Eighteen years ago, Lady (not her real name) entered the workforce like many fresh graduates and earns a humble salary of $2,200 per month.

A sole breadwinner of a family of 4, she need to desperately figure out how to survive and get by should a day she loses her job without sufficient savings.

In 2005, during her career transition, she came across her Central Depository statements and noticed that some of the stocks she bought during the early years has yielded some dividends. That was when it struck her that she could actually work towards generating passive income through dividends.

Back then, she did not have any background knowledge in finance and investment but her determination of working towards her goal of financial freedom has spurred her to learn investing by herself.

Like many young investors, she spent her free time reading investment books, finance blogs, watches CNBC and analyse companies on SGX’s website. Her curiosity has allowed her to equip herself with valuable knowledge in investing which is still relevant today.

In 2012, she made her first million dollar and an annual dividend income of $41K.

Q. Are you a spender or saver?

I am a saver although i have a soft spot for travel

Q. You have grew your portfolio to a million dollar from 2005 to 2012. That’s an incredible feat considering that the collapse of the Lehman Brothers happened in 2008 and the Eurozone crisis in 2009. How do you overcome your loss in 2008 and still hit your million dollar goal?

I didn’t see 2008/2009 as a crisis or a loss although some of my counters were in red. In fact, i felt just like my girlfriends during the Great Singapore Sale, but in this case, instead of buying bags, shoes and clothes, i was buying stocks.

Q. You have not looked back since then and continue growing your portfolio and passive income. Did you suffer any setbacks during this period besides the financial crisis?

I have been fortunate. I did not suffer any major setbacks so far. Although i wished i hadn’t sold away Allergen and Citibank too early.

Q. What’s your best and worst investment? And how’s your current portfolio looks like?

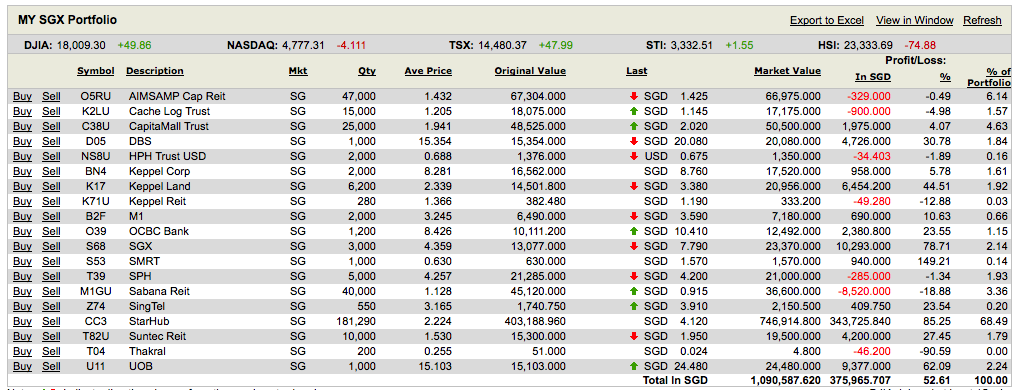

My best investment is Apple (+71%), Facebook (+145%) and Starhub (+85%). Both Apple and Starhub are giving me good returns on dividends yearly. My worst investment of late is Sabana Reit. I share an update of my portfolio every month. You can check out my latest portfolio here: http://ladyyoucanbefree.com/2014/12/23/my-stock-report-card-for-dec-2014/

Q. Are you currently employed or have you retired? If you have retired, what is your current passive income/dividend?

I am currently employed. My current passive income is $59.072.58.

Q. Does your spending habits change as your portfolio grows? Do you spend more than your passive income and how do you manage your personal finance?

I do not spend more than my passive income. I am still learning to improve my spending habits and I learnt that little indulgence do add up a lot. (For example, my indulgence in my favourite iced milk tea) As i said earlier, i also have a soft spot for travel.

Check out my spending habits here: http://ladyyoucanbefree.com/2013/11/30/retirement-planing-project/

Q. What financial planning have you done for yourself? And what’s your retirement plan?

I have just bought myself a retirement home, medical insurance for myself and my family. Moving forward, i will be continuing my journey in accumulating and exploring passive incomes that allows me the freedom to chase after things that i am passionate about and to checkoff my bucket list at http://ladyyoucanbefree.com/2013/05/31/bucket-list/

Q. What is your advice to young adults who have just started embarking on their career journey?

Love what you do and money will follow. Stay Hungry, Stay Foolish. Check out Steve Job’s Stanford Commencement Speech and be inspired!

Q. What about advice to other investors?

I don’t think i am qualified to provide advice to other investors. I would love for them to drop by my blog at http://www.ladyyoucanbefree.com and share notes with me. Let’s learn from one another.

* Lady’s portfolio has now grow to more than $1.6 million and her passive dividend income currently stands at $59,072.58. She is currently aiming for a passive income of $65K.

This is how her December’s portfolio looks like:

To get updates on her future portfolio, please visit her website at http://ladyyoucanbefree.com

(*The article first appeared on http://www.moneydigest.sg)