Centaline Singapore on March 27 announced the launch for collective sale by tender of D’Grove Villas, a freehold high-rise residential redevelopment site strategically located within Singapore’s prime District 10 in the upscale Ardmore precinct.

Located at 8A Orange Grove road, D’Grove Villas is a rare and exclusive 24-year-old development with an estimated site area of 50,400 sq ft. The development is 21-storey high with a total of 45 units. According to the Urban Redevelopment Authority’s Masterplan 2014, the site is zoned “Residential” with a gross plot ratio of 2.8. The permissible gross floor area including balconies upon redevelopment is 141,120 sq ft, which is subject to approval. The site has an allowable building height of 36-storey for future redevelopment.

D’Grove Villas is adjacent to Orchard Road shopping belt, close to Shangri-La hotel, high-end private clubhouses and several premium serviced apartments are also nearby. “This site has a verdant landscape of the Singapore Botanic Gardens and Singapore’s bustling city skyline. With the unique location and rarity, it will definitely attract both local and overseas developers,” added Centaline Singapore.

D’Grove Villas is the first collective sale project in Singapore marketed by Centaline Singapore.

Its parent company Centaline Property Group is one of Hong Kong’s largest property agencies in the region, with over 60,000 employees and 2,600 offices across China, Hong Kong, Singapore and Macau

Its parent company Centaline Property Group is one of Hong Kong’s largest property agencies in the region, with over 60,000 employees and 2,600 offices across China, Hong Kong, Singapore and Macau.

Centaline Singapore KEO Mr. Ronnie Khoo said: “We have been actively expanding our agency business in Singapore for several years, providing agency service to home owners, developers as well as overseas buyers. With our experience, we look forward to act as a bridge to overseas developers for investment opportunities in Singapore.”

Centaline Singapore also noted, “Though the new property cooling measures were announced last year, private luxury developments are still in demand among overseas investors due to the limited supply of land in prime locations. Compared to other world-class cities like Hong Kong, London and New York, the price still remains attractive for luxury developments in Singapore.”

The freehold residential development in prime District 10, D’Grove Villas, is being put up for collective sale with a reserve price of $398 million, said Centaline Singapore.

Singapore’s economy has always been stable, which makes it more attractive for overseas developers and investors looking into a long-term investment here. D’Grove Villas is an excellent and rare opportunity for developers looking to build a residential development with a distinguished address yet enjoying the lush tranquillity and quiet surrounding. Given its positive site attributes, it will definitely gain strong interest from local and overseas developers.

The collective sales tender of D’Grove Villas will close on May 23 at 3 pm.

En Bloc Sales Process Singapore – A Definitive Step-by-step Guide

Whatever decisions owners facing en bloc sale make, it is better to make it fast so that the sale (or non-sale) can be concluded with minimal delay and maximum benefit to the owners. One way is to conduct a Collective Sales Agreement (CSA) as well as concurrently collect a “Non Collective Sales Agreement (NCSA)”, so that once a NCSA reaches 20%, the collective sale process is called off. There is really no point to drag on.

As collective sale process takes 20 to 30 months to complete, during this time, the owners typically do not have sufficient funds for down-payment and their CPF OA funds are tied up in the property, hence they cannot buy a new condominium early.

By the time the transaction is completed in 20 to 30 months later, the property prices would have already moved up 10 to 20 per cent. This is already evidenced by sellers of older estate asking higher prices. Hence if the process takes 20 months to 30 months, owners may need to consider the cost of a replacement unit by that time, else they may want to hold up a higher selling price.

The rules for en bloc sale are quite onerous and stringent and is governed by the Land Titles (Strata) Act – section 84A. Over the years, additions and amendments by the Ministry of Law to the en bloc law have made the collective sale rules even tighter.

Many of the home owners who refinanced their home loans to fixed rate home loans or those with 2 years locked-in or 3 years locked-in period will incur full home loan redemption penalty. This penalty is usually 1.5% of the loan amount. This tends to affect those who have bought their properties in recent years as their loan size tends to be bigger and their corresponding home loan redemption penalty higher.

If one’s home is at risk of en bloc, the owner should consider a home loan where there is no locked-in penalty, but instead entails a higher housing interest rate cost. The next best option is to look for packages with a waiver of locked-in penalty due to sale of property. Such owners may contact a mortgage broker to assist them to find such packages with waiver of locked-in penalty.

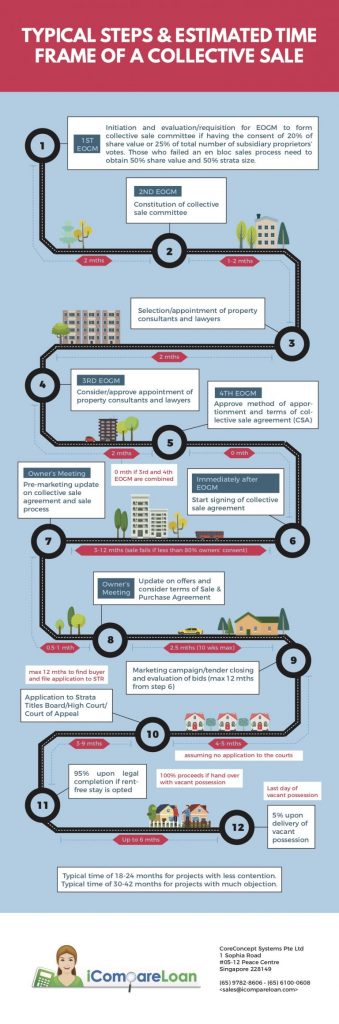

In order to understand how and whether to go into an En Bloc sales and sign on the Collective Sales Agreement (CSA), the owners will need to know how long it will take you to complete the En Bloc sales in case it is successful.The maximum and minimum duration of the en bloc sales process as indicated in the cumulative timeline in the table is roughly between 18.5 months to 38.5 months. The earliest any home owners can receive any en bloc sales proceeds could be around 13.5 months and the latest will be 32.5 months.

How to Secure a Home Loan Quickly

Are you planning to invest in private properties but ensure of funds availability for purchase? Don’t worry because iCompareLoan mortgage broker can set you up on a path that can get you a home loan in a quick and seamless manner.

Our brokers have close links with the best lenders in town and can help you compare Singapore home loans and settle for a package that best suits your home purchase needs. Find out money saving tips here.

Whether you are looking for a new home loan or to refinance, the Mortgage broker can help you get everything right from calculating mortgage repayment, comparing interest rates all through to securing the best home loans in Singapore. And the good thing is that all our services are free of charge. So it’s all worth it to secure a loan through us.

For advice on a new home loan.

For refinancing advice.