When the Workers’ Party objected to the national Budget last February, Leader of the Opposition Pritam Singh underlined that the WP disagreed with the decision to raise the Goods and Services Tax (GST) “especially at this time”.

The hike had been announced as early as 2018 and was set to take place in 2020. However, due to the Covid-19 pandemic, implementation was delayed. But this year, Finance Minister Lawrence Wong announced that the GST tax hike from 7 to 9 per cent is set to be raised one percentage point each time on Jan 1, 2023, and Jan 1, 2024.

Funds generated from the tax hike would be used for Singapore’s growing health care needs, given the country’s ageing population.

“Supply chain disruptions are having an outsized impact on people’s purses. There is a real concern on the ground that the announcement to raise the GST will lead to price rises across the board,” he added.

Since then, the WP has continued to explain its stand over posts on social media.

In April, it said it would “highlight specific aspects” of its arguments about why the hike is “unhelpful” as well as further explain the alternatives it has put forward, and why objections to those alternatives “miss the mark.”

For the first instalment of the series, the WP tackled how its proposals for the hike will not ‘slay’ Singapore’s “golden goose” — which is how former Prime Minister Goh Chok Tong once referred to the nation’s reserves.

And on Monday (June 6), the WP presented over Facebook and Instagram posts its alternatives to the GST hike as a source of additional revenue for the government.

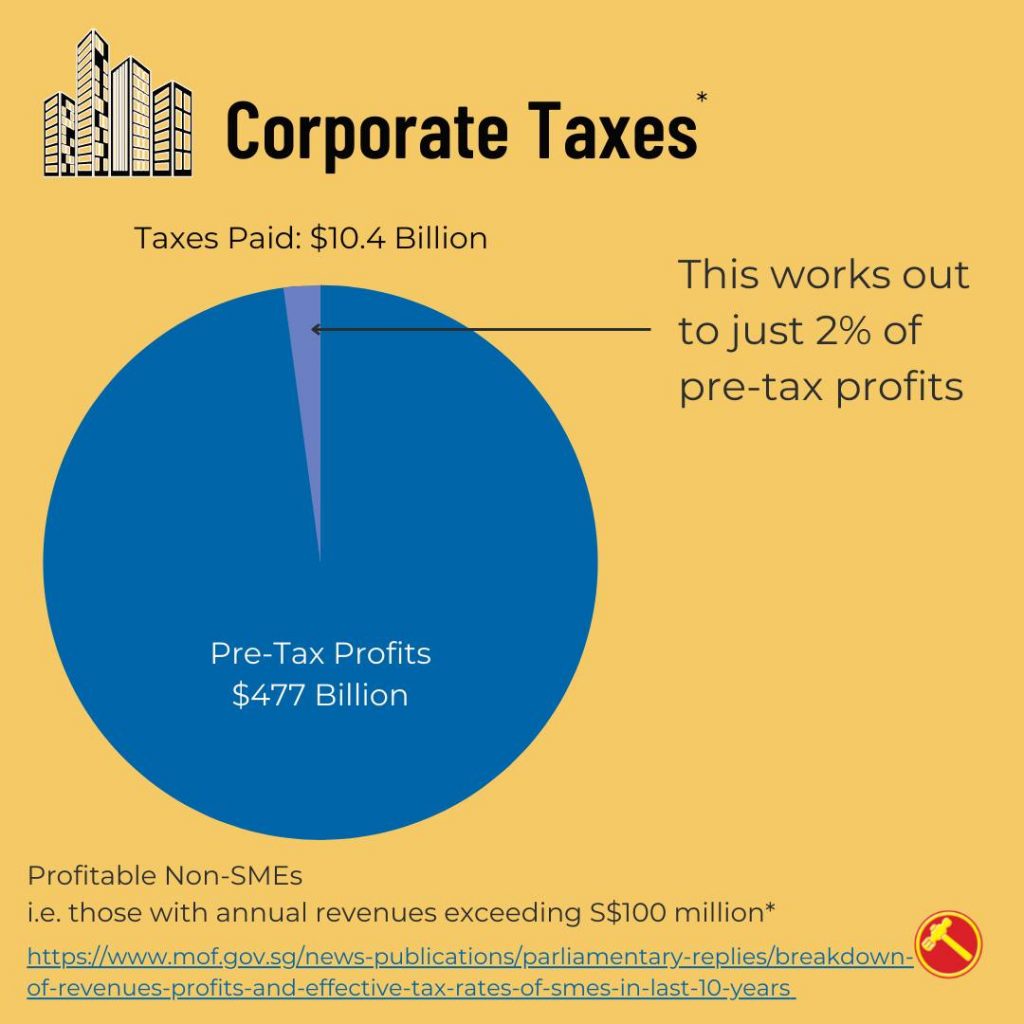

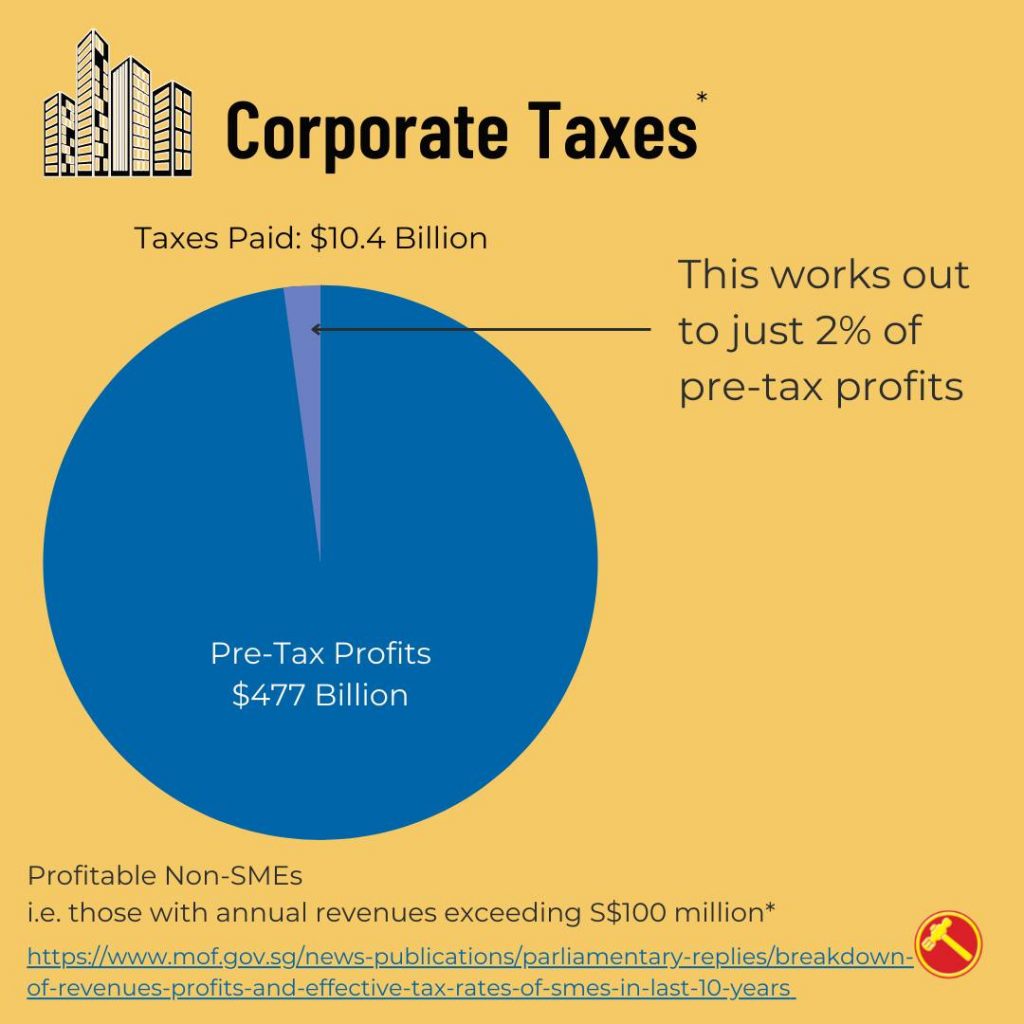

One of the alternatives is Corporate Taxes from Profitable Non-SMEs (small and medium enterprises) whose annual revenues are in excess of $100 million.

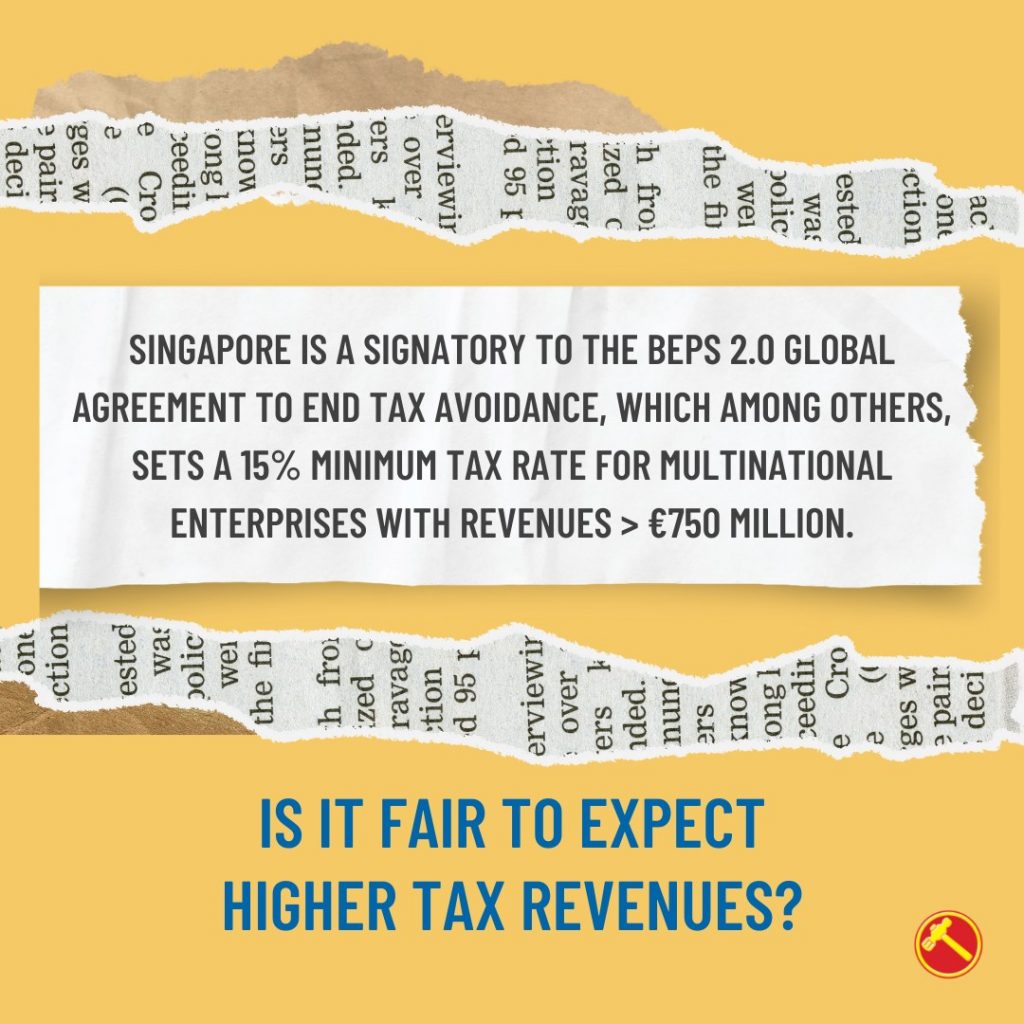

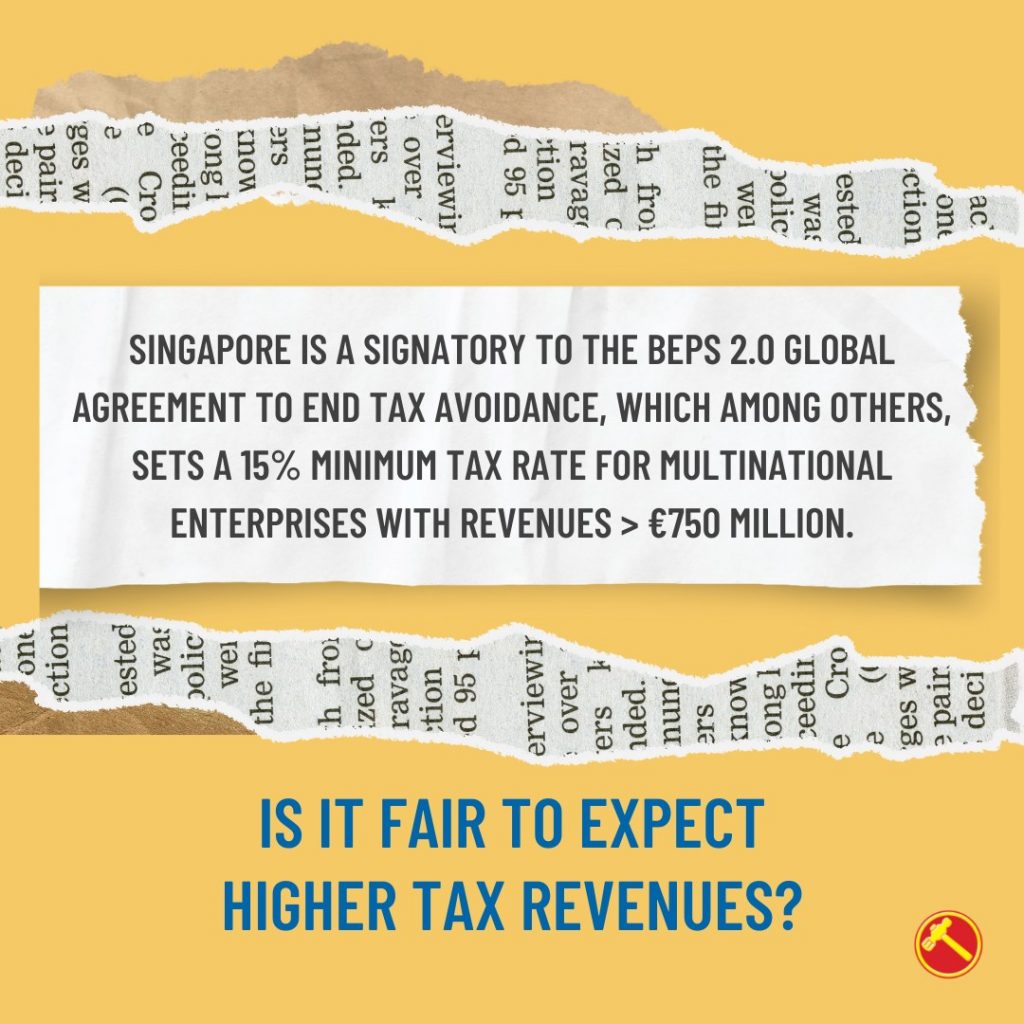

The WP noted that “Singapore is a signatory to the BEPS 2.0 global agreement to end tax avoidance, which among others, sets a 15 per cent minimum tax rate for multinational enterprises with revenues greater than €750 million.”

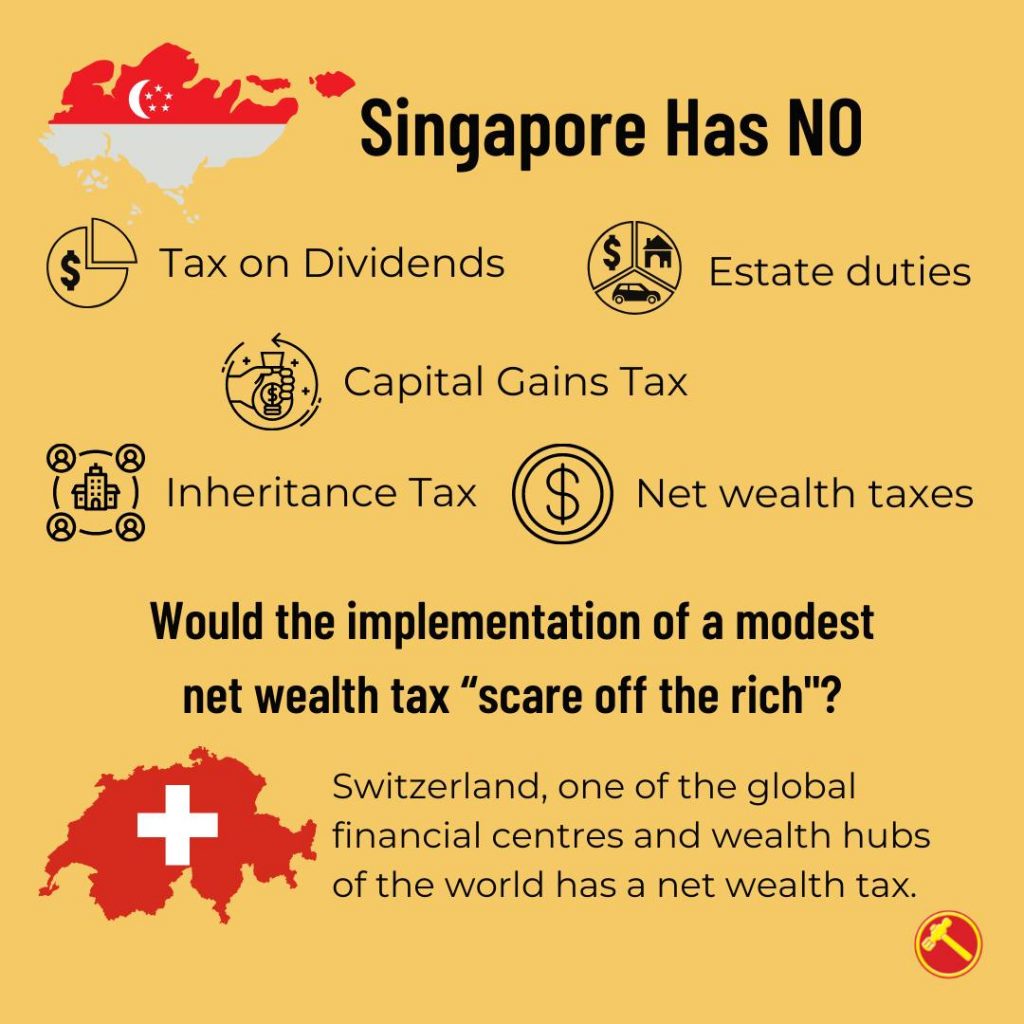

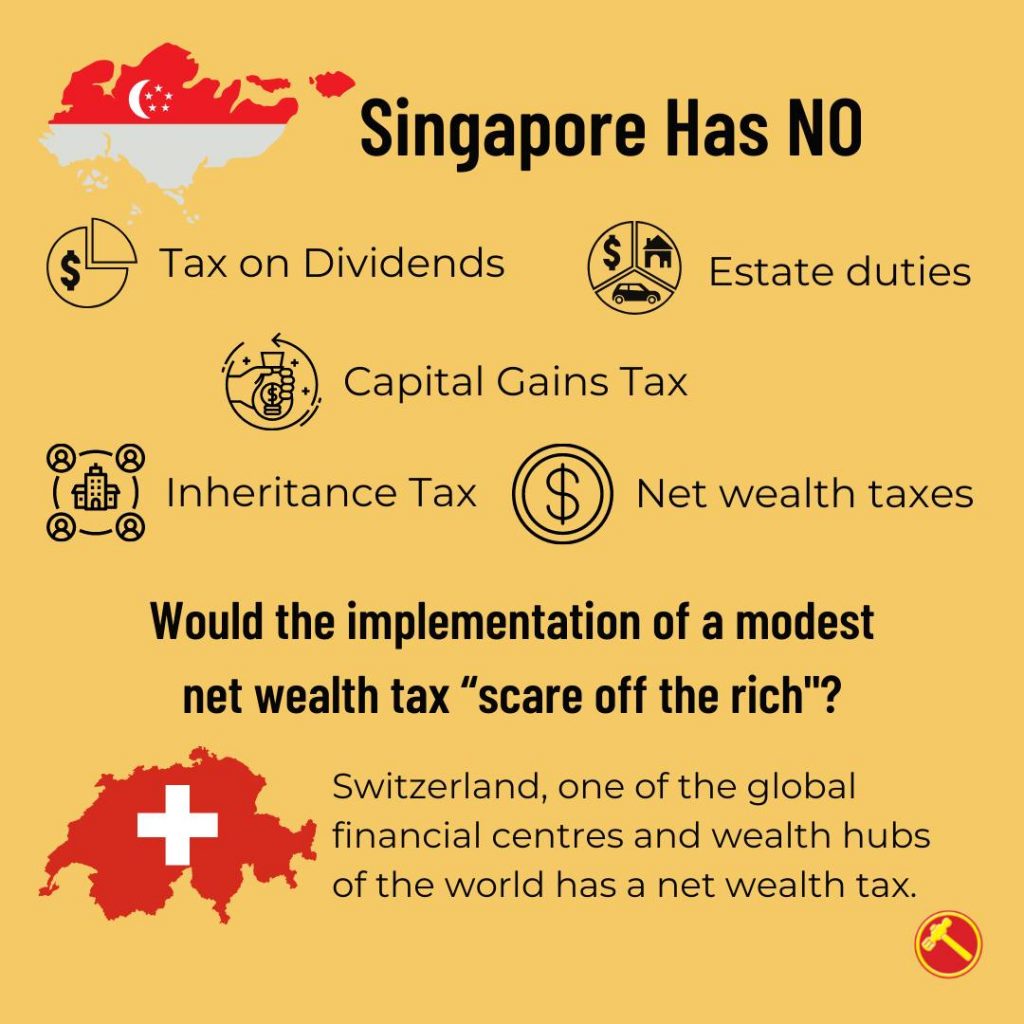

The other alternative is Wealth Tax.

WP clarified that it was not suggesting that property taxes would be raised on all flats including HDBs not raising personal income tax rates for individuals who fall under the middle-income category.

Instead, it said that Singapore has Tax on Dividends, Estate Duties, Capital Gains Tax, Inheritance Tax, and Net Wealth Taxes. /TISG