According to a recent survey by Nielsen, approximately half of Singaporeans believe that they are better off financially in 2018 than they were 5 years ago. To help our readers achieve their own financial security in the coming years, we’ve listed some of the best ways to get to a better place financially by 2024.

Consider Refinancing Your Home Loan

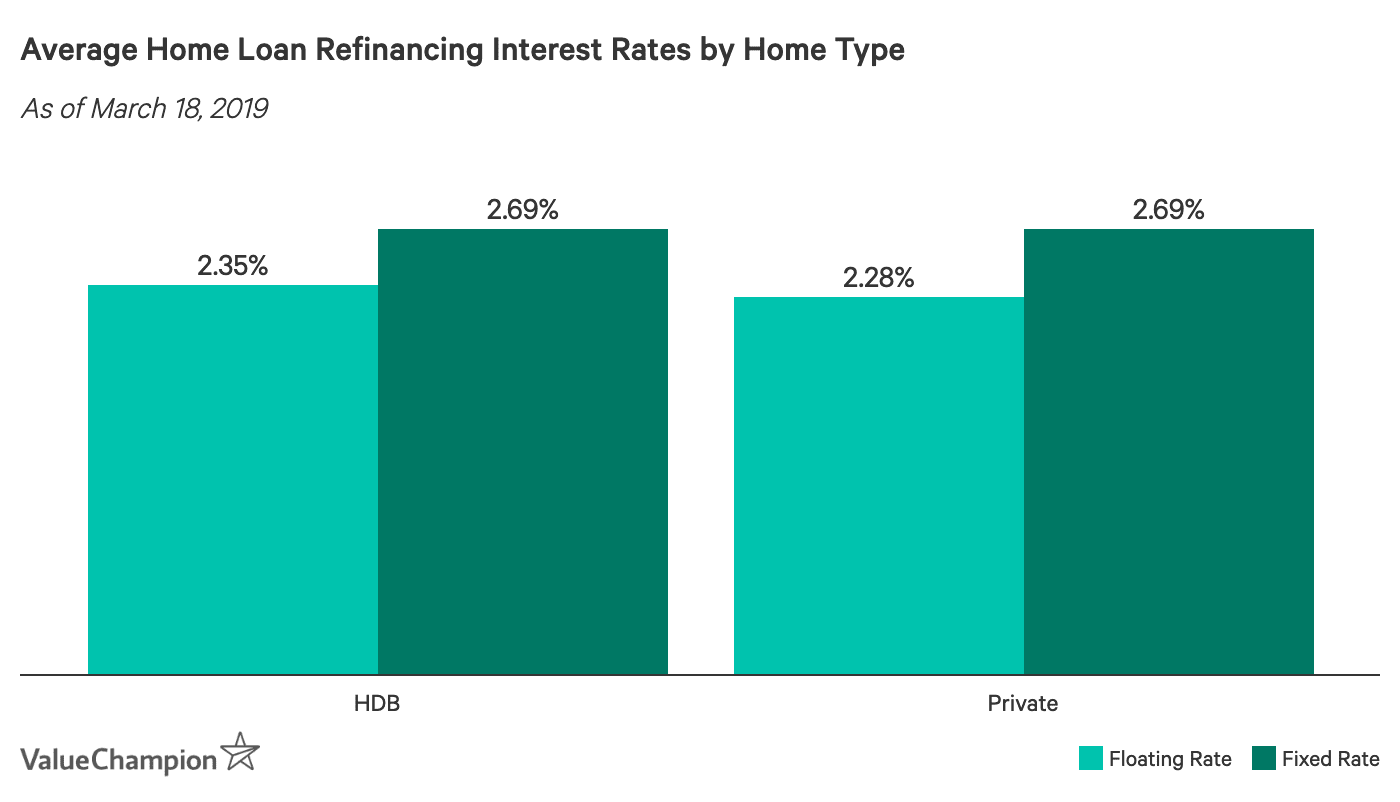

For homeowners, your home loan may seem like a significant cost that is set in stone. However, this large financial burden may actually offer a great route for improving your finances over the next few years. In order to obtain your business, banks often offer competitive interest rates to encourage you to refinance your loan through their bank. This makes home loan refinancing quite popular in Singapore.

For example, refinancing a loan with 25 years remaining S$500,000 outstanding from a rate of 3.00% to 2.50% can save you over S$1,400 annually. If you are able to obtain lower interest rates for several years, then it is worth refinancing your home loan due to these significant annual savings. Don’t forget that there are a number of costs associated with home loan refinancing, such as legal and valuation fees. Before you apply for home loan refinancing, make sure the cost of these fees are outweighed by your new low rates.

Don’t Let Debt Drag You Down

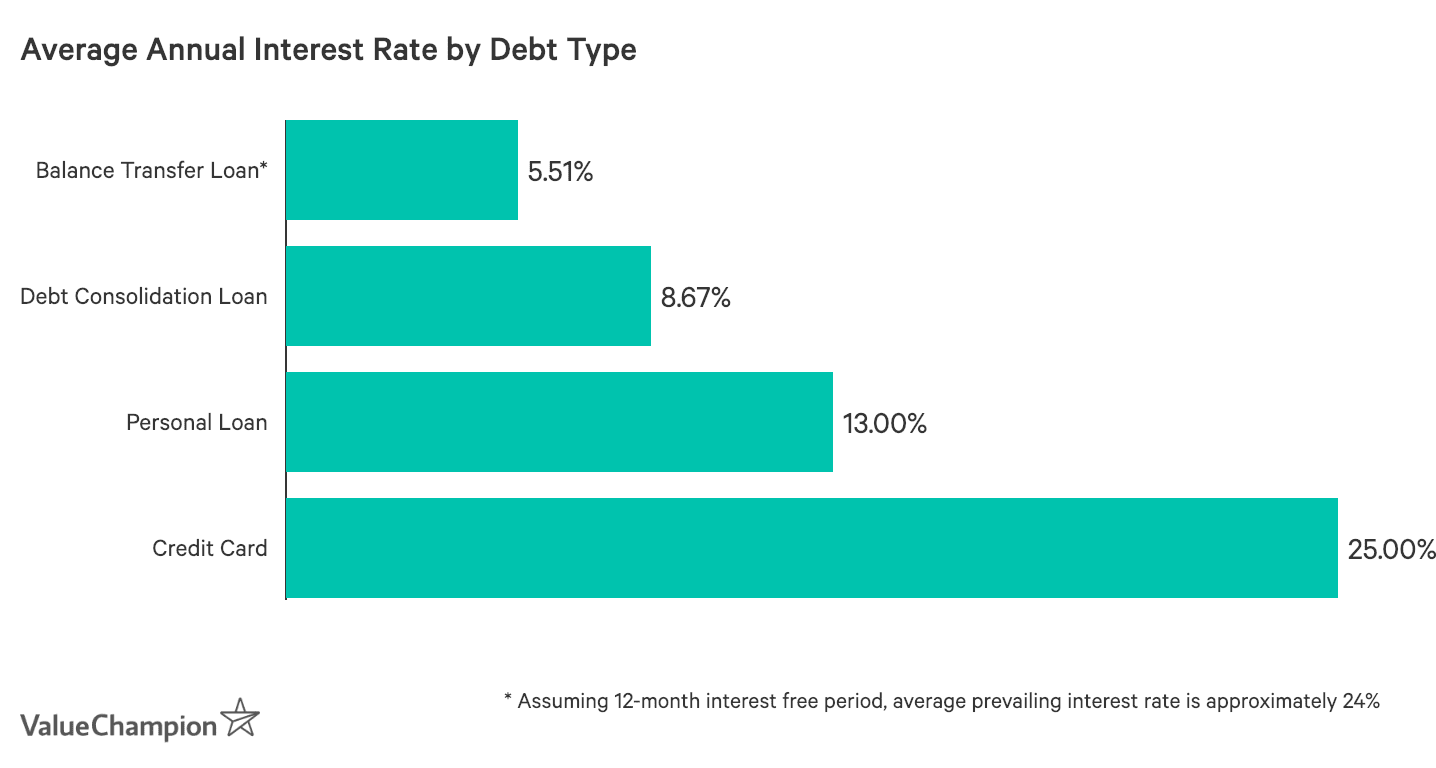

As you prepare to optimise your finances by refinancing your home loan or reining in your budget, don’t forget to address any of your existing personal debt. For example, an outstanding credit card bill can quickly snowball into a financial mess due to the high interest rates typically charged by credit card companies. For this reason, if you have any high-interest debt (e.g. credit card, personal loan), it is important to make sure that you repay or consolidate your balance in order to limit the long-term financial harm.

If you are unable to repay your entire balance at once, consider a balance transfer or a debt consolidation loan. These loans allow you to transfer your personal debt to a more manageable loan. For instance, both examples typically charge much lower rates than other forms of debt. Balance transfers are particularly useful when you have a smaller amount of debt or expect to repay your entire debt over a shorter period of time. This is because balance transfer loans typically offer an interest-free period of 3 to 18 months, which gives you a unique opportunity to repay debt without accruing additional interest.

However, once this period concludes, balance transfer loans charge about 24% in annual interest on average. Therefore, if you require a longer-term option, it makes more sense to apply for a debt consolidation loan. These loans tend to charge slightly lower rates than other forms of debt and can help you minimise the total interest that you accrue over the next few years. While it may be painful to bring these loans to mind, your future self will thank you for taking action and drastically reducing your total interest accrued.

Optimise Your Credit Card Usage

If you repay your bill every month and don’t have an outstanding credit card balance, you might think you’re doing enough in terms of optimising your finances when it comes to credit cards. In reality, you could be doing much more than just avoiding credit card debt. By using your credit cards strategically, you can maximise rewards offered by credit card issuers. For example, some cards offer as much as 15% off travel bookings, while others offer up to 10% rebates on groceries. Meanwhile, some offer significant miles or cashback bonuses just for signing up. Furthermore, there are cards available that do not charge annual fees and others that do not require a certain monthly minimum spending amount, making them more advantageous to those that would use certain cards sparingly. We are not suggesting that you sign up for every credit card out there, but properly using 2 or 3 cards to maximise rewards can help you reduce your expenses or even help you go on a great vacation.

Go Back to School

Most of our suggestions in this article help you reduce your personal expenses. However, another way to feel financially secure in the future is to increase your income. One way to significantly increase your earning potential is to go back to school in order to give yourself more career options. This could take a variety of forms depending on the person. Some individuals might be interested in coding bootcamps as a relatively inexpensive way to pick up technical skills. Others might consider an online degree in their free time. Some individuals might consider a Master’s in Business Administration (MBA) as a way to catapult their career in the finance, consulting or tech industries, among others. Many of these programmes require a significant upfront cost, and do not suit everyone’s career ambitions. However, they also offer very high potential returns in terms of your future salary due to the high demand for the skills that you can pick up.

Get Better Returns

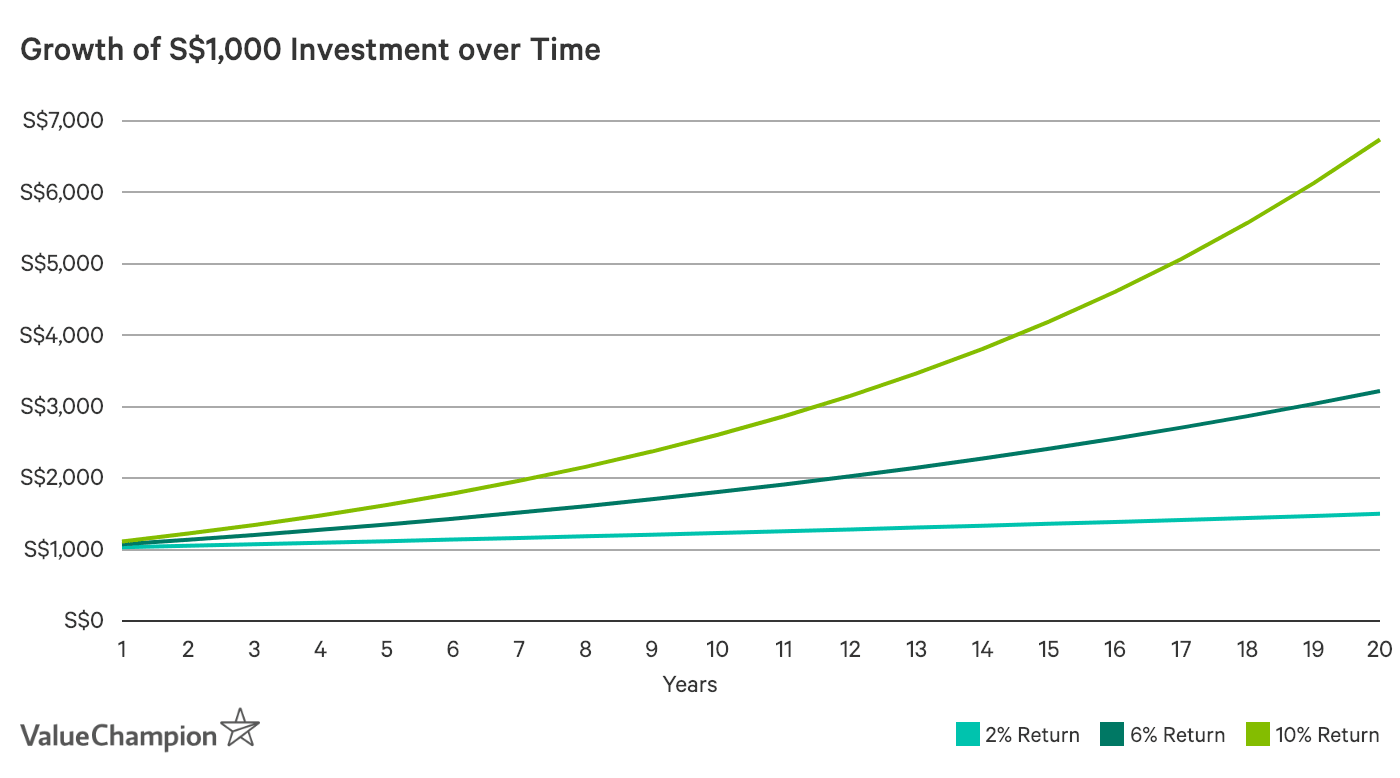

Whether you are saving for retirement or to purchase a home, you should make sure that you are getting the best returns possible. For the very risk-averse that prefer to stick with savings accounts, it makes sense to at least find a bank that offers competitive rates. In Singapore savings accounts tend to offer about 1.5-2% annually for savings accounts, although it is possible to find banks that offer higher rates. For those that prefer to seek a higher return, albeit with some additional risk, it makes sense to consider investing their savings. Individuals that have conducted thorough research consider investing in stocks, bonds or funds using an online brokerage platform. Furthermore, it helps to start your investing early, even if you are only investing a small amount at a time. For instance, a small investment of S$1,000 can more than double in just 15 years assuming that a 6% return rate.

How Take Control of Your Finances

Everyone’s personal finance goals are different. While one person may want to repay debt, another may want to buy a new home. To ensure that you meet your own goal, you will need to identify the current burdens that are holding you back and plan to address these issues. Once you’ve identified your goals and course of action, it is important to act swiftly to ensure your financial success in the future.

The article 5 Ways to Be Better off Financially in 5 Years originally appeared on ValueChampion.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like us on our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Source: VP