SINGAPORE: The Central Provident Fund Board (CPFB) will lower the maximum daily CPF withdrawal limit from S$200,000 to S$50,000 starting Sept 25. This change is designed to protect members from the rising scams involving CPF accounts, as announced on Aug 22.

According to The Straits Times, in November 2023, CPF members aged 55 and above could increase their daily withdrawal limit from the default S$2,000 to up to S$200,000 by accessing the CPF website. The policy allows members to set their daily withdrawal limit between S$0 and S$200,000 with enhanced security and a 12-hour cooling period. They can also activate the CPF Withdrawal Lock to immediately set their limit to S$0.

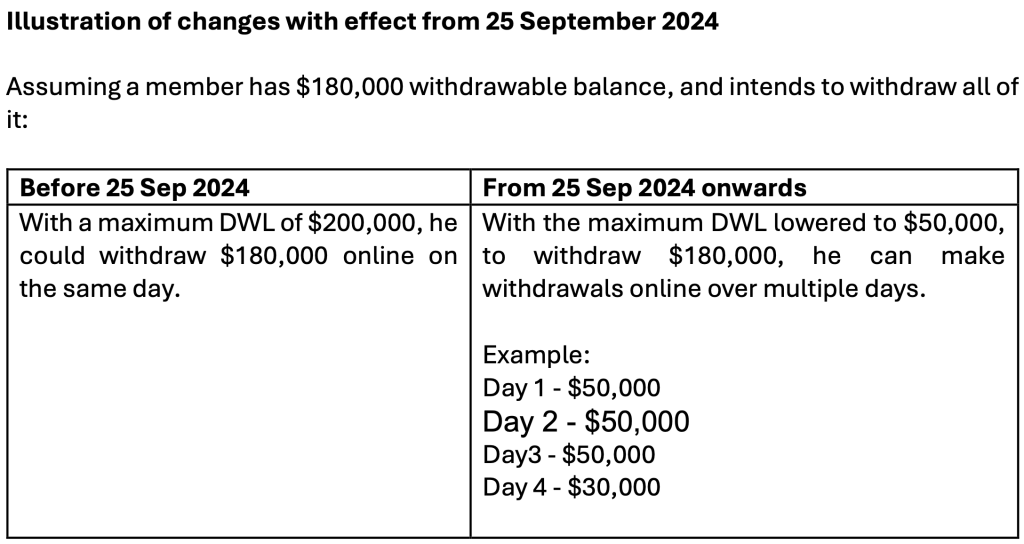

Under the new policy, members planning to withdraw more than $50,000 will need to do so over multiple days. For instance, if a member wishes to withdraw S$180,000, they would need to make daily withdrawals of S$50,000 for three days and an additional S$30,000 on the fourth day.

The first half of 2024 saw a record 26,500 scam cases, with losses totalling over S$385.6 million. While CPF-related scams account for less than 0.1 per cent of these cases, the financial impact is still significant, estimated at over S$2.5 million based on current figures.

The CPFB noted that many CPF-related scams involved “government official impersonation and investment” fraud. Victims authorised withdrawals from their CPF accounts, which were then transferred to bank accounts and subsequently transferred, often after increasing their daily withdrawal limits.

To address these concerns, CPFB believes that lowering the daily withdrawal limit will act as a deterrent to scammers and reduce potential losses. The majority of CPF members currently maintain a daily withdrawal limit of S$50,000 or less, with only a small number setting it higher. Those affected by the new limit will be notified in advance.

In addition, members who prefer to receive their CPF withdrawals via PayNow will need to complete a one-time update of their PayNow NRIC-linked bank account through the CPF website. The update will require a 12-hour cooling period and enhanced authentication, even for members who have previously used PayNow, as an anti-scam measure, said CPFB.

The CPFB is committed to collaborating with banks and other government agencies to monitor scam trends and refine security measures. Members who suspect they have fallen victim to a scam should immediately freeze their bank accounts, reset their Singpass password, and activate the CPF Withdrawal Lock to disable online withdrawals. They should also file a police report and notify the CPF Board without delay.

To activate the CPF Withdrawal Lock and disable online withdrawals, check here. /TISG

Read also: CPF Board issues warning about scam email requiring wage information from employers