results in a total annual cost of S$1,448 — a fraction of the cost of driving or using ride sharing. Additionally, an annual bike-share membership costs just S$68 on average in Singapore, giving willing individuals an easy and inexpensive way to commute.

Therefore, by using Grab for half of your travel (twice a day instead of 4 times a day) and and using public transportation and bike-sharing for the the other half of your travel, we estimate that you could save S$7,237 annually compared to owning and driving a car. Over the course of several years, these savings would amount to a very significant amount of money.

Other Ways to Decrease the Cost of Your Commute

With a combination of Grab rides, public transportation and bike-sharing, Singaporeans can easily avoid the hassle and cost of owning and driving a car on the island. By our estimates, owning and operating a car in Singapore or using Grab frequently as an alternative both cost over S$16,000 per year. However, it is possible to decrease these annual costs just by paying for petrol or ride-sharing with the right credit card. For example, several credit cards such as the Citi Cash Back card and Standard Chartered Unlimited Cashback Card offer more than 20% rebates at select petrol stations and 8% to 15% discounts on Grab rides. These savings highlight the importance of carefully selecting and using a credit card that maximises your rewards based on your spending habits.

The article How Much Could You Actually Save by Not Owning a Car? originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Source: VP