The Housing and Development Board (HDB) announced on Saturday (Mar 3) that since July 2013, 3,330 singles aged 35 and above have collected the keys to their Build-to-Order (BTO) flats as of the end of January this year. This means that an average of 61 eligible singles collected the keys to their BTO every month. Unmarried applicants could previously only buy from the resale market. The rule was changed in July 2013 to allow eligible singles to apply for new two-room flats in non-mature estates.

HDB said that since the change of rules almost 5 years ago, about 12,200 singles have booked a new two-room flat but that only 5.9 applicants vied for a single flat last year, down from a high of 57.5 applicants in the first exercise in 2013. HDB added that it would monitor demand and “calibrate its supply” of two-room flats to meet the housing needs of singles.

The flat supply for two-room flats in non-mature estates has remained steady at an average of about 4,000 units per year from 2014 to 2017. Single Singaporeans looking to own their own HDB flats can choose between a BTO unit or purchasing a flat from the resale market. Budget 2018 announced that eligible singles will enjoy enhanced Proximity Housing Grant if they buy a resale flat with or near their parents’ residence.

What are the HDB Eligibility Requirements for Singles?

HDB flats are only available to Singaporeans or Permanent Residents if you are applying as an unmarried or divorced individual. You may apply for your own flat upon turning 21 if you are an orphan with no siblings. Unrelated singles who are 35 years or older can also jointly apply for an HDB flat. Up to 4 such individuals can co-own a flat this way. The only other eligibility requirement is the EIP and SPR quota (used to encourage and maintain social cohesiveness).

Why choose a BTO flat over a resale one?

Finance (or the lack of it) is the biggest advantage of choosing a BTO flat over a resale one. There are, however, several disadvantages.

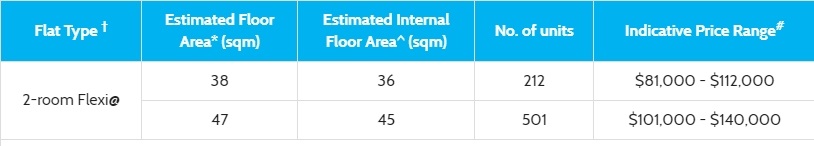

The size of HDB’s 2-room* Flexi unit is one big disadvantage. Even if there are multiple co-applicants, unmarried individuals are restricted only to 2-room* Flexi units in a BTO Sales Launch exercise. HDB’s BTO Sales Launch of February 2017 lists the sizes of the 2-room* Flexi units at between 400 – 450 sq ft.

source: HDB

The long waiting time of about 3 to 4 years for your flat to be built before you can move in is another big disadvantage.

Resale flats are available immediately but may cost a tad more

If the long wait time and the size of the flat is unappealing to you, you can try looking for a suitable apartment on the resale market. Singles – whether individually or jointly – can purchase any type of HDB resale they desire, provided they can afford it. 3-room resale flats have transacted at between $260,000 – $280,000 in some non-mature estates in the 3rd quarter of 2017.

Without a doubt, price is certainly one big factor why resale flats may be unattractive to eligible singles. The resale unit however, offers you a distinct financial advantage which a 2-room BTO does not. If you don’t need the extra rooms, you can rent them out to generate some additional income.

HDB announced in January 2018 that resale flat prices fell by 0.2 percent in Q4 2017 from the previous three-month period. For the whole year, prices dropped by 1.5 percent. With analysts expecting resale flat prices to remain flat this year, it may be a good time to snap up a unit.

Speak to an iCompareLoan mortgage broker today for free help in comparing mortgage loans in Singapore.

For advice on a new home loan.

For refinancing advice.

The post Are size limitations and other restrictions main reasons for lesser singles vying for two-room BTO flats? appeared first on iCompareLoan Resources.

Source: iCompareLoan