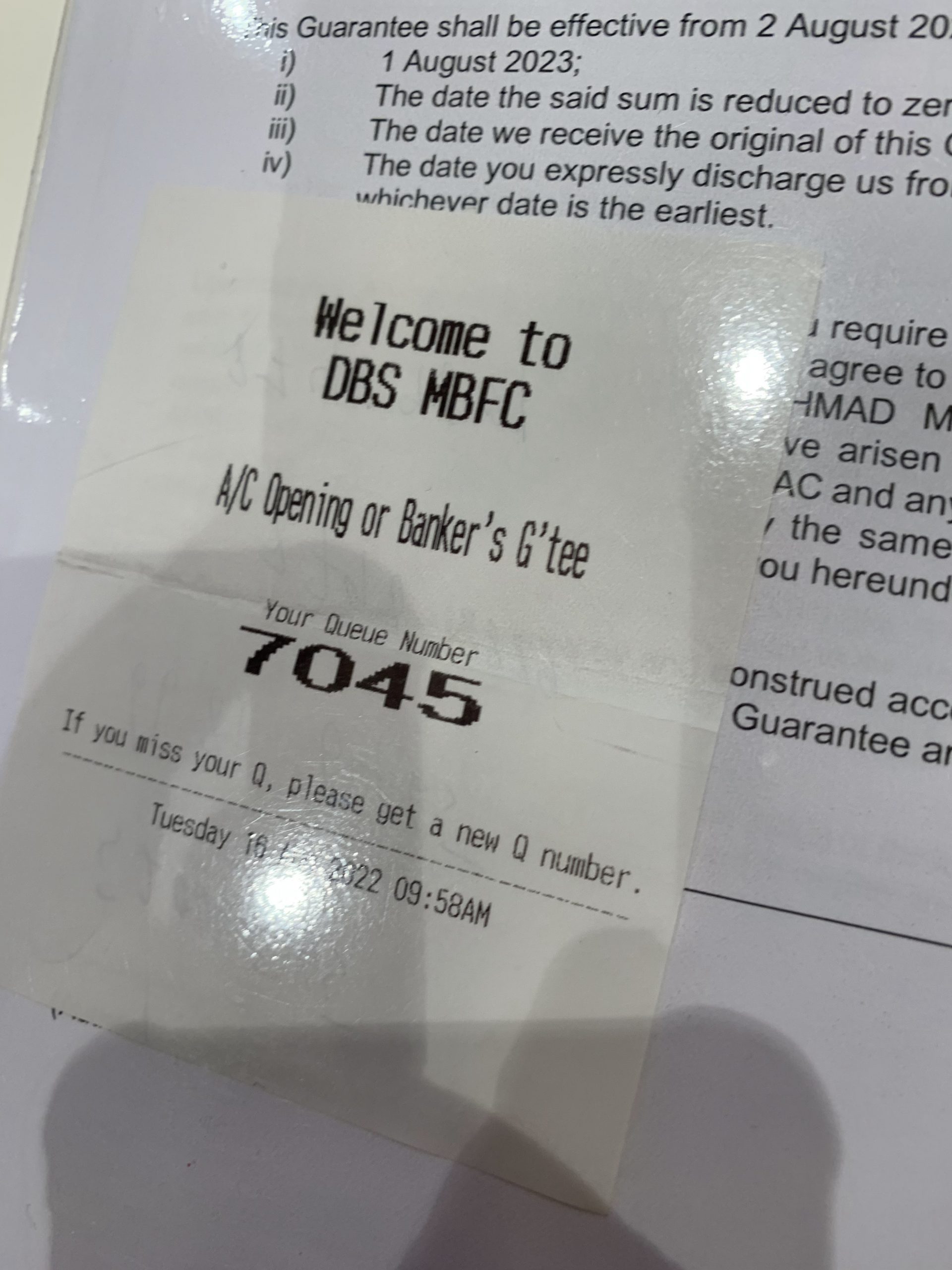

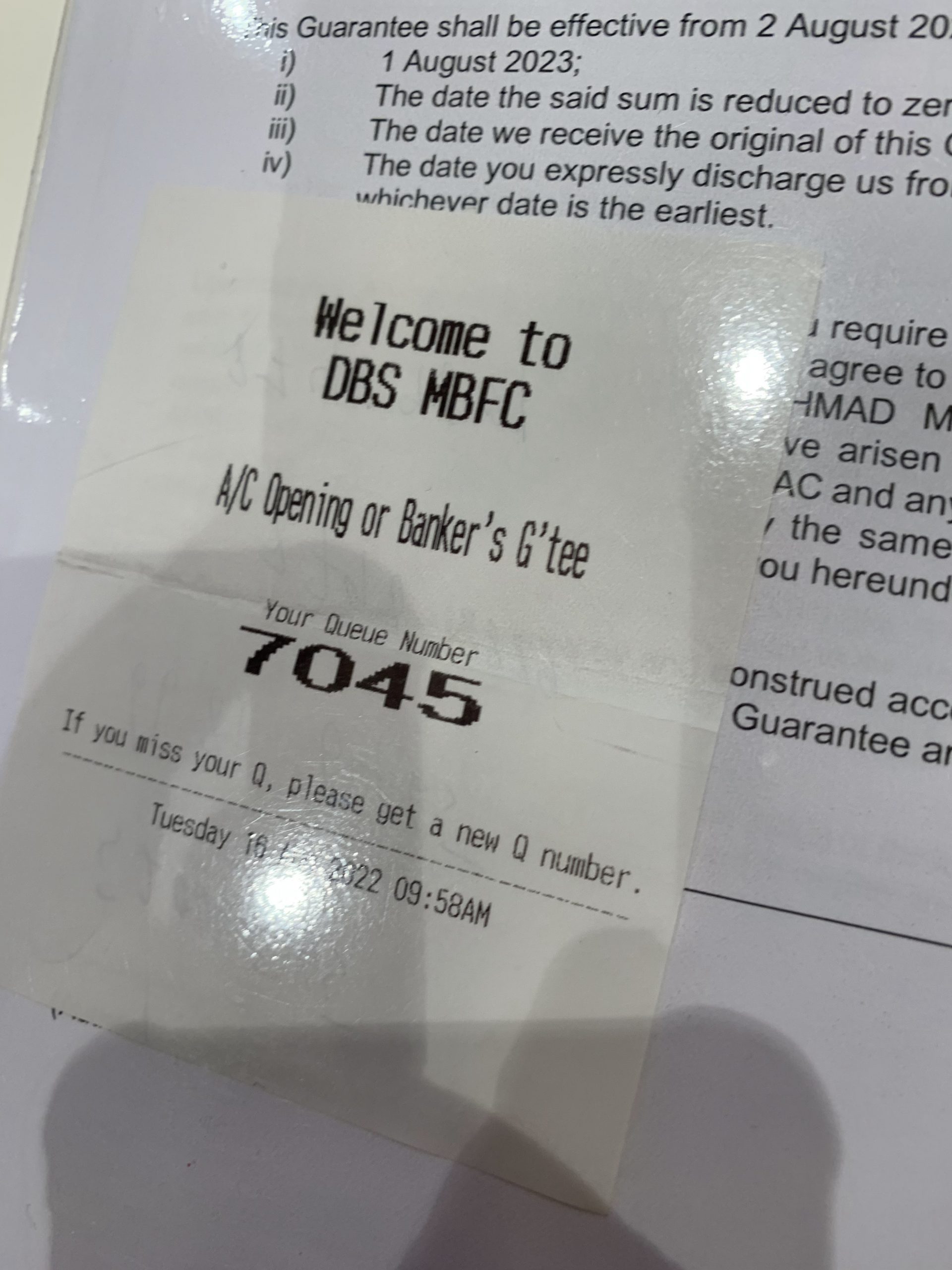

I have just had the most unproductive day. Was tasked to queue up at DBS Marina Bay Financial Centre Branch. The objective was to get a banker’s guarantee form signed and handed over to the bank. The experience started at 11am. As a matter of full disclosure, DBS is the bank I operate out of.

The mission, in military speak, was a total failure because, well, the customer was still waiting for service as the bank was closing. To be fair to the bank, they continued to serve customers even after official closing hours. You could say that at least the bank was behaving like a restaurant that holds its doors open for that customer who continues to sit there well beyond the last order.

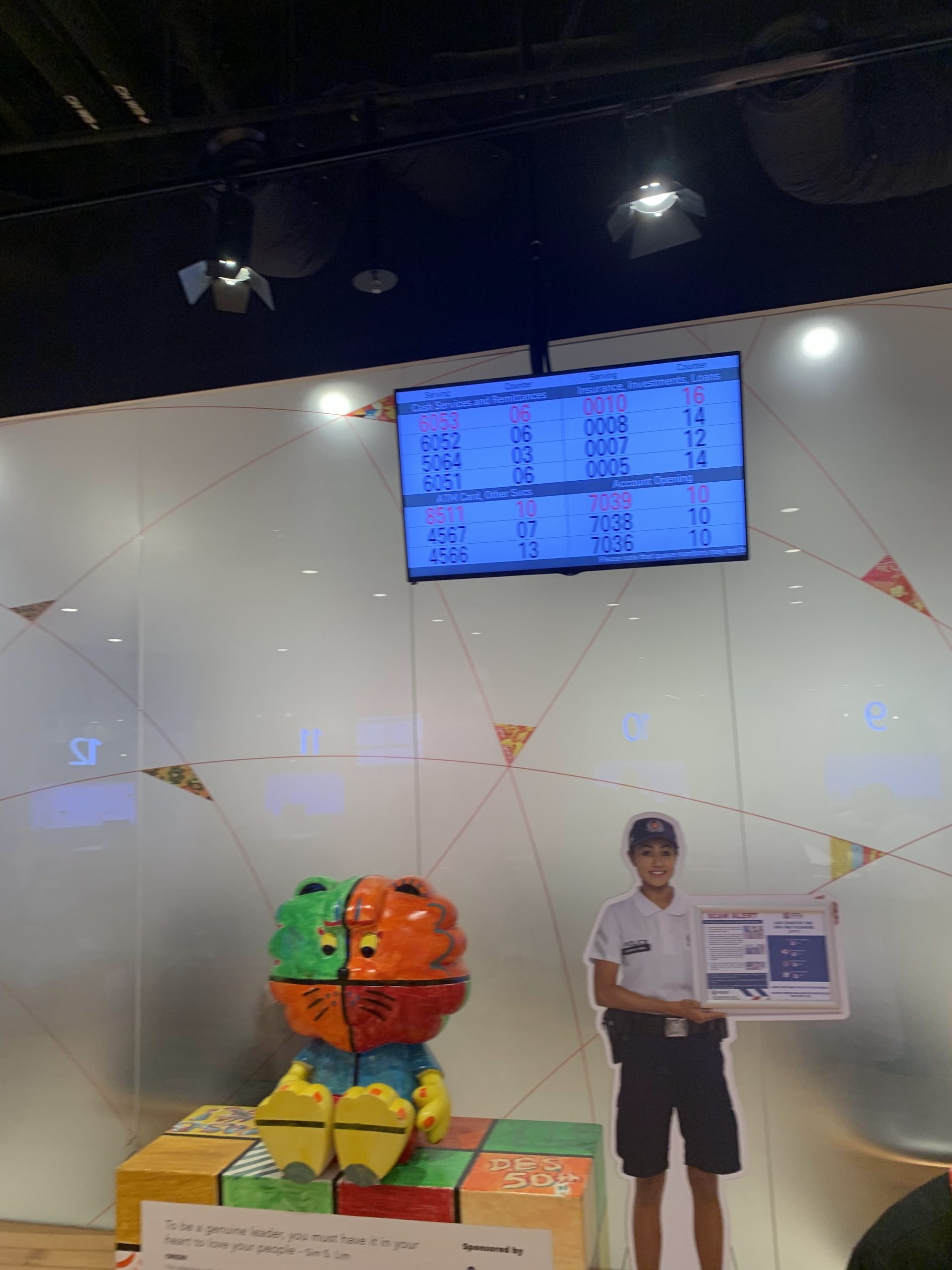

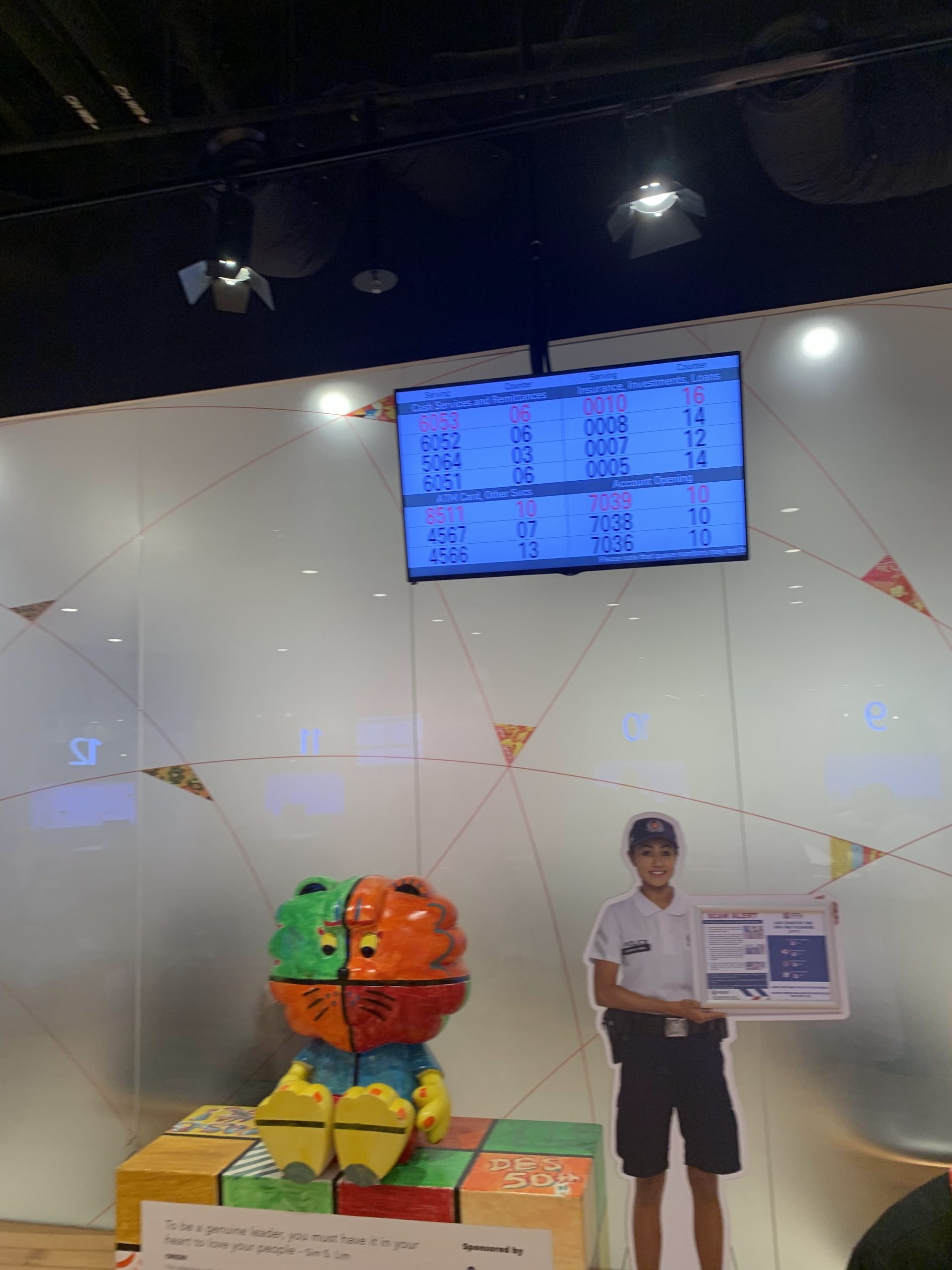

However, unlike restaurants, this is a bank where people were obliged to sit there and wait. No one came round to offer refreshments and what became very clear that whilst the staff on the floor were grossly overworked, they were also underpowered to their jobs. You could count the number of times an individual had to run to the backroom to check things.

I went to see a manager about an issue, which she then tried to pass on to another staff who was dealing with an irate customer who had been waiting for an hour and a half. When I finally managed to see a member of staff who could answer my questions, she proceeded to run into the backroom for over 20 minutes.

Again, I understand that banking can be a bureaucratic process and when it comes to compliance, one should be careful. However, why does the person facing the customer need to run to a backroom to check on things for every single enquiry? If you calculate the time it took for the front staff to rush to the backroom and back, you will probably find that it would probably add up to around 12 hours or more.

In fairness to DBS, the place was crowded. It was as if people felt that in the post-lockdown world, people were releasing their pent-up frustration of not being able to see their bankers.

Around a month ago, I had to visit the OCBC Main Branch on Chulia Street to buy a banker’s draft for a client. As a matter of full disclosure, OCBC is the bank that holds my mortgage.

The place was not what you would call crowded. So, the bank decided that it would follow suit and a huge counter designed for 10 had only three manning the counter. Well, I rephrase, it was actually two, the third person was a “supervisor” working very hard looking over the shoulder of the other two.

In the meantime, the rest of the customer service staff were very busy looking at each other, probably discussing the results of lunch. Which was far more than what I had because I was prancing around from 11.45 all the way to 15.30. It took nearly four hours for a 10-minute transaction.

You know, I get that things may not be as efficient as we may like them to be. I do get that sometimes there is give and take. But seriously, why must customers wait for corporates to take their own sweet time to do simple things?

There is no reason for banks to be short-staffed (You tell me a construction site cannot hire locals, I can understand – but a bank?).

We have so many technologies to make things so much easier. I think of a former client who has a product that can analyse bank statements in a matter of seconds and another product that automates making entries into accounting ledgers. Sure, I get that it’s good to have old-fashioned skills, but why insist on doing things by hand when a machine can do it faster, and dare I say, better?

Processes need to be redesigned around the customer. I think of Seafirst bank (Now Bank of America), which was so cocksure of its service that it offers five dollars for anyone who had to wait more than five minutes, and this was in the early nineties when you laughed at people with mobile phones for being pretentious and the internet was only a Geeks wet dream.

Why can’t our local banks that are trying to be “world-class” and Singapore trying to be a “financial hub” take a leaf from a bank in Washington State and challenge themselves in making life better for the people they are taking money from?

A version of this article first appeared at beautifullyincoherent.blogspot.com