Earlier this week, UOB announced that they are raising the interest rate of their UOB One account to up to 7.8% per annum. UOB is not alone in doing so. Across the board, we see banks in Singapore fighting to remain competitive by offering increasingly attractive interest rates to encourage people to deposit their money with them.

During the COVID-19 pandemic, many countries were cutting their interest rates to increase lending and spending to stimulate the economy. This led to record low levels of interest rates on savings accounts. Many opted to expose themselves to some level of risk and invest their savings rather than leave them idle in low-interest savings accounts.

However, with the current upsized interest rates on savings accounts, is it still worthwhile to invest your money into various investment vehicles, such as fixed deposits, treasury bills or even ETFs, or are you better off saving your money in a high-interest savings account?

Read Also: Best Fixed Deposit Rates & Promotions in Singapore

If You Have A Small Amount Of Savings

One major caveat to the current high-interest rate promotions banks are running on their savings accounts is that you need a large amount of money in your savings account to reap the advertised interest rate.

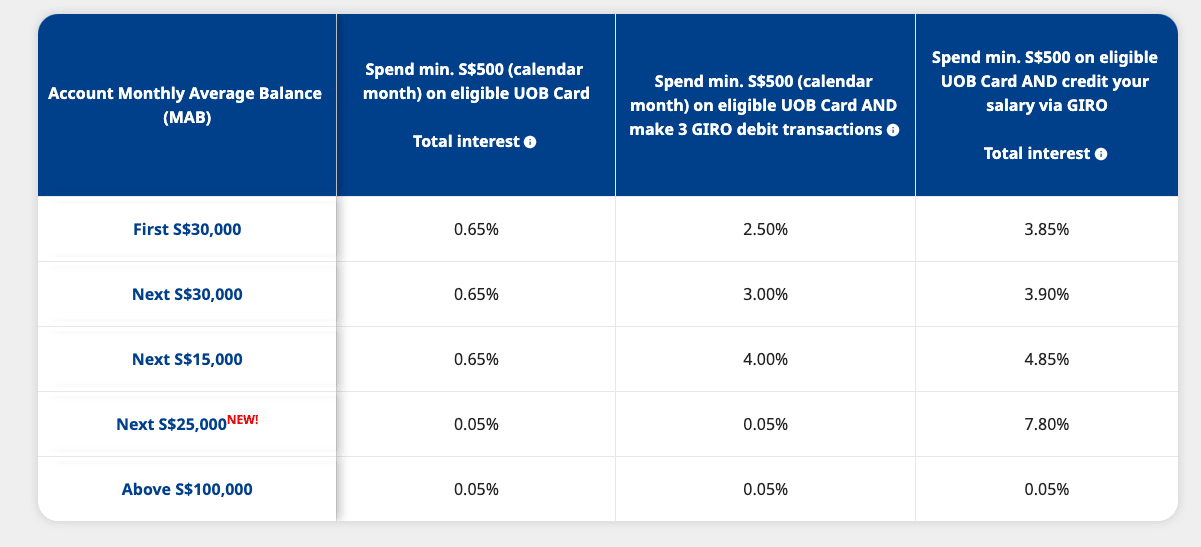

For example, with the UOB One account, you can only enjoy the full 7.8% interest on your savings if you have an account monthly average balance of over S$75,000.

If you have less than S$30,000 in your savings account, you will only enjoy an interest rate of 3.85% p.a. This is almost half the advertised high-interest rate of 7.8% p.a for the UOB One account.

This is in contrast to the six-month tenor for Singapore Treasury Bills, released on 8 December 2022, with an interest rate of 4.30%. The minimum bid amount for a Treasury Bill is S$1,000. Hence, with a smaller amount of money, you can get a higher rate of return if you invest rather than place your money in a high-interest savings account.

Furthermore, if you do not have a large amount of capital right now but can budget a small amount of your monthly income towards investing, taking a dollar-cost averaging approach might also be more lucrative for you in the long run.

The S&P 500, an index that tracks the 500 largest companies in the United States, has averaged an annual rate of return of 11.88% from 1957 to 2021. Choosing to dollar-cost average into an ETF every month might be a better allocation of your money. Granted, this incurs more risk than a savings account, as you expose yourself to market volatility. However, the risk-to-reward ratio might be easier to stomach when working with a smaller budget.

Related: Best Online Brokerages for ETF & Unit Trust Trading 2022

If You Have A Large Amount Of Savings

Conversely, if you have a large amount of capital, choosing to deposit it into a high-interest savings account like the UOB One account might be a good option. With Singapore’s inflation rate in 2022 sitting at around 6%, an interest rate of 7.8% is not only matching but slightly beating inflation.

There are currently very low hurdles to achieving the 7.8% p.a. interest rate on deposit accounts with more than S$75,000. All that is required is you to credit your monthly salary of at least S$1,600 into your UOB One account and spend at least S$500 on any UOB credit or debit card. For the average working adult, it should not be too difficult to meet this requirement.

Savings accounts account are seen as an extremely low-risk asset. The Singapore Deposit Insurance Corporation (SDIC) insures all member banks and financial companies for up to S$75,000. This means that in the unlikely event that a bank goes bankrupt, all of your deposits, up to S$75,000, will be guaranteed and returned to you. Hence, there is very little risk of losing your initial capital, unlike when you are invested in the stock market.

Furthermore, a savings account provides the most liquidity. There is no lock-up period like with a fixed deposit or Singapore treasury bill. Savings accounts are also not subject to market fluctuations the way ETFs are. If you need to dip into this savings pot for emergencies or investing opportunities, you can do so without facing any penalties or losses.

This prevents one from jumping into an investment that they do not have a full understanding of just because they do not want to let their idle cash get eroded by inflation. With a high-interest savings account, you can buy yourself time to wait on the sidelines for the perfect investment opportunity to arise.

Read Also: Best Savings Accounts in Singapore 2022

Conclusion

Whether you choose to take advantage of the high-interest savings accounts such as the UOB One account now or to continue investing depends on both your financial situation and risk appetite.

While choosing to invest may not be as lucrative a decision if you have a smaller amount of savings, the peace of mind you get from knowing that your money is currently accruing interest in a rather risk-free vehicle could be good enough, even if you do not enjoy the full 7.8% p.a. interest rate.

For more information on different options available to you on the market right now, check out our round-up of the best savings accounts out there.

Like what you just read? Follow us on Telegram, Instagram, Facebook, and LinkedIn to get up to date on fresh content!

Read More:

- Best Online Brokerages and Trading Platforms in Singapore 2022

- Fixed Deposit Vs Singapore Savings Bonds: Which Should You Go For?

- Rising Interest Rates and Returns for Singapore Savings Bonds (SSB) – Should You Start Investing In It?

- Endowment Insurance vs Savings Accounts: Which One Should You Choose?

The article originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Best Online Brokerages and Trading Platforms in Singapore 2022

Fixed Deposit Vs Singapore Savings Bonds: Which Should You Go For?