SINGAPORE: There are several ways to reduce your taxable income in Singapore, from contributing to your retirement savings to donating to charity.

Singapore has a progressive tax system, meaning higher earnings lead to higher tax rates.

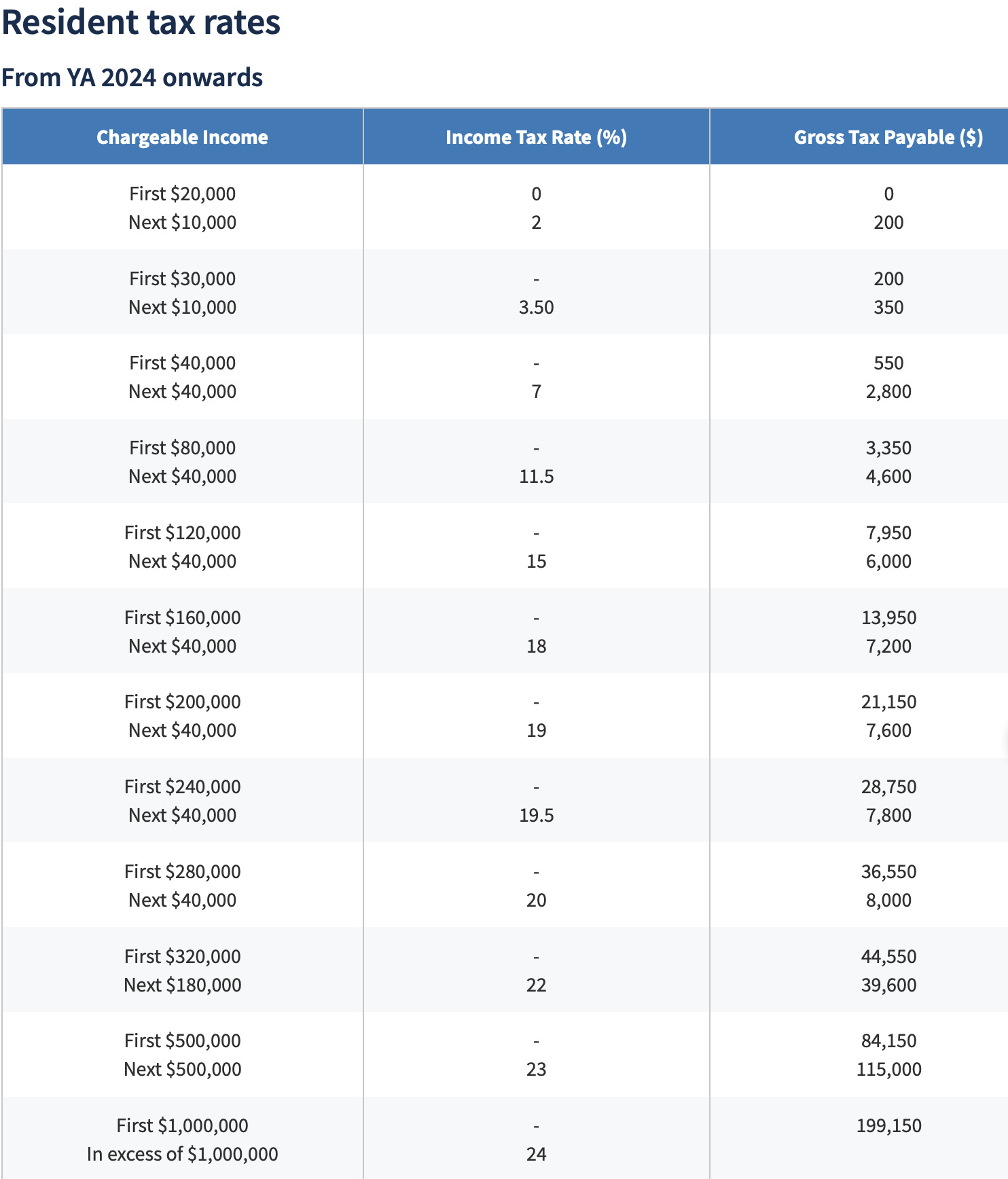

For resident tax, rates range from 0% to 24% in 2024. And keep in mind that there’s a personal income tax relief cap of S$80,000 each year.

So, how can you lower your payable tax in Singapore? Here are five tips to help you do just that, according to Syfe.

1. Contribute to a Supplementary Retirement Scheme (SRS) account

One effective way to reduce your income tax is by contributing to your SRS account. This voluntary scheme helps grow your retirement savings, and contributions are deducted from your chargeable income.

For example, if your taxable income is S$100,000 and you contribute S$15,300 to your SRS account, your taxable income will decrease to S$84,700, and your tax payable will drop from S$5,650 to S$3,891.

2. Make cash contributions to your CPF account

Another option is making voluntary cash contributions to your Central Provident Fund (CPF) accounts.

These contributions can qualify for tax relief, especially if you top up your Special Account, Retirement Account (if you’re 55 or older), or Medisave Account.

You may qualify for the following tax reliefs for cash top-ups:

- Cash top-ups to your CPF Special Account (for those under 55) or Retirement Account (for those 55 and above): up to S$8,000

- Cash top-ups to your loved ones’ CPF: up to S$8,000

- Medisave cash top-ups to yourself or your loved ones: up to S$8,000

Note: Loved ones include your parents, parents-in-law, grandparents, grandparents-in-law, spouse, or siblings.

To qualify for relief for spouse/sibling top-ups, the recipient must either have an annual income of no more than S$8,000 in the year before the cash top-up (including salary, tax-exempt income like bank interest, dividends, and pension) or be a person with a disability.

3. Claim deductions for educational courses when you upskill

The Course Fees Relief allows you to claim tax deductions for self-education expenses if the course relates to your current job or a job you plan to take.

This includes fees for aptitude tests, examinations, tuition, and registration/enrolment, but courses related to hobbies or general knowledge (like photography or languages) are not eligible.

The maximum claimable relief is S$5,500.

4. Donate to approved charities

Donating to approved charities in Singapore can also lower your tax bill. Donations to Institutions of a Public Character (IPCs) or the Singapore Government qualify for tax deductions of 2.5 times the donation amount.

Ensure the charity is an approved IPC, as donations to non-approved charities are not tax-deductible.

5. Support your ageing parents

If you’re supporting ageing parents, grandparents, parents-in-law, or grandparents-in-law, you may qualify for Parent Relief or Parent Relief (Disability).

To qualify, your dependent must be at least 55, live in your household, or have a disability for Parent Relief/Parent Relief (Disability)

Tax filing season might feel far off, but planning ahead is always a good idea. /TISG

Featured image by Depositphotos (for illustration purposes only)